bet365 Bingo Scratch 2 Win – Claim bet365 Bingo Prizes!

Now is the best time to join bet365 Bingo, a trusted platform known for its top titles and offers. It currently offers the exclusive bet365 Scratch to Win bonus, which gives players a chance to win daily prizes for gameplay.

City AM’s journalism is supported by our readers. If you click links to other sites on this page, we will earn a commission.

bet365 Scratch 2 Win Bingo Offer: Win Up To £50

T&Cs: New and eligible customers only. Available prizes: Bingo Tickets, Free Spins and cash. Prize not guaranteed. Max. prize, time limits, game restrictions and T&Cs apply. Registration Required. #ad

18+ Gambling Can Be Addictive. Please Play Responsibly. Registration Required GambleAware GamStop Gambling Commission.

The bet365 Scratch to Win bonus offer gives new and eligible customers the chance to grab a free daily scratchcard! Claim yours and have the opportunity to win potentially exclusive prizes and rewards at the site!

Create your account and log in to start playing for free! Scratch away on your card to reveal if you have won any rewards! If you are lucky enough to have won, you can receive prizes such as bingo tickets, free spins, or cash prizes, which can be used across various bingo rooms and popular online slot games at bet365!

Step-by-Step Guide: Claiming the Scratch To Win bet365 Bonus

To get involved with the bet365 Scratch to Win offer, follow these simple steps below.

- Head to the bet365 Bingo Scratch To Win offer by following the link above.

- Create an account, log in to your Bingo account and click ‘Play for Free’.

- You should then be presented with a scratchcard. Scratch yourself or select ‘Reveal’ to auto-scratch it.

- Wait to see what you have won!

- Your rewards will be credited to your account automatically, and you will be notified via a pop-up.

- Accept your rewards via the pop-up and claim them within three days.

- Go ahead and use your free bingo tickets or free spins on eligible games.

- Enjoy!

Available bet365 Scratch To Win Prizes

Players who claim the Scratch to Win bet365 offer can win free Bingo tickets, free spins, or £50 cash when they reveal their prize.

All rewards will automatically be credited to players’ accounts, with no wagering requirements attached. Bingo tickets can be used in all Bingo rooms, where each ticket costs 5p or less, except rooms with a discounted feature. Any free spins rewards can be used on the following three slot games: Big Bass Splash, Extra Juicy, and Floating Dragon and are valued at 10p per spin. There is also the opportunity to win cash prizes up to £50!

Eligible Games for the bet365 Scratch Bonus Prizes

Players who win free spins from the bet365 Bingo scratch-to-win bonus can use them on three top slot games at the site. We have looked at these games and what each entails below.

Big Bass Splash

Big Bass Splash is a classic online slot game with a fishing theme. It has five reels, three rows, and 10 paylines, with colourful symbols like monster trucks, fishing rods, tackle boxes, and the gruff fisherman Wild. The game has several standout features, including free spins bonuses, multipliers, and more. It is a game full of great graphics, a fun theme, and lots of great gameplay. The RTP of the title is 96.71%.

Extra Juicy

A classic fruit machine slot game combined with modern bonuses and mechanics, Extra Juicy has five reels, three rows, and 10 paylines. Symbols include the traditional fruits, plus a golden bell and diamond scatter. The game’s main bonus feature is a progressive multiplier free spins; multipliers are also available. The RTP is around 96.52%.

Floating Dragon

Floating Dragon is another 5×3 online slot with 10 paylines. It features a fishing/cherry blossom theme, stunning graphics, and seamless gameplay. Its key features include hold and spins bonuses, free spins, and multipliers that players can potentially benefit from. It also features a nice soundtrack for players to enjoy while they play. The RTP of Floating Dragon is reasonable at 96.71%.

Available bet365 Bingo Rooms

Players who win Bingo tickets with their bet365 bingo scratch card can enjoy a selection of bingo titles that are 5p or less. We have listed some available games and included a little about them. It is important to remember that not all games will always be available.

| Bingo Game | Description |

| The Race Track | A fast-paced bingo game, The Race Track is a 30-ball variation with tickets costing as little as 2p. |

| The Arena | A bet365 Bingo exclusive title, The Arena is a traditional 90-ball bingo game. |

| Beachball Blast | A standard 90-ball bingo variation, Beachball Blast features a beach theme with some great prizes. |

| The Stadium | With tickets ranging from 1-5p, The Stadium is another exclusive 90-ball bingo title. |

| Club Tropicana | Another 90-ball bingo game, Club Tropicana, is a free-to-play title at the site. |

| Penny Hi-5 | With tickets ranging from 1p-5p, Penny Hi-5 is a 90-ball bingo game featuring prize pools and top-quality gameplay. |

| Animingo | Animingo is a playful, animated, and animal-themed bingo room with a 50-ball bingo game designed for players of all abilities. |

| Space Odyssey | Space Odyssey is a 90-ball bingo game with an outer space theme. It is fun and immersive to play at bet365 Bingo. |

Terms and Conditions of the bet365 Bingo Scratch Card Offer

Before getting involved with the bet365 Scratch to Win bonus, there are some key terms and conditions to be aware of that we have included below.

- New and eligible customers only.

- Available prizes: Bingo Tickets, Free Spins and cash.

- Prize not guaranteed.

- Max. prize, time limits, game restrictions.

- Log in to your Bingo account and click ‘Play for Free’.

- All rewards will be credited automatically and have no attached wagering requirements.

- Players must accept Free Spins rewards via the pop-up.

- Free Tickets can be used in all Bingo rooms where each ticket costs 5p or less.

- Free Spins are worth 10p and can be used on any of the following games: Big Bass Splash, Extra Juicy, or Floating Dragon.

- Any unused Free Tickets and Free Spins will be removed after three days.

Other bet365 Bonuses & Offer 2026

There are plenty more opportunities to claim exciting bonuses alongside the bet365 Scratch to Win offer, including across sports, casino, and online bingo!

bet365 Bingo Bonus Code – CITYBINGO

New players at bet365 Bingo can claim an exciting bonus to use on some of the site’s top bingo games. All you need to do is sign up for an account, opt in, and enter the promo code CITYBINGO. Then deposit and play £10 on Bingo tickets to receive 365 Free Tickets to use in eligible bingo rooms.

T&Cs: New Bingo customers only. Opt in required. Min. staking requirements apply to receive 365 Free Tickets. Time limits, exclusions and T&Cs apply. #ad

bet365 6 Scores Challenge

The bet365 6 Scores Challenge is available each weekend for new and eligible customers to get involved with. It sees players in with the chance to win a share of cash prizes up to £250,000 in addition to other prizes. No promo code is required to participate in the challenge and have the chance to win prizes. Simply sign in or create your bet365 account to start playing the 6 Scores Challenge.

T&Cs: New and eligible customers only. Max prize value shared equally if there are multiple winners. Entry to 6 Scores Challenge is separate from standard bet placement and all bet365 offers do not apply. T&Cs apply. Registration Required. GambleAware.com. #ad

Responsible Gambling

When playing online casino or bingo games, players must remain in control of their activity. Whether this is the amount they are spending or the amount of time spent playing, there are various tools and resources in place to help support players in the maintenance of healthy and responsible gambling habits.

bet365 offers various tools, including activity statements, deposit limits, reality checks, time out, and self-exclusion tools to its users to help keep them on track. Several responsible gambling resources are also available to players for more information and support, including GambleAware and GamCare.

Frequently Asked Questions (FAQs)

What prizes can I win with the bet365 bingo scratch card offer?

Players can win bingo tickets, free spins, or cash prizes when claiming the bet365 Bingo scratch offer.

What’s the minimum deposit at bet365?

Players must deposit a minimum of £5 to £10 at bet365.

Do I have to be a new customer to claim the bet365 scratch to win bonus?

The bet365 Scratch to Win bonus is available to new and eligible customers.

Are there any other bet365 bingo bonuses?

Yes, players can claim various bet365 Bingo bonuses, including free tickets, deposit offers and more.

Is the bet365 bingo scratch to win offer fair?

The bet365 Bingo scratch card offer is a fair and worthwhile offer to claim.

City AM is committed to responsible gambling. Please gamble responsibly and only bet what you can afford. To gain help, support and advice for a person struggling with gambling, contact the National Gambling Helpline on 0808 8020 133. If you are worried about your gambling or that of a friend visit gambleaware.org.

US tax consultancy faces $12bn threat, but AI could deliver $19bn in gains

New research suggests AI could drive a $7bn (£5.2bn) net increase in the US tax consulting industry if firms shift focus from routine compliance to high-value advisory.

The report from Source Global Research revealed that despite the potential threat to revenue, over half of all US tax services are expected to be significantly powered by AI in the coming years.

