Mediobanca hurt by a crash in profits at its insurance business

INVESTMENT incomes crashed at Italian lender Mediobanca, its first quarter results showed yesterday.

Net profit came in at €160m (£126m) in the three months to the end of September, down 6.5 per cent on the year. The biggest blow came from its principal investing arm where profits dived 61 per cent to €53.3m on weak results at its insurer Assicurazioni Generali.

Corporate and private banking profits climbed almost five-fold to €84.2m, while retail banking profits increased 24 per cent to €23.5m.

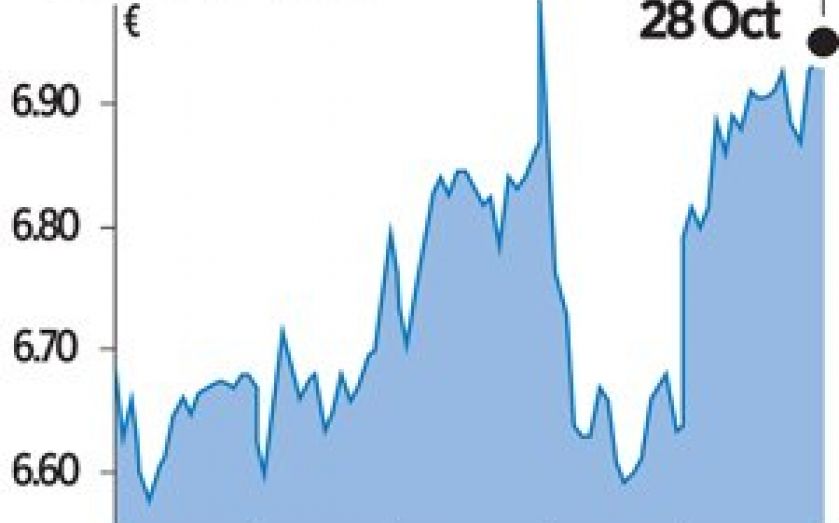

Despite the good profit figures, Mediobanca’s shares were flat yesterday, closing at €6.94.

“We expect the market to have an initial positive reaction due to better than expected fee income, stable trading and some improvement in lending growth,” said Citi’s Azzurra Guelfi. “Mediobanca could also benefit from potential future consolidation in the Italian banking space given its leadership position.”

The bank passed the European stress tests this week, with a capital buffer of 6.24 per cent under the stressed scenario – well above the 5.5 per cent pass threshold.