Brent crude oil price rally hits blip after analysts voice concerns

The oil price rally appeared to be losing steam today with investors turning their attentions to the global supply glut, which would suggest low oil prices aren't going anywhere soon.

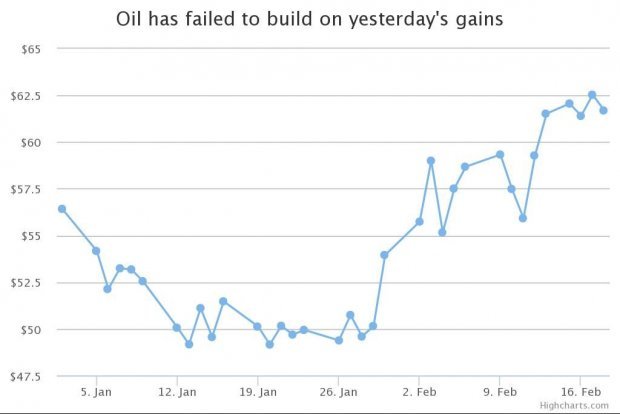

Oil prices have jumped over 35 per cent since skidding to an almost six-year low of $45.19 per barrel in January, with oil producers' spending cuts and a dwindling number of US rig fuelling future supply concerns.

But oil fell over $1 toward $61 a barrel today, failing to build on gains of over one per cent yesterday. Brent, the global benchmark, had soared towards its highest level this year yesterday, peaking at $63.

"The oil market is still fundamentally oversupplied and prices will start to struggle as we enter the second quarter," Steve Sawyer, analyst at Facts Global Energy. Mr. Sawyer told the Wall Street Journal. "We expect oil prices to come off during March and April … but it's a roll of the dice by how much."

Others said another warning sign was the fact oil prices had failed to climb despite yesterday's stellar gains.

"The lack of follow-through higher yesterday is a worry and there's plenty of reason to be neutral here and observe carefully," Robin Bieber, PVM Oil Associates director and technical analyst, told Reuters.