The report concluded that if tax consulting firms deliver greater value to businesses, this will more than offset any predicted losses.

In the worst-case scenario, the US tax services market, which was worth $42bn (£31.3bn) in 2024, could shrink by $12bn (£8.9bn) (29 per cent), according to the report.

However, with increased efficiency, Source forecasts that the $12bn loss could be offset by a gain of up to $19bn (£14.1bn), resulting in a market that is worth $7bn more, giving a market that would be 16 per cent bigger.

Invest or lose out

Fiona Czerniawska, founder and CEO of Source Global Research, frames AI not as an option but as a survival requirement: “If they don’t [invest], they’ll lose out to competitors who do.”

However, she noted several key implications for tax consulting firms, including the need to pick and choose which services are most susceptible to AI replacement and focus on them.

“Clients aren’t looking for wholesale replacement of people with AI, and there’s a danger that firms invest too much in AI tools that clients don’t want and aren’t prepared to pay for,” she stated.

But she added, “While there are significant areas where AI can be used, human tax expertise will remain critical to complement the AI opportunities that lie ahead.”

In a recent feature on how AI is reshaping the consultancy sector, City AM explained that ‘clients want results’, as the surge of AI will shift a consultant’s role, placing greater emphasis on outcomes as the determining factor of success.

Amentum and Rolls-Royce SMR Partner on Building First Small Modular Reactors in the UK and Czech Republic

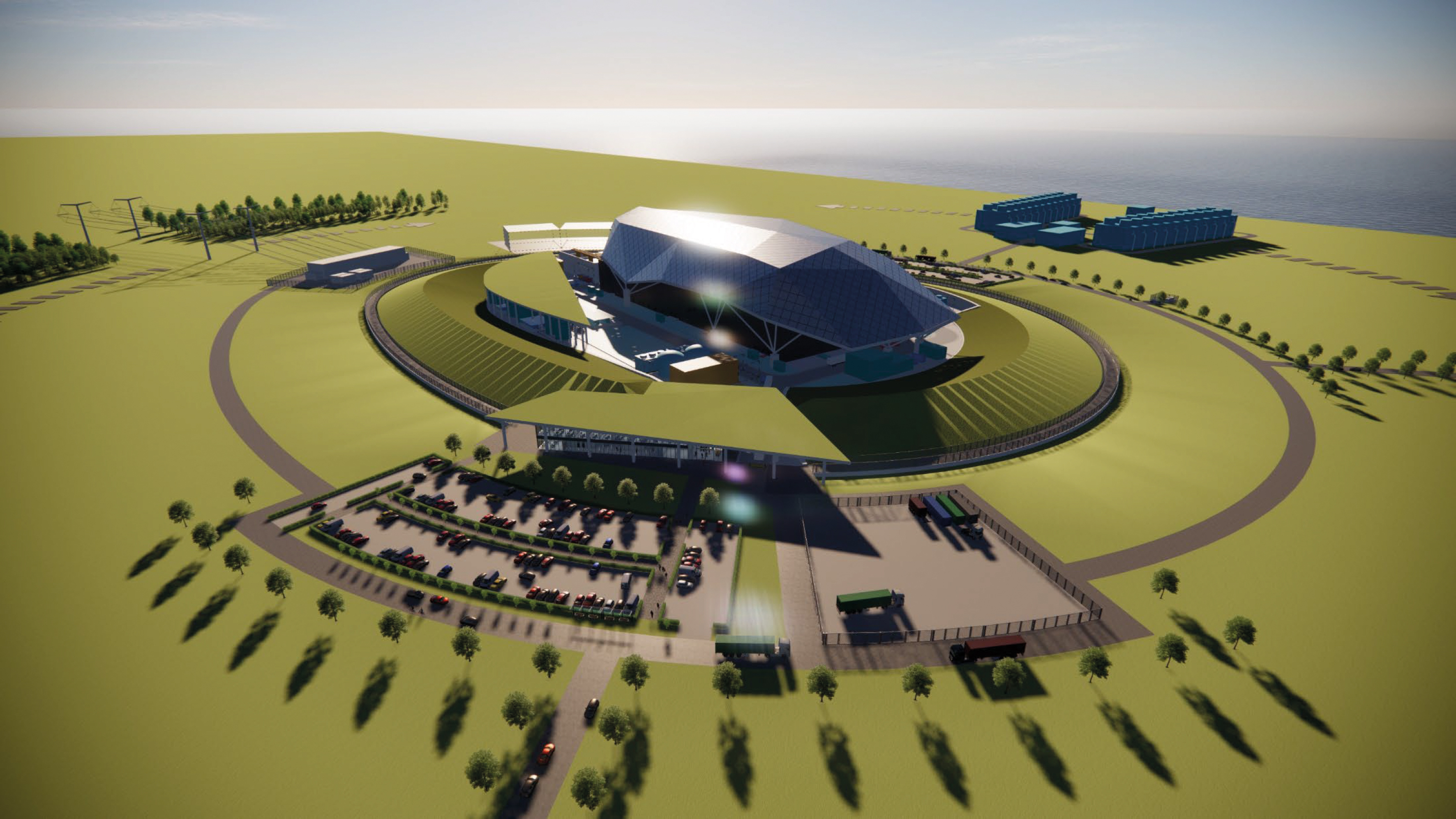

Amentum (NYSE: AMTM), a global leader in advanced engineering and technology solutions, has been selected as the program delivery partner for the first deployments of the Rolls-Royce Small Modular Reactor (SMR). In the UK, Rolls-Royce SMR will deliver up to 1.5GW of low-carbon energy to the grid, supporting the UK’s net zero goals and creating more than 8,000 quality long-term British jobs.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20260120029004/en/

Rolls-Royce SMR and Amentum have signed a collaborative agreement giving Amentum the program delivery role responsible for integration, oversight and governance, construction management and execution of SMR deployment.

Amentum will immediately work on ensuring successful delivery of the first Rolls-Royce SMRs in the UK and Czech Republic. In partnership with Rolls-Royce SMR, the company will deploy its full nuclear life cycle experience to oversee multi-functional program execution and integrated planning to support the on-time and on-budget delivery of SMR-generated power.

“The Amentum Rolls-Royce SMR collaboration advances the deployment of this transformational technology, a critical enabler in strengthening energy security in the UK and continental Europe,” said John Heller, chief executive officer of Amentum. “Amentum brings its industry-leading expertise as a project delivery partner for complex energy infrastructure to the forefront of small modular reactor deployment, ushering in the next generation of clean, reliable energy.”

“Amentum will support the deployment of a fleet of Rolls-Royce SMRs, contributing to our growth and our plan to create new jobs in the UK over the next four years,” said Loren Jones, senior vice president and head of Amentum’s Energy and Environment-International business. “Amentum’s deep nuclear expertise and robust supplier network are ideal to support growing energy requirements and drive long-term industrial growth.”

“By working with Amentum, an established and experienced global nuclear leader, we are combining our skills to build a powerful team that will enable successful delivery on our order commitments in multiple markets,” said Rolls-Royce SMR chief executive Chris Cholerton. “We have secured a world‑leading partner that is fully invested in our success. This partnership plays directly to our strengths – ours in advanced manufacturing and engineering, and theirs in program and construction excellence. It is a truly synergistic relationship that strengthens our overall offering.”

“Partnering with Amentum to successfully deliver the Rolls-Royce SMR program is an important moment for us,” said Ruth Todd CBE, Rolls-Royce SMR’s operations and supply chain director. “This partnership supplements our existing capabilities with specialist expertise, geographical reach and provides access to the breadth of Amentum’s wider supply chain. It ensures we are equipped to deliver our programs in the UK, Czech Republic, in Sweden and globally with confidence, scale and robust delivery assurance. The Amentum – Rolls-Royce SMR collaboration advances our deployment plans significantly.”

With global electricity demand expected to double in the coming decades, Rolls-Royce SMR offers a radically different approach to new nuclear: smaller, scalable factory-built nuclear power plants that can be deployed, using a modular approach, for a range of applications.

Amentum was part of a consortium of supply chain companies that began working with Rolls-Royce in 2016 to develop a new kind of modular power station to meet the growing need for nuclear generated electricity. Amentum is supported in this role by supply chain partners Turner & Townsend, Hochtief, Mace Consult and Unipart.

About Amentum

Amentum is a global leader in advanced engineering and innovative technology solutions, trusted by the United States and its allies to address their most significant and complex challenges in science, security and sustainability. Our people apply undaunted curiosity, relentless ambition and boundless imagination to challenge convention and drive progress. Our commitments are underpinned by the belief that safety, collaboration and well-being are integral to success. Headquartered in Chantilly, Virginia, we have approximately 50,000 employees in more than 70 countries across all 7 continents.

