Results beat expectations at MF Global

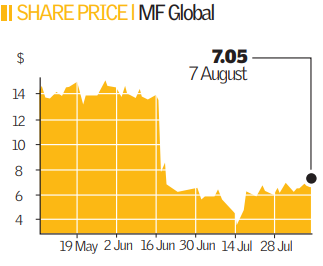

Shares in MF Global, the global futures and options broker, gained as much as 12 per cent on Wall Street after its first-quarter results came in better than-expected, despite profits plummeting 80 per cent on last year.

For the three months ending 30 June, the company posted profits of $14.4m (£7.2m), compared to $72.9m a year earlier. Total revenue fell about 42 per cent to £913.9m while net revenue for the quarter was flat at £374.7m, above analysts’ estimates of $370.3m.

Excluding items, the company earned 29 cents a share, beating analysts’ consensus of 18 cents a share.

Total income from interest in the quarter rose 20 per cent from the previous year to $108, but was down on the previous quarter due to “narrowing of short-term credit spreads coupled with the reduced duration of the investment of client funds”.

In a statement chief executive Kevin Davis said although interest income fell, trading volumes rose by 17 per cent to 550m contracts.

“Now, with our new capital structure in place and our investment grade ratings reaffirmed, MF Global is well positioned to create value for its clients and shareholders going forward,” he said.

In February, the world’s largest broker of exchange-listed futures and options, had to set aside $141.5m to cover losses from unauthorized trades in the volatile Chicago wheat market. MF Global said that the review of its risk management systems business was complete and that it was evaluating the recommendations made by them. Following the broker-related loss, the Hamilton, Bermuda-based company had commissioned the review of its risk management systems and processes.