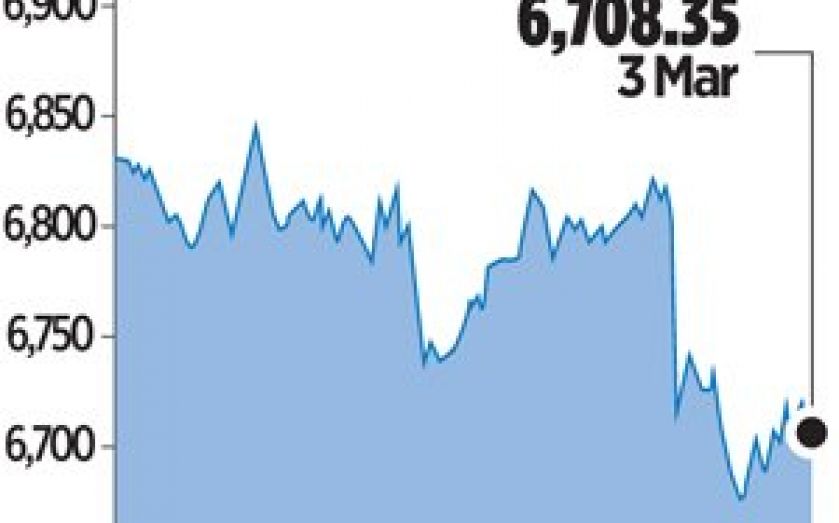

London Report: Ukraine unrest drags on FTSE as volatility climbs

BRITAIN’S top share index fell to a two-week low yesterday, led down by asset management firms as stocks most exposed to emerging markets fell on increasing tensions in Ukraine.

The possibility of war between Russia and Ukraine hit stocks that are particularly sensitive to optimism over global markets, such as fund managers Schroders and Aberdeen Asset Management, which fell 4.6 per cent and 4.3 per cent respectively.

Banks, insurers, mining and energy stocks were other big losers after Ukraine mobilised its reserves following Russian President Vladimir Putin’s declaration that he had the right to invade his neighbour.

Volatility, an indicator of investor fear, spiked by 28.3 per cent, its largest daily rise since 2011.

“The complex situation in Ukraine brings potential for heightened volatility in the near term amid concerns of an escalation into a wider conflict,” said Alan Higgins, UK chief investment officer at Coutts.

“Our central scenario is that a wider conflict will ultimately be avoided … As such, our six to 12 month views remain unchanged,” he added.

Companies with direct exposure to Russia – including oil major BP – were the hardest hit.

BP, which has a significant stake in Russia’s biggest oil producer Rosneft, fell 2.3 per cent, alone trimming 8.5 points off the index.

Rosneft shares slumped by as much as eight per cent.

The FTSE 100 was down by 101.35 points, or 1.5 per cent, at 6,708.35 by the close, holding just above the 6,700 level seen as significant by technical analysts.

“I was already bearish in the near-term, and the situation in Ukraine is supporting this view,” Fawad Razaqzada, technical analyst at Gain Capital, said.

Only five stocks were in positive territory, with precious metal mining companies Randgold and Fresnillo the top risers, benefiting from a flight to safety that boosted the gold price.

Shares in miners of other metals suffered. The UK mining index fell 1.7 per cent, hurt by geopolitical concerns and weakness in copper, which slipped on data showing a further drop in factory activity in China, the world’s top metals consumer.

The final Markit/HSBC manufacturing purchasing managers’ index (PMI) for China fell to a seven-month low of 48.5 in February from January’s 49.5, its third straight monthly decline.