About Amentum in the United Kingdom

With more than 6,000 people in the UK, Amentum is the delivery partner for program, project and construction management services at Hinkley Point C; sole program and project management delivery partner at Sizewell C; and also supports the UK’s existing nuclear power stations under a Lifetime Enterprise Agreement with EDF. It is a major supplier of engineering design, safety case and project management at Sellafield and other UK nuclear decommissioning sites and operates the country’s largest private sector complex of nuclear laboratories and engineering test facilities in Warrington. In the defence sector, Amentum has an essential role in the UK’s continuous at-sea deterrent by providing safety advice and technology services for the Royal Navy’s nuclear submarines and program management and engineering support for AWE. Amentum’s specialist teams also assist procurement and operational delivery of goods and services across the whole of the UK Ministry of Defence.

Visit us at www.amentum.com to learn how we advance the future together.

Follow @Amentum_corp on X

Follow Amentum on LinkedIn

Forward-Looking Statements

This press release contains or incorporates by reference statements by Amentum Holdings, Inc. (the “Company”) that relate to future events and expectations and, as such, constitute “forward-looking statements” as that term is defined in the Private Securities Litigation Reform Act of 1995 and other federal securities laws. These forward-looking statements may be characterized by terminology such as “believe,” “project,” “expect,” “anticipate,” “estimate,” “forecast,” “outlook,” “target,” “endeavor,” “seek,” “predict,” “intend,” “strategy,” “plan,” “may,” “could,” “should,” “will,” “would,” “will be,” “will continue,” “will likely result,” or the negative thereof or variations thereon or similar terminology generally intended to identify forward-looking statements. All statements, other than historical facts, including, but not limited to, statements regarding the anticipated work and revenue under the awarded contract, and the Company’s objectives, expectations and intentions, applicable legal, economic and regulatory conditions, and any assumptions underlying any of the foregoing, are forward-looking statements.

A number of important factors could cause actual results to differ materially from those contained in or implied by these forward-looking statements, including those factors discussed in our filings with the Securities and Exchange Commission (SEC), including, among others: the occurrence of an accident or safety incident; the ability of the Company to control costs, meet performance requirements or contractual schedules; and other factors set forth under Item 1A, Risk Factors in our Annual Report on Form 10-K for the fiscal year ended September 27, 2024, which can be found at the SEC’s website at www.sec.gov or the Investor Relations portion of our website at www.amentum.com. Any forward-looking statement speaks only as of the date on which it is made, and the Company assumes no obligation to update or revise such statement, whether as a result of new information, future events or otherwise, except as required by applicable law.

View source version on businesswire.com: https://www.businesswire.com/news/home/20260120029004/en/

Contact

Media Contact:

Stephen Brauner

+44.7875.877120

stephen.brauner@global.amentum.com

Investor Contact:

Nathan Rutledge

IR@amentum.com

TweetText

“Amentum brings its industry-leading expertise as a project delivery partner for complex energy infrastructure to the forefront of small modular reactor deployment, ushering in the next generation of clean, reliable energy.”

European Utilities Accelerate Digital Transformation

European power and utilities companies are increasing investments in advanced analytics and AI-enabled operations to achieve grid modernization, decarbonization and digitalization, according to a new research report published today by Information Services Group (ISG) (Nasdaq: III), a global AI-centered technology research and advisory firm.

The 2025 ISG Provider Lens® Power and Utilities Industry — Services and Solutions report for Europe finds that utilities are responding to stricter clean energy regulations and decarbonization targets by expanding renewable generation and investing in grid infrastructure. These trends are also prompting utilities to reassess operating models, capital priorities and long-term planning as market and regulatory conditions continue to evolve across Europe.

“Enterprises are moving beyond commodity electricity procurement to pursue new, value-driven revenue models,” said Julien Escribe, partner and managing director of SEMEA for ISG. “By partnering on demand response, storage and grid-interactive platforms, they gain flexibility and reduce risk.”

Power companies face ongoing challenges from the variability and intermittency of wind and solar energy, which complicate real-time balancing of electricity supply and demand and increase risks to grid stability. To address this, enterprises are making IT and operational systems more flexible and data-driven for power generation forecasting and coordination with the electricity market. Providers support utilities by modernizing grids and strengthening integration between IT and operational systems, utilizing data analytics and AI to improve forecasting, operational coordination and investment planning.

Utilities across Europe are placing a greater emphasis on modernizing their transmission and distribution networks and digitalizing grid operations to enhance resilience and add renewable energy sources. They are upgrading assets and making IT and operational systems more data-driven to enhance system visibility and improve maintenance planning and control. Providers offer consulting and technology services for using data analytics and AI to enable predictive maintenance, better outage management and higher grid reliability.

Decarbonization planning is becoming more structured and investment-driven as energy companies prepare for long-term shifts in generation, storage and network design. Enterprises are relying on consulting support and structured planning approaches to guide their technology choices, investment priorities and risk assessments. Providers inform clients’ decisions on grid reinforcement, battery deployment and distributed generation. They are also helping utilities implement new operating and commercial models, including energy-as-a-service, capacity platforms and hybrid microgrids that strengthen regional resilience.

“Grid investment remains the top priority for European utilities as networks adapt to higher renewable penetration and electrification,” said Harish B., principal analyst, ISG Research, and lead author of the report. “Modular and scalable grid architectures are coming online to integrate new connections and deliver the flexibility needed for transport, heating and industrial growth.”

The report also explores other trends in the European power and utilities industry, including growing workforce shortages in digital and engineering and the increasing use of innovative financing models to fund large-scale grid and generation investments.

For more insights into the challenges European power and utilities companies face, along with ISG’s advice for addressing them, see the ISG Provider Lens® Focal Points briefing here.

The 2025 ISG Provider Lens® Power and Utilities Industry — Services and Solutions report for Europe evaluates 39 providers across four quadrants: Enterprise Asset Management, Process and Customer Experience Management, Smart Metering and Grid Modernization, and Technology, Transformation and Consulting.

The report names Accenture, Capgemini, Cognizant, Deloitte, IBM, Infosys, NTT DATA, TCS and Wipro as Leaders in four quadrants each. It names DXC Technology and Tech Mahindra as Leaders in two quadrants each. It names Atos, EXL, HCLTech, Hitachi Digital Services, PwC, TP and WNS as Leaders in one quadrant each.

In addition, Atos, Firstsource and PwC are recognized as Rising Stars — companies with a “promising portfolio” and “high future potential” by ISG’s definition — in one quadrant each.

In the area of customer experience, Capgemini is named the global ISG CX Star Performer for 2025 among power and utilities service providers. Capgemini earned the highest customer satisfaction scores in ISG’s Voice of the Customer survey, part of the ISG Star of Excellence™ program, the premier quality recognition for the technology and business services industry.

A customized version of the report is available from WNS.

The 2025 ISG Provider Lens® Power and Utilities Industry — Services and Solutions report for Europe is available to subscribers or for one-time purchase on this webpage.

About ISG Provider Lens® Research

The ISG Provider Lens® Quadrant research series is the only service provider evaluation of its kind to combine empirical, data-driven research and market analysis with the real-world experience and observations of ISG’s global advisory team. Enterprises will find a wealth of detailed data and market analysis to help guide their selection of appropriate sourcing partners, while ISG advisors use the reports to validate their own market knowledge and make recommendations to ISG’s enterprise clients. The research currently covers providers offering their services globally, across Europe, as well as in the U.S., Canada, Mexico, Brazil, the U.K., France, Benelux, Germany, Switzerland, the Nordics, Australia and Singapore/Malaysia, with additional markets to be added in the future. For more information about ISG Provider Lens research, please visit this webpage.

About ISG

ISG (Nasdaq: III) is a global AI-centered technology research and advisory firm. A trusted partner to more than 900 clients, including 75 of the world’s top 100 enterprises, ISG is a long-time leader in technology and business services that is now at the forefront of leveraging AI to help organizations achieve operational excellence and faster growth. The firm, founded in 2006, is known for its proprietary market data, in-depth knowledge of provider ecosystems, and the expertise of its 1,600 professionals worldwide working together to help clients maximize the value of their technology investments.

View source version on businesswire.com: https://www.businesswire.com/news/home/20260120165852/en/

Contact

Laura Hupprich, ISG

+1 203-517-3100

laura.hupprich@isg-one.com

Philipp Jaensch, ISG

+49 151 730 365 76

philipp.jaensch@isg-one.com

Abstract

European power and utilities companies are investing in analytics and AI for grid modernization, decarbonization and digitalization, ISG says.

TweetText

Enterprises are moving beyond commodity electricity procurement to pursue new, value-driven revenue models. By partnering on demand response, storage and grid-interactive platforms, they gain flexibility and reduce risk.

