Sin taxes and VAT hit low income families hardest

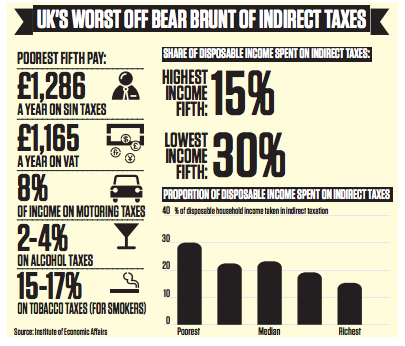

THE POOREST fifth of British households spend nearly one third of their disposable income on the Treasury’s indirect taxes, twice as much as the richest fifth, according to research published today.

The new report, from the Institute of Economic Affairs (IEA), says that taxes on cigarettes, alcohol, fuel and other consumer goods impact the worst-off people in the UK most severely of all.

The report also suggests that the poorest fifth have to shell out an average of £1,286 a year on sin taxes, with another £1,165 on top in VAT.

The report’s author, Christopher Snowdon, commented on the findings: “It’s clear that an increase in taxes on the goods families consume is making life harder for people. This is especially true for the poorest who spend a much higher proportion of their income on high-taxed products such as alcohol and tobacco.”

In 1977, the authors show that the distribution of tax was felt much more evenly: the fifth of people in the lowest incomes paid 22 per cent of their income on the same type of taxes, while the fifth on the highest incomes paid 20 per cent.

The report draws attention to the fact that people with lower incomes are much more likely to smoke: routine workers are three times as likely to be smokers than those in the top tiers of professional employment.

However, the reverse is true of drinking: routine and manual workers are least likely to drink, and managerial employees are most likely.

The IEA proposes that taxes on alcohol, fuel and tobacco products should be cut by half, while VAT should be reduced to 15 per cent. The think tank also suggests that green subsidies are cut entirely.