Shell wraps up Repsol portfolio deal for $600m less

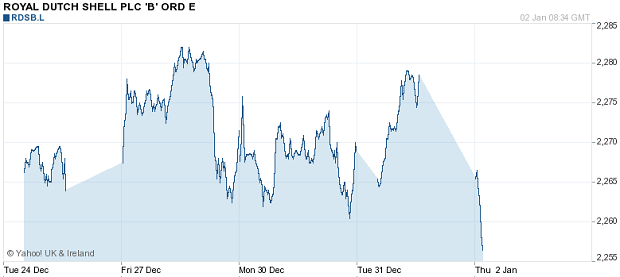

Royal Dutch Shell shares are trading down just over one per cent this morning following news that its acquisition of Repsol's liquefied naturual gas (LNG) portfolio has been completed, but with figures altered compared to the original deal.

Shell will pay $3.8bn (£2.3bn), compared with the $4.4bn price given in February, after "certain value adjustments".

As part of the deal, the oil and gas company will also assume $1.6bn of balance sheet liabilities, compared with $1.8bn initially announced. These relate to existing leases for LNG ship charters which, it says, are "substantially increasing the shipping capacity available to Shell's world-class LNG marketing business".

The acquired portfolio is outside North America and gives Shell an additional 7.2m tonnes of directly managed LNG volumes per year. The supply ranges from Trinidad & Tobago and in the Pacific from Peru.