Knoops to open first US store as international expansion gathers pace

Knoops is gearing up to open its first US store as the chocolate drinks brand’s international expansion gathers pace.

The London-based business said it will open a store in Utah in April as part of plans to have over 160 locations in the US over the next six years.

Knoops, which was founded in Sussex in 2013, also hopes to build a 150-strong UK store estate over the same period, as well as opening more than 200 stores in key international markets.

“There will be thousands of Knoops stores across the globe in time – this is now obvious – but we remain focused on our disciplined medium term plan to help us get there,” said Knoops chief executive William Gordon-Harris.

The Hotel Chocolat rival said it was on track to deliver turnover of £20m for the year to end March, after toasting a 12 per cent jump in sales over the six-week Christmas period.

Sweet possibility of London IPO

Knoops recently tapped former Game chief executive Martin Long to become its new chief financial officer as it seeks to bolster its board expertise for further growth. The company has also talked up the possibility of a London IPO – but to date it has not set out any timetable for a listing.

Knoops, which has seen a major store expansion across London since 2020, has become known for its wide variety of drinking chocolates, ranging from a 28 per cent white chocolate from Colombia to a 100 per cent extra-dark single origin from the Philippines.

The hospitality business now has nearly 30 stores across the UK, with six across London including the swanky districts of Kensington, Chelsea and Knightsbridge. Cheltenham has been earmarked as the company’s next UK store opening.

Alongside scaling its physical footprint, the firm’s wholesale arm has become a major avenue for growth, with sales nearly tripling since April, driven by its “Knoops at Home” chocolate flakes range, which is available on Amazon and in Selfridges.

The company is part-owned by Brixton-based department store Morley’s, while Pret founder Julian Metcalfe is also a shareholder. The business completed a £8m funding round in 2023.

Wise reports jump in users ahead of US dual listing

Money transfer firm Wise delivered a bumper third-quarter as the UK fintech continued to lay the groundwork for its US dual listing.

The payments firm recorded a 26 per cent surge in cross-border volumes to £47.4bn in its latest quarter as its customer base swelled.

Wise said it now served near-11m users, up by a fifth from the year prior.

This helped boost income to £424.4m, a 21 per cent increase. The fintech said it expects full-year income to land in the middle of its 15 to 20 per cent target range.

Meanwhile, the firm’s profit margin is forecast to come at the top end of its 13 to 16 per cent target despite plans to bulk up investment.

In the first half of the financial year, Wise’s pre-tax profit tumbled 13 per cent to £254.6m.

Marketing investment increased by 59 per cent to £57m, while tech investment rose by 18 per cent to £144m.

Over the course of the first half, the fintech hired over 1,000 additional colleagues as it beefs up capacity.

Wise to launch dual listing this year

Wise shocked the City last year after announcing plans to ditch its primary listing in London in favour of New York.

“We consider that the US is offering us a larger liquidity with a larger investors community,” finance boss Emmanuel Thomassin told reporters following the half-year report.

Wise expects to complete its US dual listing in the first half of 2026 as part of its mission to accelerate global growth.

When making the announcement in June 2025, Wise said transferring its main listing would “provide a potential pathway to inclusion in major US indices, further enhancing liquidity and demand for Wise shares”.

“While Wise is not initially expected to be eligible for these indices, a US primary listing provides the opportunity to work towards this inclusion,” the firm added.

The plans triggered a major rift between founders Kristo Käärmann and Taavet Hinrikus, with the latter saying he was “deeply troubled” over plans to change voting rights as part of a vote on the listing change.

He accused Käärmann of a “lack of transparency,” adding it was “entirely inappropriate and unfair to wrap these distinct issues together,” referring to the transferred listing and shares extension.

But Wise was able to curb a rebellion, as more than 90 per cent of Class A shareholders and 84.6 per cent of Class B shareholders approved the deal, which permitted a ten-year extension of the super-voting shares held by only a handful of inside investors.

bet365 Mobile UK App – bet365 Mobile Offer and Sites 2026

One of the most recognised and leading online gaming and betting platforms in the country, bet365 mobile has impressive mobile betting platforms available across its various offerings.

We have looked at each of the bet365 mobile offers and apps below, including how to download, what offers are available, the best features, and more!

City AM’s journalism is supported by our readers. If you click links to other sites on this page, we will earn a commission.

Claim a bet365 Mobile Offer

Each of the bet365 mobile apps offers exclusive promotions and bonuses for customers to claim when registering or returning to play. Learn more below.

bet365 Casino: 10 Days of Free Spins

T&Cs: Min. £10 in lifetime deposits required. Offer must be claimed within 30 days of registering a bet365 account. Select prizes of 5, 10, 20 or 50 Free Spins; 10 selections available within 20 days, 24 hours between each selection. Max. prize, game restrictions, time limits and T&Cs apply. #ad

18+ Gambling Can Be Addictive. Please Play Responsibly. Registration Required. GambleAware GamStop Gambling Commission

At bet365 mobile casino, players can be in with the chance to claim 10 days of Free Spins when registering with the platform. It is really easy to claim, and players will have 30 days after registering to get their hands on them! Simply complete the bet365 sign-up process and make a minimum deposit of £10. Select a colour 10 times over the next 20 days to reveal your free spins prizes of 5, 10, 20, or 50!

bet365 Bingo: 365 Free Tickets using code CITYBINGO

T&Cs: New Bingo customers only. Opt in required. Min. staking requirements apply to receive 365 Free Tickets. Time limits, exclusions and T&Cs apply. #ad

18+ Gambling Can Be Addictive. Please Play Responsibly. Registration Required. GambleAware GamStop Gambling Commission

New customers signing up to bet365 bingo who opt in can receive up to 365 free bingo tickets to use in bingo games where the ticket costs 3p or less! Select the new player offer in the bingo lobby, opt in, create your nickname in the bingo room and stake £10 cash on bingo tickets in any eligible bingo room. Receive your rewards as soon as a notification pops up to let you know they are available.

bet365 Sports Bonus Code: CITYBONUS: Bet £10 Get £30

T&Cs: For New Customers. Min deposit requirement. Free Bets are paid as Bet Credits and are available for use upon settlement of qualifying bets. Min odds, bet and payment method exclusions apply. Returns exclude Bet Credits stake. Time limits and T&Cs apply. Registration Required. #ad

18+ Gambling Can Be Addictive. Please Play Responsibly. Registration Required. GambleAware GamStop Gambling Commission

If sports betting is more your thing, why not sign up for bet365 sports and have the chance to claim up to £30 in free bets when you bet £10? Create your account with the betting giant and make a minimum deposit of between £5 and £10 to be eligible for the offer. Place qualifying bets to the value of your deposit and wait for these to settle to receive your free bet rewards!

bet365 Games: Prize Matcher

T&Cs: New and eligible customers only. Three reveals will be available each day from 17:00 local time and the game grid will reset each week. Max. prize, time limits, game restrictions and T&Cs apply. #ad

18+ Gambling Can Be Addictive. Please Play Responsibly. Registration Required. GambleAware GamStop Gambling Commission

At bet365 games, first-time sign-ups have the opportunity to claim an exciting prize matcher bonus! Create your account with the bet365 mobile app and play the daily free Prize Matcher game to reveal three tiles each day. Collect symbols for the chance to win anything from free spins, golden chips, free bets, or instant prizes!

bet365 Sports Betting: 2 Goals Ahead Early Payout

T&Cs: Only available to new and eligible customers. Bet restrictions and T&Cs apply. 18+. GambleAware.org. Registration Required. #ad

18+ Gambling Can Be Addictive. Please Play Responsibly. Registration Required. GambleAware GamStop Gambling Commission

Another opportunity for new customers to get their hands on an offer to enhance their sports betting, the bet365 2 Goals Ahead Early Payout offer can see new customers who sign up with bet365 mobile can see their selections settled early if the team they have backed goes 2 goals ahead! To claim, simply complete the sign-up process and place a pre-match full-time bet on a match from the selected competitions.

Guide to the bet365 Mobile App Download Process

Downloading the bet365 mobile app is a quick and straightforward process that helps bettors get up and running quickly. Whether you use an iOS or Android device, we have provided steps below for downloading the dedicated bet365 app.

Downloading on iOS

- Head to the App Store on your device and search for the bet365 mobile app.

- Once found, click to download the app to your device and wait for it to complete.

- When the download is complete, open the app and click to sign up or sign in.

- Go ahead and start your betting journey at the bet365 mobile app.

Steps for Android Downloads

- Go to the Google Play Store on your Android device and look up the bet365 mobile app.

- Press to install the app and wait for the download to complete.

- Once completed, you can open the app and sign in or create an account.

- Enjoy!

What Makes a Good Mobile App?

So what makes the mobile bet365 app a ‘good’ mobile betting platform? We have explored the various features below.

