Motorists beware: RAC warns petrol prices likely to rise after OPEC cuts

Prices at the pumps will spike following OPEC’s decision to heavily cut oil production, warned motoring group RAC.

Fuel spokesperson Simon Williams argued the cartel’s pledge to reduce output by 2m barrels per day would “inevitably see oil prices rise”, consequently driving up the wholesale cost of fuel.

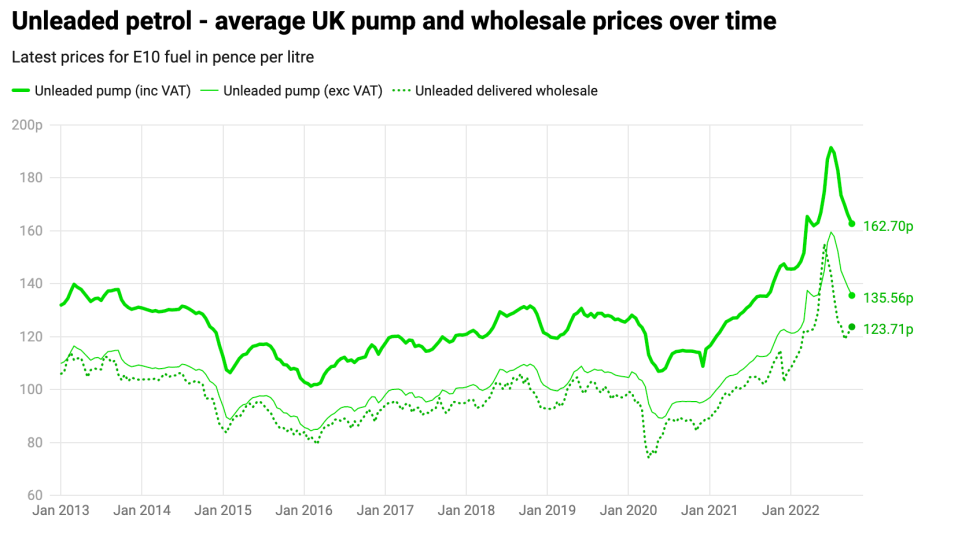

This follows three straight months of petrol prices falling across UK forecourts, with oil prices sliding from over $120 per barrel in June to around $90 per barrel on both major benchmarks amid growing recession fears and reduced demand.

However, RAC believes the retailers have failed to fully pass on these reductions to drivers, and that if forecourts bump up prices again, this will confirm they are taking a higher margin.

While the average price of a litre of petrol dropped to 162.9p last month, RAC has calculated that savings for motorists should have been 10p higher if retailers had not hiked their profit margins.

Its ‘Fuel Watch’ data suggests retailer margins are averaging around 17p a litre – 10p more than normal.

Prices are currently hovering at 162.43p per litre for unleaded petrol.

However, OPEC’s decision to cut production has already seen Brent Crude prices spike 2.16 per cent in today’s session to $93.78 per barrel,

Williams said: “If we see pump prices go up within the next fortnight, we’ll know that retailers are sticking to their strategy of taking far more margin on every litre they sell than they have historically – much to the dismay of drivers up and down the country.

“We’ll be watching what retailers do when it comes to pump prices closely in the next few weeks.”