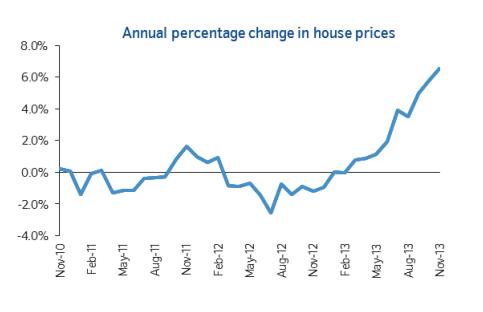

Fastest rise in UK house prices since July 2010

(Nationwide)

The Nationwide UK house price index rose by 0.6 per cent in November, taking the annual rate of increase to 6.5 per cent – the biggest seen since July 2010.

October's month-on-month increase was 1.0 per cent, whilst year-on-year the index rose 5.8 per cent.

November's figures follow the news yesterday that the Bank of England is to end its Funding for Lending scheme for mortgage borrowers.

(Nationwide)

The robust rise in house prices will heighten concerns that the UK is en route to a new housing bubble, although Nationwide said that they are still about six per cent below the all-time high recorded in 2007. Howard Archer, chief UK and European economist at IHS Global Insight, says:

House prices look set to see further strong increases over the coming months despite the Bank of England ending Funding for Lending support for mortgage lending, and they could very well see another marked rise in December and then increase by around 8 per cent in 2014.

While these projected house price rises are expected to be driven by increases in London (especially) and parts of the South East, house prices are likely to strengthen appreciably in most regions and to make gains across the country. [But]… we are currently some way off from an overall housing market bubble emerging.

Nevertheless, there remains a very real danger that house prices could really take off over the coming months, especially if already significantly improving housing market activity and rising buyer interest is lifted appreciably further by the Help to Buy mortgage guarantee scheme.