- Graphics and Site Design: To be a standout betting app, the site must be intelligent, organised, and designed with its users in mind. It should be modern and kept up to date, with everything easy to navigate. The quality of the features should be top-notch, with standout graphics and flawless gameplay throughout, from registering with a bet365 mobile app to playing games, placing bets, and making payments.

- Exclusive Offers: A good mobile betting app like bet365 will feature exclusive promotions that can not otherwise be claimed on the desktop or mobile-compatible website. These are to encourage users to download and use the bet365 mobile app, with offers available for downloading and signing up and plenty for existing bettors.

- Payment Methods: Users of the bet365 mobile app can expect to make fast, secure, and easy payments thanks to the mobile payment options available exclusively on the app, alongside the regular accepted payment methods such as Visa, Mastercard, PayPal, and Bank Transfer.

- Easy Download Process: Downloading and getting started at any of the bet365 mobile betting platforms is quick and easy—just a press of a button away! The apps are easy to find on each device’s relevant app store, and the downloads are completed quickly to ensure no delay to users’ betting or online gaming.

- Data Storage: Good mobile betting apps will store data from users’ preferences and activity on the platforms to help provide personalised recommendations of games, betting markets, and offers. This can help users continually find new features and return to the app.

- Security and Licence: Like the website, the bet365 mobile app offerings are licensed by the UKGC, which ensures the safety and security of players, fair play, and a commitment to responsible gambling.

- Variety of Games and Betting Options: Users can still expect a large selection of games and betting options on mobile bet365 platforms. There can even be some mobile-exclusive titles and betting options available! The same portfolios will provide the same great gaming or betting experience.

- Support Options: The bet365 mobile apps offer the same customer support options as the desktop and mobile websites. Users can expect to find a detailed and dedicated FAQ page to seek answers in the first instance, and the support team is easy to contact via email, live chat, and social media.

Each bet365 Mobile App Listed

Whether you prefer online betting or gaming, bet365 has a dedicated app for each! Download the specially designed app after sports betting, bingo, casino games, or something else!

bet365 Sports Betting App

Created especially for sports fans and bettors, the bet365 mobile sports betting app is home to one of the most extensive sports betting offerings on the market. Its interface is modern and immersive, providing a user-friendly experience that emulates the same great experience had on the desktop or mobile-compatible website. There is a large selection of sports to bet on and different ways to bet, including in-play. A live streaming service is available to bettors to watch selected sports and place or amend bets simultaneously.

bet365 Bingo Play Bingo Live

For bingo enthusiasts, bet365 mobile offers a dedicated section just for you. The colourful and futuristic purple, green, and black platform draws players in immediately, where they will discover a selection of bingo games. Bingo players can expect to play 75-ball, 80-ball, and 90-ball games, and even some bet365 bingo exclusive titles, too! Plenty of bingo offers are available for new and existing players to enhance their time at the platform.

bet365 Casino Games & Slots

Online casino enthusiasts can get stuck into the bet365 mobile casino app that offers one of the most up-to-date online casino experiences on the market. bet365 casino is home to a vast selection of games from top providers in the business. Find what you want quickly and easily thanks to the superb mobile bet365 platform and intelligent, player-friendly design. A variety of payment methods are also available to ensure players have fast and secure transactions when making deposits or withdrawals.

bet365 Poker Texas Hold’em App

If you are looking for a place dedicated to online poker, this is the best bet365 mobile app. The bet365 Poker Texas Hold’em App offers a variety of poker variants to suit most players’ preferences. It is highly rated by players, including both the App Store and Google Play Store, for providing a top poker experience. The app is designed with its players in mind and operates a well-organised interface to ensure a seamless gaming experience.

Exclusive Features of the bet365 UK Mobile Apps

The bet365 mobile app collection offers a range of exclusive features that benefit bettors and provide the best possible betting and gaming experience. We have reviewed some of these in more detail below.

| Feature: | Explanation: |

| Exclusive Payment Methods 💳 | The bet365 mobile betting apps allow users to make instant payments via mobile payment methods such as Apple Pay and Google Pay. These are even more convenient for bettors as deposits and withdrawals can be made with just a button and without having to enter any payment details. |

| Exclusive Promotions 🎁 | Bettors and online casino players can also expect to benefit from exclusive promotions at the various bet365 mobile betting apps. These can include extra opportunities to claim free bets, spins, deposit offers, and more. They can be awarded to users for simply downloading the app and registering, or be limited-time offers exclusively on the app. |

| Personalised Experience 🙋 | When using the bet365 mobile app, data will be stored to learn users’ preferences and any trends in their activity. This enables the platform to offer a more personalised experience to users based on their previous activity and recommend games and/or betting markets that they may be interested in. |

| Notifications and Updates 💬 | There is also the ability to set up push notifications and updates to be sent to your mobile with the bet365 apps. This ensures that users can be kept in the loop and be up to date with the latest news, offers, active bets, and more concerning their mobile bet365 accounts. |

Responsible Gambling

When betting online, it is essential to always remember to practice responsible gambling wherever possible. This includes setting a budget to spend at betting platforms and keeping track of the time you spend placing bets. Betting platforms offer several responsible gambling tools to users, such as setting deposit limits on your account, time limits, reminders, and self-exclusion tools. There are also several responsible gambling tools and resources available should anyone need further assistance or advice regarding responsible gambling, which we have included below.

- National Gambling Helpline: 0808 8020 133

- GamCare: https://www.gamcare.org.uk

- GambleAware: https://gambleaware.org/

Frequently Asked Questions (FAQs)

Can I download bet365 mobile on Android devices?

Yes, a bet365 mobile app is available for download to Android devices.

Is bet365 mobile safe?

bet365 mobile is safe and secure, licensed by the UKGC to ensure safe, fair, and responsible gambling.

Is bet365 Games mobile better than desktop?

It entirely depends on personal preference, the bet365 mobile betting platform is modern and continually updated and can be taken on the go with bettors wherever they are.

Can I participate in bet365 mobile live betting?

Yes, there is live betting available on bet365 mobile that bettors can get involved in.

City AM is committed to responsible gambling. Please gamble responsibly and only bet what you can afford. To gain help, support and advice for a person struggling with gambling, contact the National Gambling Helpline on 0808 8020 133. If you are worried about your gambling or that of a friend visit gambleaware.org.

bet365 Casino Bonus – New Player offer Get up to 200 Free Spins

Are you a big slots fan looking for another opportunity to earn free spins at a top online casino site? Then look no further than this bet365 10 days of free spins promotion. In this dedicated review, readers can learn all about this excellent free spins promotion and how it works. In addition, players can learn why bet365 Casino is such a great site to sign up for.

City AM’s journalism is supported by our readers. If you click links to other sites on this page, we will earn a commission.

bet365 Sign Up Offer – bet365 10 Days of Free Spins

T&Cs: Min. £10 in lifetime deposits required. Offer must be claimed within 30 days of registering a bet365 account. Select prizes of 5, 10, 20 or 50 Free Spins; 10 selections available within 20 days, 24 hours between each selection. Max. prize, game restrictions, time limits and T&Cs apply. #ad

18+ Gambling Can Be Addictive. Please Play Responsibly. Registration Required. GambleAware GamStop Gambling Commission

This exciting bet365 free spins promotion is available to new customers with a verified bet365 account, aged 18+ and with lifetime deposits of £10. Once these criteria are met, users can claim 5, 10, 20, or 50 free spins daily for up to 10 days (across a 20-day period). To claim these spins, customers must pick a red, yellow or blue button each day, and behind each button will be 5, 10, 20 or 50 free spins. These spins are valued at 10p each, and players can claim up to 200 as a part of this offer.

The bonus spins claimed can be used on Book of Horus, Curse of the Bayou, Magic Forge, and Wrath of the Deep. It is also worth noting that deposits made using Paysafecard are not eligible for this promotion. Read the terms and conditions fully before claiming.

| Claimed Within ⏳ 30 Days of Account Creation | Min Lifetime Deposits 💸£10 | Max Number of Spins: 500 |

| Available Games 🎰: Book of Horus, Curse of the Bayou, Magic Forge and Wrath of the Deep. | Number of Reveals: 10 over 20 days | |

Alternative Free Spins Welcome Offers 2026

This exciting free spins promotion is not the only free spins offer users can take advantage of. Check out the alternatives listed below.

How To Claim the bet365 10 Days of Free Spins Offer

Follow the steps listed below if you wish to claim this top-notch welcome promotion.

- Using the link provided, head to the bet365 promotional page.

- Read the terms and conditions.

- Create your bet365 account and verify it. Account verification is a requirement to claim this bonus.

- Deposit a minimum of £10.

