London’s FTSE 100 edges lower as economic gloom knocks risk appetite

London’s FTSE 100 posted a damp day today driven by economic gloom hitting investors’ risk appetite.

The capital’s premier index dropped 1.05 per cent to 7,284.15 points, while the domestically-focused mid-cap FTSE 250 index, which is more aligned with the health of the UK economy, fell 0.45 per cent to 19,063.75 points.

A recent string of downbeat forecasts predicting where the UK economy is headed over the coming year has weighed on London FTSE 100 stocks.

Investment bank Goldman Sachs yesterday said inflation could surge to over 22 per cent unless global gas prices drop from their historic highs.

European gas prices yesterday tumbled, driven by Germany reportedly receiving more gas inflows than expected, pushing it to near its storage target.

“A fall in wholesale gas prices yesterday, as European storage targets were met early, provided some hope that the current energy crisis might ease slightly,” Russ Mould, investment director at AJ Bell, said.

The pound weakened around 0.3 per cent against the US dollar to buy $1.1624.

Sterling has been on a downward spiral in recent months, mainly fuelled by investors flowing into dollar-denominated assets to capitalise on the Federal Reserve’s rapid rate hike cycle and anxiety over the UK tipping into a long recession.

FTSE 100-listed UK energy operator National Grid shed over four per cent, pushing it to the bottom of the index.

Pharmaceutical giants AstraZeneca and GSK were among the biggest losers, dipping more than 1.5 per cent.

FTSE 250-listed online fashion retailer ASOS dropped 3.07 per cent, mainly driven by investors fretting over the historic inflation surge eroding consumers’ capacity to spend.

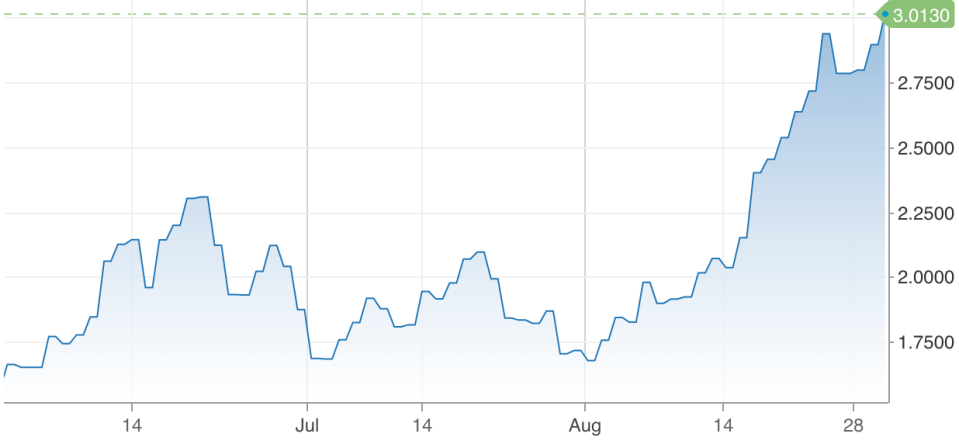

Yields on UK government debt extended their gains from yesterday. The 2/10s yield curve remains inverted, signalling traders believe the Bank of England will need to cut interest rates to lift the economy. An inverted yield curve often precedes a recession.

10 year UK government debt yield

Oil prices fell around one per cent.