London Report: Retail gloom and US gridlock weigh on FTSE

THE UK’S top share index slipped to three-month lows yesterday as weak data and downbeat analyst comments hit retailers and the fiscal deadlock in the United States kept broader sentiment subdued.

In contrast to buoyant recent British data, retail sales growth slowed for a second month in September, according to BRC numbers.

Analyst notes on the sector were also downbeat, with Deutsche Bank cutting its full year earnings forecast for Marks & Spencer by two per cent while Bernstein downgraded the stock to “underperform”. M&S dropped 3.4 per cent, while the FTSE 350 General Retail index lost 1.9 per cent.

“The retailers are notably weak today after the BRC numbers. They are all quite close to (technical) support levels, but whether they actually hold those levels I am not sure – it certainly feels that the path of least resistance is lower at the moment,” said Zeg Choudhry, head of equities trading at Northland Capital Partners.

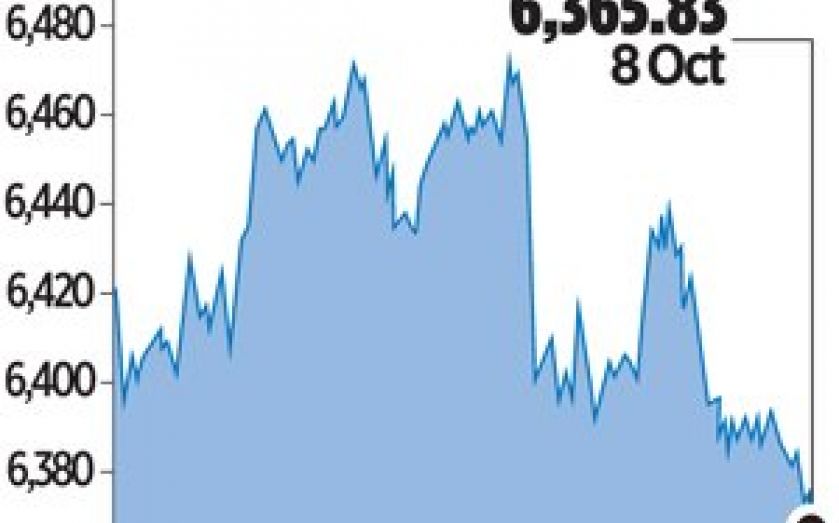

The broad FTSE 100 index closed down 71.45 points, or 1.1 per cent at 6,365.83, its lowest finish since July.

Also among the top fallers were heavyweight miners like BHP Billiton, hit by slowing service sector growth in top metals consumer China.

Broader sentiment was also bruised by concerns a US budget compromise may not be reached before a 17 October deadline for raising the country’s debt ceiling.

The FTSE 100 – whose companies rely on the United States for nearly a quarter of their sales – has proved more vulnerable to the US jitters than euro zone peers.

Volumes were relatively low – at 88 per cent of the 90-day daily average – with many investors opting to sit out the US political uncertainty, while others waited for more attractive entry points from a deeper correction.

“We’re just waiting for the right price points… if the market wants to get anywhere towards 6,000 I’m sure that would chuck up a lot of extremely interesting situations,” said George Godber who manages the Miton UK Value Opportunities Fund.

The London index broke below technical support at the 200-day moving average, and has gone into oversold territory on the seven-day relative strength indicator.

The number of companies trading above their 200-day moving average has fallen to 53 from 75 over three weeks, according to Datastream, but is still above its June trough of 47.