- To claim, click the yellow, blue or red button at the top of the offer page. Depending on your chosen colour, you should earn 5, 10, 20 or 50 free spins. This can be done up to 10 times over the next 20 days (leaving 24 hours minimum between picks).

- Use any free spins you claim within 7 days; unused ones will be forfeited.

bet365 10 Free Spins Terms and Conditions

Below, we explain the main terms and conditions users should know before claiming the bet365 offer. However, players should still read the offer T&Cs before claiming.

Significant T&Cs:

- 10 Free Spins reveals across 20 days of your first claim.

- Wait 24 hours between each reveal.

- Minimum of £10 in lifetime deposits.

- Maximum wins of 500 free spins.

- 7 Days to use all free spins.

- No wagering requirements.

Qualifying Criteria:

- Available to new customers until 10:59 GMT on 17th March 2025.

- Offer must be claimed within 30 days of account creation.

- Customers aged 18+ only.

- New and fully verified customers.

- Deposits made with Paysafecard are not eligible.

Free Spins:

- Can win 5, 10, 20 or 50 free spins per reveal.

- Awarded on Book of Horus, Curse of the Bayou, Magic Force, and Wrath of the Deep.

- Can take up to 72 hours to receive your spins.

- Value of 10p per spin.

Available Games for bet365 10 Days of Free Spins

As we mentioned previously, the bet365 10 days of free spins promotion has game restrictions, so to help players decide which game most appeals to them, we have listed and explained the games available.

Book of Horus

This exciting ancient Egypt-themed slot game allows players to win up to 5000x their initial bet, which can be as little as £0.10 up to £50 per spin. The game has medium volatility and a range of great features to boost a player’s gaming experience.

| Reels: 5 | Developer: Bwin Party | Theme: Ancient Egypt 🇪🇬 | RTP: 95.52% |

| Paylines: 10 | Special Features: Wilds, Bonus Game, Scatter, Expanding Wilds, Free Spins, etc. | ||

Curse of the Bayou

The next slot game on which users can use their free spins is the Curse of the Bayou. This excellent Hillside Media slot has a max win of 12,000x a user’s initial bet, which can be up to £20. It is another slot with medium volatility and a range of special features.

| Reels: 5 | Developer: Hillside Media | Theme: Horror 💀 | RTP: 96.0% |

| Paylines: 25 | Special Features: Wilds, Free Spins, etc. | ||

Magic Forge

Looking for a bit of magic while using your free spins? Then try out the fantasy magic slot, Magic Forge. Magic Forge is a medium volatility slot with a max win of 12,000x a user’s initial bet (of up to £20), just like the previously mentioned slot, Curse of the Bayou.

| Reels: 5 | Developer: Hillside Media | Theme: Fantasy & Magic ✨ | RTP: 96.0% |

| Paylines: 50 | Special Features: Bonus Game, Wilds, Scatters, Multiplier, & Free Spins. | ||

Wrath of the Deep

The final slot customers can use their free spins on is Wrath of the Deep, an excellent sea life-themed slot title created by Hillside Media. This action-packed slot has a range of special features, including multipliers, free spins, and a bonus game. With a top win of 12,000x, customers should check out this top slot.

| Reels: 5 | Developer: Hillside Media | Theme: Sea Life | RTP: 97.0% |

| Paylines: 25 | Special Features: Bonus Game, Wilds, Scatters, Multipliers, & Free Spins. | ||

Standout Features at bet365 Casino

Of course, a great welcome offer shouldn’t be the only reason a player signs up for an online casino, so to help you decide if bet365 Casino is the right place for you, we have listed its standout features.

- Game Library: At bet365 Casino, players can find a wide range of gaming titles from top software providers. Categories include slots, bingo, tables, and live casinos.

- Customer Support Options: If users need help, they can find it through live chat, email, social media, posts, and an extensive FAQ section.

- Payment Methods: The site offers many deposit and withdrawal methods, including Visa, Maestro, Mastercard, Apple Pay, Google Pay, PayPal, Trustly, Paysafecard, and more. All options have fast processing times and fair minimum and maximum transaction limits.

- Mobile Compatibility: bet365 has multiple options for customers who want to play on mobile. For starters, the site can be accessed on mobile internet browsers. On top of this, the brand offers various apps, including Bingo, Casino, and Sports.

- Licencing and Security: The site is highly secure, with various security measures in place and a licence from the UKGC.

- Promotions: Customers can enjoy a range of promotions while playing at bet365. These bonuses are available to new and existing customers and cover many betting options on the site. This includes casino bonuses, sportsbook offers, and miscellaneous promotions.

- Other Standout Features:

- This well-designed site is nice to look at and allows users to find everything they want quickly and without issue.

- One account allows access to all bet365 sites.

- Range of responsible gambling tools.

- Multiple social media accounts.

- Extensive selection of sports betting markets.

Top 10 Original Games at bet365 Casino

Once you have used up your free spins, you will likely want to get started on other bet365 slot games. As such, we have listed the best slots which can be exclusively played at bet365 to get you started.

- Spin O’Reely’s Pots of Gold ☘️: A bet365 slot with 20 paylines and an RTP of 96.01%.

- Sizzling 7s Fortune 🍒: High volatility slot with multipliers from bet365 Software.

- Book of Horus 🇪🇬: Exciting bet365 slot with multipliers and free spins.

- Spin O’Reely 🇮🇪: Medium volatility game with free spins and bonus games.

- Kitchen Chaos Rush Hour 🧑🍳: A bet365 exclusive slot with 1024 paylines.

- Savannah Bonanza 🦒: Based in the savannah, this slot has multipliers & free spins.

- Lynn O’Reely 🍀: Irish luck-themed slot with spins, multipliers, and bonus games.

- Bit Heist Neon Blast 🎆: A pays anywhere slot with an RTP of 95.43%.

- Northern Nights 🌌: bet365 exclusive slot with five reels and 10 paylines.

Dodo Eggstinction 🦤: Great for those looking for a slot with re-spins and scatters.

Responsible Gambling

bet365 Casino prioritises its players above all else, so the site is well-equipped with responsible gambling tools and resources. It is important that players always ensure that they are in control of their gambling habits. Available resources at bet365 Casino include links to gambling support sites, deposit limits, reality checks, time out, and self-exclusion. For immediate help, check out the options listed below.

- National Gambling Helpline: 0808 8020 133

- GamCare: https://www.gamcare.org.uk

- GambleAware: https://gambleaware.org/

Frequently Asked Questions (FAQs)

Are there any other free spins promotions at bet365?

Yes, you can claim alternative free spin offers at bet365. An example includes the bet365 Prize Matcher offer.

Do I have to be a new customer to claim the bet365 10 days of free spins offer?

Yes. Users must have a new and verified account to claim the bet365 10 days of free spins welcome promotion.

What’s the value of free spins at bet365?

Free spins at bet365 are valued at 10p each.

How long do withdrawals take at bet365 Casino?

Withdrawals at bet365 typically take 1-4 hours, depending on how long your chosen method takes to process payments.

City AM is committed to responsible gambling. Please gamble responsibly and only bet what you can afford. To gain help, support and advice for a person struggling with gambling, contact the National Gambling Helpline on 0808 8020 133. If you are worried about your gambling or that of a friend visit gambleaware.org.

bet365 2 Goals Ahead Early Payout Offer – Early Payout bet365 January

bet365 is one of the most well-loved betting sites in the UK, and its early payout offers are some of the best available, so to please new and existing customers alike, the site is now offering a 2 goals early payout promotion. This bonus is available at various football competitions across the world; learn more in this article.

Below, we will cover everything you need to know about this exciting new offer, including how to claim it and important terms and conditions. Users can also learn about alternative bet365 promotions.

City AM’s journalism is supported by our readers. If you click links to other sites on this page, we will earn a commission.

bet365 Early Payout – 2 Goals Early Payout Offer

T&Cs: Only available to new and eligible customers. Bet restrictions and T&Cs apply. Gamble Responsibly. Registration Required. #ad

18+ Gambling Can Be Addictive. Please Play Responsibly. Registration Required. GambleAware GamStop Gambling Commission

New and eligible customers at bet365 are currently entitled to the bet365 2 goal ahead early payout offer. This bonus can be redeemed on a selection of over 100 football leagues and competitions taking place all over the world until December 31st, 2026, despite the promotion only being available to customers from the UK and Ireland.

This offer includes Multiple types of bets: single bets, multiple bets, and bet builders. For single bets, your chosen winning team must go two goals ahead at any stage of the match; if that happens, then the bet will be paid out, even if the opposing team makes a comeback and wins the match. For multiple bets and bet builders, if a team you have backed as a part of your selection goes two goals ahead at any point, that bet selection will be marked as won.

| Available Leagues & Competitions ⚽️: 80+ | Expiry ⏳: Running Until December 31st 2026 | Betting Options ☑️: Singles, Multiples & Bet Builders |

| Available To 🧑💻: New and Eligible Customers in the UK and Ireland | Requirements 📋: 2+ goals scored by your selected team | Status: Currently Active in the UK and Ireland |

How To Claim the bet365 Early Payout Offer

If you are a new customer looking to claim the bet365 2 goals ahead early payout offer, follow the steps listed below.

