Mortgage rates could be on the rise

With rising costs and house price highs spooking homebuyers, shop around for a good deal

NEWS that house prices in England have hit record highs – now 0.9 per cent higher than their previous peak in January 2008 – has heightened fears that the government’s Help to Buy subsidised mortgage scheme is fuelling a housing bubble.

While not all economists share that view – IHS Global Insight’s Howard Archer has said we are “some way off bubble territory” – nearly two-thirds of lenders have said an artificial boom in house prices is the biggest threat to George Osborne’s initiative. Lord Wolfson, chief executive of Next, has warned that improving mortgage availability could result in an “unhelpful house price bubble”.

REGIONAL VARIATIONS

And while the broader UK housing market remains below its pre-recession highs, data from the Office of National Statistics has revealed wide regional variations – with London prices jumping 9.7 per cent in the year to July. In addition to rising house prices, house buyers may have to contend with the reality that mortgage deals have bottomed out.

The increase in the number of mortgage products available has partly been the result of the Funding for Lending credit easing scheme, introduced last summer. Since then, rates have been on a downward trend on both two and five-year fixes. But despite governor Mark Carney’s forward guidance pledge last month, the record-low fixed-rate deals witnessed in the past few months could be coming to an end. David Hollingsworth of London and Country Mortgages, for example, thinks we may have reached the point where the rate of reduction in benchmark deals has slowed permanently.

CHANGING CONDITIONS

Driving this change is a combination of swap rates, and high demand for certain products – which has led companies to remove them from the market. Swap rates – the cost of obtaining fixed-term funding on the money markets for lenders – typically impact fixed-rates, with base rate/Libor impacting variable-rate mortgages. Swaps have seen a considerable increase – from 0.93 per cent in April this year to 1.87 per cent earlier this week – and Hollingsworth is concerned that this could mean mixed messages from lenders for some time to come.

Yorkshire Building Society and NatWest are among those who have increased rates in recent weeks. The former tweaked its five-year fix last week from 2.49 per cent to 2.59 per cent. NatWest, meanwhile, has increased its 60 per cent loan-to-value (LTV) five-year fix from 3.09 per cent to 3.35 per cent (with no product fee). And Principality Building Society withdrew its five-year fixed rate of 2.99 per cent, which had been on offer to borrowers with deposits as small as 25 per cent. The news is driving current borrowers to remortgage into low, long-term fixed rates. Indeed, according to Hollingsworth, “there is little point in waiting” to lock in.

Eight out of ten borrowers are now opting for a fixed-rate over a variable-rate mortgage, which Nigel Bedford of Large Mortgage Loans attributes to the fact that new variable-rate deals, which track the official Bank rate, “only have downsides”. But while we may have witnessed record lows for fixed-rate mortgages, we are also seeing sky high arrangement fees. Which? analysis of around 2,800 mortgages found that only 19 per cent are now available without set up costs. As such, you may be better off choosing a mortgage with low set-up fees and a higher interest rate.

FIXING IN

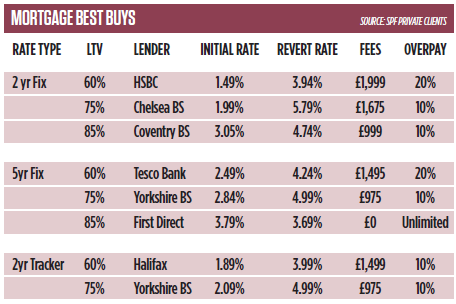

For the moment, there are still good deals available to homebuyers if you shop around. Best buy variable-rate deals include Halifax’s two-year tracker, which has an initial rate of 1.89 per cent, reverting to 3.99 per cent, with £1,499 fees. But when viewed alongside the lowest five-year fix (Tesco Bank’s 2.49 per cent and £1,495 fees), borrowers – and those looking to lock in – may find it is more a question of length of fix, rather than of fixed versus variable.

For shorter-term products, Hollingsworth points to Norwich & Peterborough’s 1.99 per cent two-year fix, with 65 per cent LTV and a £295 fee. At the other end of the spectrum, borrowers can find good deals if they opt for a ten-year fix. Norwich & Peterborough offers 3.84 per cent, up to 75 per cent LTV, no fee, and £200 cash-back on purchase.

But longer fixes do have their downsides. They could mean reduced flexibility – if you decide to move house and need to borrow more, for example, you may find your lender won’t offer the best deals. And if you exit before the end of the fixed period, you will have to pay a penalty. Which? analysis has also found that, with variable products, it is more likely that you can switch to a different product with a lower LTV and lower interest rate.

A third risk is that rates fall lower than the rate you fixed at. But with fixes still so low, this is unlikely. “The peace of mind that comes with a fix usually outweighs the downsides,” says Harris. So consider your long-term plans, and where possible, seek professional, independent advice. The best deal will depend on individual circumstances, so do your research – a comparison website is a good place to start.

LOOKING FORWARD

In the longer term, Hollingsworth doesn’t see the competition in the mortgage market falling away. Indeed, he believes Help to Buy could see more big players offering competitive rates and better deals for borrowers. And new entrants – like Aldermore Money – are already reaching out to borrowers who may not fit mainstream lending criteria. But these developments do carry worrying risks. Magellan Home, for example, hit headlines last month by offering loans to borrowers with bad credit scores, fuelling concerns that we may see a return of subprime lending, widely viewed as a leading cause of the financial crisis.

Harris thinks the increases in mortgage rates are not cause for panic. In view of reports that rates have bottomed out, if you can find a fix-year fix at less than 3 per cent, it might be worth taking. It will, at least, give you certainty in a time of house price volatility.