RAC urges more support for drivers amid near-record petrol price spike

Petrol prices rocketed over 10p last month, the second largest monthly rise on record – putting more pressure on road users amid the deepening cost of living crisis.

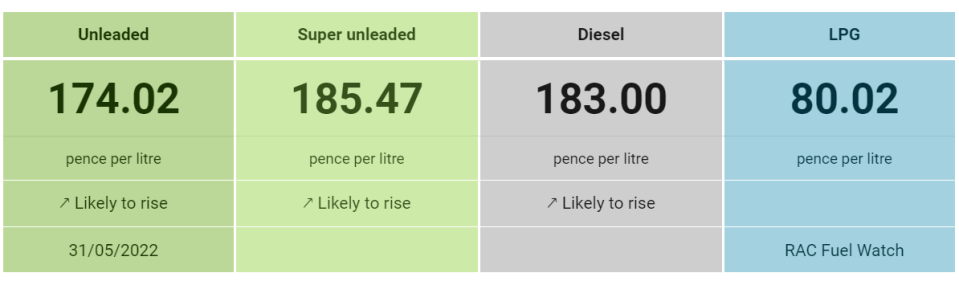

A litre of unleaded rose from 162.87p at the start of May to 174.02p at the close of the month, according to RAC Fuel Watch Data, with the price of filling up an average 55-litre family car soaring to £95.

Meanwhile diesel broke the £1.80 threshold, peaking at 183p, with business and delivery vehicles still highly dependent on the fuel.

This takes the cost of filling a complete 55-litre diesel tank above £100 for the first time ever.

The spikes in prices happened despite a historic 5p-a-litre duty cut invoked by the Chancellor Rishi Sunak during the Spring Statement in March.

It also comes alongside soaring energy bills and skyrocketing inflation, which has hit food prices and consumer goods.

RAC has called on the government to intervene in the petrol market once more, with the motoring group expecting average petrol prices to hit 185p as a result of the rising cost of oil, with diesel heading towards the 190p mark.

The company’s fuel spokesman Simon Williams described May as “another horrible month for drivers” with a “dire situation on the forecourts.”

He called on the government to either reduce fuel duty further or reduce VAT from its current rate of VAT.

Williams explained: “Arguably, a duty cut would make a bigger difference to both businesses and individuals, but it also seems very unfair that the Treasury is benefitting to the tune of 30p a litre in VAT revenue from the record high prices – as it’s effectively a tax on a tax, applied on top of the wholesale fuel cost, duty, delivery and retailer margin.”

Previously, the RAC accused petrol retailers of taking an extra 2p per litre from the margins, while the government has threatened to fine retailers who do not pass on the 5p fuel duty cut to consumers.

However, fuel experts have played down claims petrol retailers are gouging at the pumps, and have instead suggested they are pricing in expected hikes in wholesale costs amid market volatility.