- Create an account with the site using the link provided in this article.

- Make a deposit using your chosen payment method.

- Now, place a pre-match bet on a standard full-time result market for football games from the list of selected competitions before December 31st, 2026. These bets can be single, multiple or bet builders.

- Now wait; as soon as the criteria of your bet are met, it will be paid out.

- Note that this offer is only valid for players from the UK and Ireland.

Notable Early Payout Terms and Conditions at bet365

When claiming the bet365 2 goals ahead early payout promotion, users must read the terms and conditions fully. Below, we have listed the most notable T&Cs for this offer.

Eligibility:

- New and eligible customers.

- Users from the UK and Ireland.

- Pre-match single and multiple neys on the standard Full Time Result market for football games from selected competitions.

Restrictions:

- Full-Time Results – Enhanced Prices do not count towards the offer.

- Does not apply where the bet has been fully cashed out.

- Edited bets to include or amend a selection for an in-play event will be excluded.

- A bet will not pay out again if it is paid out early.

General:

- Expires 31st December 2026.

- 80+ Competitions and Leagues.

- Funds should be credited within 15 minutes of the selection, going two goals ahead.

bet365 Sports Review

bet365 is one of the most well-known and loved betting brands in the UK and when checking out the site, we weren’t surprised why. While betting on this top brand, players can find various options for everything they want or need. This includes a vast selection of sports betting markets, payment methods, customer support methods, promotions, casino games, and more. On top of this, the site is easy to navigate and well-designed, making it perfect for users at all experience levels.

The bet365 brand also offers its services on mobile devices. Customers can access the site using mobile internet browsers or by downloading an app through the iOS and Android app stores. The only problems we had with the site were that its size could overwhelm new customers and the long verification process.

| Pros ✅ | Cons ❌ |

| • Generous promotions for new and existing customers. • Multiple mobile versions of the site. • A vast range of sports markets and casino games. • Good selection of secure payment methods. • Helpful customer support team. | • Long verification process. • The size of the site can be daunting to bettors with less experience. |

Other bet365 Promotions UK

As we mentioned above, the bet365 2 goal ahead early payout promotion is not the only excellent bonus offered at the site. Below, we have listed some of the other great bonuses users can claim from bet365.

bet365 Bet £10 Get £30

New customers signing up for the bet365 site can claim an exciting bet365 bonus code offer. This promotion offers customers who create a new account with the site £30 in free bets when they deposit £5 and bet £10 or more. The bet must be placed at odds higher than 1.5 (1.20); otherwise, it will not count towards the release of your bet credits. These free bets can be used across various markets available on the site, so it is a great way for new bettors to try out the site, as they can place various wagers without having to use a large amount of their own money.

T&Cs: For New Customers. Min deposit requirement. Free Bets are paid as Bet Credits and are available for use upon settlement of qualifying bets. Min odds, bet and payment method exclusions apply. Returns exclude Bet Credits stake. Time limits and T&Cs apply. Registration Required. #ad

18+ Gambling Can Be Addictive. Please Play Responsibly. Registration Required. GambleAware GamStop Gambling Commission

bet365 Prize Matcher

Another excellent promotion currently offered at the bet365 site offers bonus rewards for the selection of sports markets, casino games, and table games found on the site. The bet365 Prize Matcher bonus can be claimed by new and eligible customers at bet365, which offers free spins, cash, and free tokens. For the opportunity to win these prizes, users must take part in the free-to-play prize matcher game, which can be played once a day at 17:00. Customers must then match symbols to get the chance to win. The prizes can be used on three slots, two tables, and various sports markets. Be sure to read the terms and conditions for more details.

T&Cs: New and eligible customers only. Three reveals will be available each day from 17:00 local time and the game grid will reset each week. Max. prize, time limits, game restrictions and T&Cs apply. #ad

18+ Gambling Can Be Addictive. Please Play Responsibly. Registration Required. GambleAware GamStop Gambling Commission

bet365 Bet Boost

Those looking for an alternative sports betting promotion may enjoy the current bet365 bet boost offer available to new and eligible bet365 customers. This promotion offers users boosted odds on a range of sporting selections, as indicated by a green arrow. It is worth noting that boosted multiples cannot be combined with other selections. Any bets users place on a bet boost market are available for all sports offers (with some exclusions applying to multiple bets). Read the terms and conditions fully before claiming.

bet365 Free Spins

This fun bet365 free spins promotion is specially designed for new customers who have a verified bet365 account! Each day, players have the chance to claim 5, 10, 20 or even 50 free spins for up to 10 days over a 20-day period. All you need to do is choose a red, yellow, or blue button each day, and you’ll reveal either 5, 10, 20 or 50 enticing free spins! Each spin is valued at 10p, so you can enjoy up to a fantastic total of 500 spins as part of this rewarding offer.

You can use your bonus spins on exciting games like Book of Horus, Curse of the Bayou, Magic Forge, and Wrath of the Deep. Just a quick note: deposits made using Paysafecard aren’t eligible for this promotion. Be sure to give the terms and conditions a thorough read before you dive in!

You can find more bet365 welcome offers by following this link.

T&Cs: Min. £10 in lifetime deposits required. Offer must be claimed within 30 days of registering a bet365 account. Select prizes of 5, 10, 20 or 50 Free Spins; 10 selections available within 20 days, 24 hours between each selection. Max. prize, game restrictions, time limits and T&Cs apply. #ad

18+ Gambling Can Be Addictive. Please Play Responsibly. Registration Required. GambleAware GamStop Gambling Commission

Responsible Gambling

Ensuring that you are always in control of your gambling habits is vital when betting online, and bet365 knows this. That’s why the brand offers a range of gambling control tools. These tools include deposit limits, reality checks, time-outs, and self-exclusion. In addition to this, users can also find links to multiple gambling help sites like GamStop and Gamble Aware. For immediate help, check out the options below.

- National Gambling Helpline: 0808 8020 133

- GamCare: https://www.gamcare.org.uk

- GambleAware: https://gambleaware.org/

Frequently Asked Questions (FAQs)

What markets can I use the bet365 early payout offer on?

The bet365 early payout offer can be used on over 80 football competitions worldwide.

Can existing customers claim the bet365 2 goal early payout bonus?

Yes, new and eligible customers are able to claim the bet365 2 goals ahead early payout offer.

Do I need a bonus code for the bet365 early payout promo?

No. No bonus code is required for the current bet365 early payout offer, but some offers on the site require a bet365 bonus code.

What’s the minimum deposit for bet365 early payout?

There is no minimum deposit required to claim the bet365 early payout offer.

Is there a bet365 mobile offer?

Customers can download the bet365 app on their iOS or Android devices to place bets on mobile.

City AM is committed to responsible gambling. Please gamble responsibly and only bet what you can afford. To gain help, support and advice for a person struggling with gambling, contact the National Gambling Helpline on 0808 8020 133. If you are worried about your gambling or that of a friend visit gambleaware.org.

bet365 Bonus Code CITYBONUS: Bet £10 Get £30 in Free Bets

Whether you are a new or experienced online bettor, you have probably already heard of bet365 thanks to its outstanding reputation. In this article, learn about the excellent bet365 sign up offer of £30 in free bets when you place a deposit of £10 on your first bet, plus all the other outstanding features bet365 has to offer.

City AM’s journalism is supported by our readers. If you click links to other sites on this page, we will earn a commission.

Bet £10 Get £30 in Free Bets – Use Code CITYBONUS

T&Cs: For New Customers. Min deposit requirement. Free Bets are paid as Bet Credits and are available for use upon settlement of qualifying bets. Min odds, bet and payment method exclusions apply. Returns exclude Bet Credits stake. Time limits and T&Cs apply. #ad

18+ Gambling Can Be Addictive. Please Play Responsibly. Registration Required. GambleAware GamStop Gambling Commission

The current bet365 bonus code promotion offers users a 500% deposit bonus when they make a qualifying bet of £5 or more. This deposit bonus will allow users to earn up to £30 in free bets, which can be used at a range of betting markets on the site. This promotion is only available to new customers, so if you already have an account with one of the bet365 sites, you cannot use this bet365 promo code.

