| Updated:

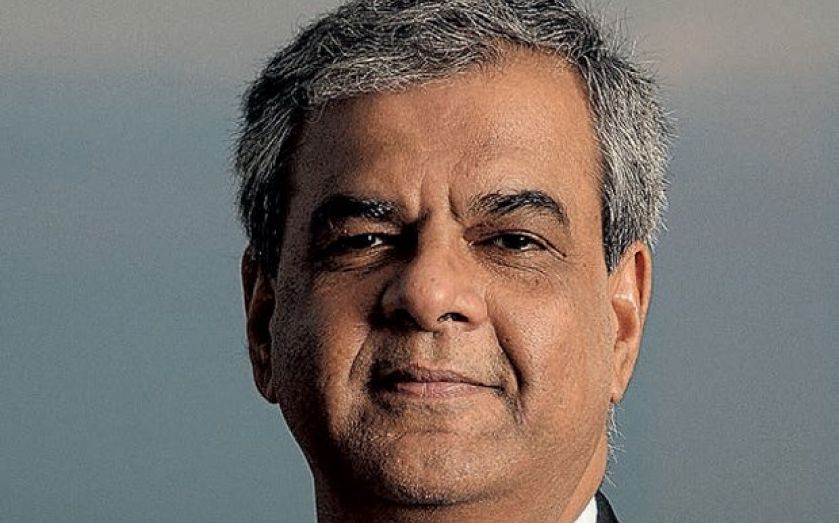

Barclays’ Ashok Vaswani is hoping to turn around the UK’s most broken industry

"My name is Ashok Vaswani. My role is to listen to customers, to make sure we give them what they want.”

This understates his job title somewhat. Vaswani is Barclays’ CEO of personal and corporate banking, a powerful new job which has seen him take control of its global operations in retail, business and wealth management.

But then, this is not Vaswani’s usual crowd. He is not pitching to a group of investors or a conference of analysts.

He is speaking to a class of 90 school children, aged 14, at the Walworth Academy in east London – and it might be his most important audience yet.

They were seven years old when Northern Rock crashed, so have grown up in a world saturated with negative stories on banks and the UK economy.

This is the front line of Barclays’ war to turn its reputation around.

“It is a serious issue. The UK has always been on the forefront of the financial services industry and it is still a very very important part of the economy,” he says.

“It is inherently important for people like me that [the pupils] get to see a balanced view of what this really means – of how important banking is, of how important it is how we behave, how when we made the mistakes we stand up and say we are sorry.”

Vaswani is keen to provide evidence the bank is changing, since it is still being hit by costs of pre-crisis wrongdoing like PPI mis-selling – it is set to put aside several hundred million pounds more this week to cover the redress bill, when it reports its interim results – and by new allegations. For instance, Barclays is fighting US claims that it lied to investors in its dark pool trading facility as recently as this year.

“The really important thing is that we don’t create any future sins of the past,” says Vaswani.

“We’ve got to go through our business in detail and if anything there could create a problem, we absolutely stop it, even if it means loss of revenue.”

He estimates that more than 35 per cent of customers have avoided paying fees for unauthorised overdrafts thanks to a new scheme where the bank sends text messages each morning to alert those at risk of the charges.

The service loses the bank millions of pounds in fees, but, he hopes, making customers trust Barclays again.

The Life Skills class Vaswani spoke at is also part of that brand building.

So far the bank and some of its biggest corporate clients have run classes at more than 5,000 schools. It aims to help children bridge the gap from school to work.

But it is also a recruiting ground for apprentices and new staff. At the start of this class, just one pupil raised his hand when asked if anyone wants to work in a bank. Vaswani hopes to turn this around with the effort he is putting into new technology. “The digital revolution is bigger than the industrial revolution,” he says.

Such sweeping changes tend to leave individuals behind, and Barclays is on a major advertising push offering help to those without digital skills.

But the revolution also threatens traditional banks, and Vaswani hopes the development of services like payment app Pingit will keep the bank ahead.

New banks are on the way, like Atom which claims to be the first digital only lender. And firms like Paypal and Google are breaking into the sector.

“In a sense this is the kind of competition which can disrupt the most,” he concedes. “Typically what they will do is pick up one niche, like PayPal does payments, and they go at it and they do a really nice job.”

By contrast, he wants to do digital banking in every part of the business, from small business banking to forex.

“That entire gambit is very difficult to fulfil, and that is where we differentiate ourselves,” Vaswani says.

“Many times I’ve asked myself, ‘Am I in the game of finance? Am I in the business of information? Am I in the business of technology?’ Life has moved on, those industrial lines have blurred.”

CV ASHOK VASWANI

■ Degrees from Bombay University, the Institute of Chartered Accountants of India and the Institute of Chartered Secretaries of India.

■ Other roles include sitting on the advisory board of the SP Jain Institute of Management. He is founder director of Lend-a-Hand, a non-profit focused on economic development in India.

■ Spent 20 years up to 2007 in marketing, cards and consumer banking in different regions across the world for Citi.

■ He spent almost three years at finance-focused private equity firm Brysam Global Partners in New York.

■ Joining Barclays in 2010, Vaswani initially managed the credit card business, before heading operations in Africa, then running the retail banking arm.

■ He is married and has one daughter.