Arrived here from the US? Find our bet365 US Review below:

| bet365 US Bonus Code | Promotion | Want to find out more? |

| EBNEWS | $150 Bonus Bets or $1k First Bet Safety Net | bet365 US Sportsbook Review |

Various terms and conditions apply to this welcome offer, which should be kept in mind when you decide to claim the offer; some of these can be found below, and even more details can be found later in this article. However, it’s vital to read the T&Cs for yourself.

| Qualifying Deposit 💷 £5 | Max Bet Credits £30 | Qualifying Bet £10 |

| Available From ⏳ 03/12/2024 | Claimed Within 30 Days | Promo Code 🔐 CITYBONUS |

Steps for Claiming the bet365 Promo Code Bonus

If you want to claim this top-notch bet365 new customer bonus, follow the simple steps below, and you’ll be able to use your free bets in no time.

- Using the link provided on this page, head to the bet365 site.

- Click the Join button.

- Start the signup process by ensuring you enter all required information correctly.

- Enter the bet365 bonus code: CITYBONUS.

- Make a minimum deposit of £5 to qualify for the bonus. Then make a qualifying bet of £10. Note that this qualifying bet does need to meet certain criteria.

- Wait for your deposit to settle, and then enjoy your free bets.

Notable T&Cs of the bet365 Welcome Offer

Many noteworthy terms and conditions are attached to the bet365 welcome promotion, which should be considered when deciding whether to claim and use the new customer bonus. To help customers, we have listed some of the most important below.

⭐️ Qualifying Criteria:

- New customers only.

- Aged 18+.

- A qualifying deposit of £5+ is made within 30 days of registration.

- This deposit (capped at £10) is the largest deposit made in the seven days before you claimed the offer.

- PayPal, Paysafecard, and all other prepaid cards and debit cards cannot be used for the qualifying deposit or subsequent withdrawals until two forms of ID have been verified.

- Offer must be claimed within 30 days of registration.

⭐️ Releasing Bet Credits:

- Place qualifying bets with a total stake value equal to or greater than the value of your qualifying deposit.

- Must be done within 30 days of claiming the offer or bet credits will be forfeited.

- Any single bets placed at odds of less than 1/5 (1.20) will not count towards the release of your Bet Credits.

- Various market restrictions apply.

⭐️ Using Your Credits:

- Bet Credits are non-withdrawable. Bet stakes are not included in returns.

- If a bet is void and has not had an opportunity to win, Bet Credits stakes will be returned.

- Cash outs will already have the bet credits stake removed.

- Cannot be:

- Used as stakes on Tote, Colossus bets, Lotto markets, and Fantasy Sports entries.

- Used as stakes on bankers, if bets, reverse if bets, or teasers.

- It will expire 7 days after being added to the bet credits balance.

- Bet credit bets will not qualify for ACCA boosts.

Sporting Events to Use bet365 Free Bets January

- Tennis: This January, the tennis world will have all eyes on the United Cup, as well as the WTA 500 Brisbane / WTA 250 Auckland, as well as the ATP 250 Brisbane / ATP 250 Hong Kong. The Australian Open will also take place between Jan 17 – Feb 1.

- Formula 1: N/A

- Football: Monday, the 5th of January, sees footballing action from the EFL Championship as Leicester take on West Brom. January also sees some top-of-the-table clashes in the Premier League as Arsenal host Liverpool on the 8th of Jan. The EFL Cup continues as both semi-final first legs are set to be played on Tuesday, the 13th, and Wednesday, the 14th. Tuesday sees Newcastle Utd take on Manchester City, and Wednesday sees Arsenal travel to Chelsea.

- Cricket: January kicks off with a historic finale to the 2025/26 Ashes series as Australia and England battle in the 5th Test at the Sydney Cricket Ground (Jan 4–8), with pride and legendary rivalry on the line after a dramatic series. Meanwhile in India, an exciting India vs New Zealand white-ball tour dominates the month, featuring three ODIs (starting Jan 11) and five T20Is running through to Jan 31 — a key lead-up to the 2026 T20 World Cup. Australia’s Big Bash League (BBL) also heats up in January, with plenty of marquee T20 clashes and the BBL Final slated around Jan 25. International action includes a West Indies vs Afghanistan T20I series in the UAE and England touring Sri Lanka for ODIs later in the month

Darts: January kicks off with the final showdowns of the PDC World Darts Championship at Alexandra Palace, London, where the title is decided in the quarter-finals (Jan 1), semis (Jan 2) and the final on Jan 3 — a must-watch clash at the pinnacle of the sport. Following the World Championship, the first major World Series of Darts events begin: the Bahrain Darts Masters (Jan 15-16) and the Saudi Arabia Darts Masters (Jan 19-20), bringing top PDC stars to the Middle East for global ranked-showcase battles.

Reasons To Sign Up for the bet365 Sportsbook

As mentioned at the beginning of this article, there are many reasons to sign up for this well-known sports betting site, some of which are listed and explained below.

⚽️ Sports Betting Markets

While betting at bet365, users can place wagers on a range of betting markets, sports and otherwise. In fact, the range of options available at bet365 puts many other online sportsbooks to shame. Some available markets include football, horse racing, cricket, darts, greyhound racing, fantasy, esports, lotto, ice hockey, and specials, such as Love Island betting.. Users can also find a range of betting markets within these markets, which means they can bet on almost any outcome they want.

⚙️ Usability

bet365 is perfect for users at all experience levels for many reasons, but one of the most important is its usability. Thanks to the quality of the site design, users can find everything they need and want quickly and efficiently. Betting markets are organised, support can be found easily, the sign-up process is straightforward, a search bar can be used, and users can even easily access the other bet365 sites.

📞 Customer Support

Those who often need additional support or encounter issues while betting at bet365, which is possible though unlikely, will be pleased to know that multiple support options can be utilised. The current customer support methods are live chat, social media, email, post, and an extensive help page, which should have the answers to any commonly asked questions. All support methods are available 24 hours a day, 7 days a week, and the support team on the other side is helpful, knowledgeable, and kind.

🎥 Live Streaming

When betting on certain markets at the bet365 sports betting site, users can stream certain games, matches or events in real-time thanks to the bet365 live streaming feature. Some sports markets with live streaming options include tennis, NBA, cricket, table tennis, horse racing, greyhound racing, and more. On top of this, live streaming at bet365 goes hand in hand with in-play betting, which allows customers to place wagers on their favourite sports or events as they are happening.

🎁 Promotions and Bonuses

Bettors will be excited to learn that the bet365 welcome offer is not the only bonus available at this great site. Another perk of bet365 is its extensive selection of promotions and bonuses available to new and existing customers. The sports promotions offered at this top site are available for use on various sports betting markets, including horse racing, football, greyhounds, NFL, NBA, and more. Current and previous examples include acca boosts, bet boosts, free bets, early payouts, extra chances, and best odds guaranteed, among others. While on the site, users can also find bonuses for the casino and bingo sites.

🔒 Site Security

Customers at bet365 can relax while betting thanks to the site’s top security measures, which are put in place to ensure their safety. Many measures are in place, starting with a valid licence from the UK Gambling Commission (UKGC), as required by UK law, as well as licences from The Gibraltar Betting and Gaming Association (GBGA) and the Malta Gaming Authority (MGA). Other security measures can be found in the site’s privacy policy; examples include eCORGA checks, SSL encryption technology, and fair gaming testing. To further ensure user safety, bet365 also only offers payment methods with the highest security measures.

📱 Mobile Compatibility

As we have already established, bet365 is a great online sportsbook for desktops, but does this carry over into the site’s mobile versions? The answer is yes; bet365 is also an excellent mobile betting site. There are multiple ways to access the bet365 mobile offer, but which one you check out depends on personal preference. Customers can access the site via mobile internet browsers or by downloading one of the mobile apps in either the Google Play Store or Apple App Store. The mobile version functions just as well as the desktop version and offers all the same top features.

💳 Payment Options

Like most online sportsbooks, you will likely need to utilise a range of payment methods regularly, and as such, it’s important for top sites to offer a variety, and bet365 is no exception. At bet365, customers can use e-wallets, prepaid cards, debit cards, and mobile payment options while betting, so customers are spoilt for choice. Some of the available options include Maestro, Visa Debit, Mastercard, Apple Pay, Google Pay, and Paysafecard. Deposit and withdrawal limits are fair, and all methods are fast and have little to no transaction fees.

To find out more information on bet365 and what they have to offer, follow this link.

Other bet365 Promotions 2026

| Offer: | Details: |

| bet365 Prize Matcher | Cash, Free Spins or Golden Chips. |

| T&Cs: New and eligible customers only. Three reveals will be available each day from 17:00 local time and the game grid will reset each week. Max. prize, time limits, game restrictions and T&Cs apply. #ad | |

| bet365 Early Payout | 2 Goal Early Payout for selected football markets. |

| T&Cs: Only available to new and eligible customers. Bet restrictions and T&Cs apply. #ad | |