Letters: Making an entrance

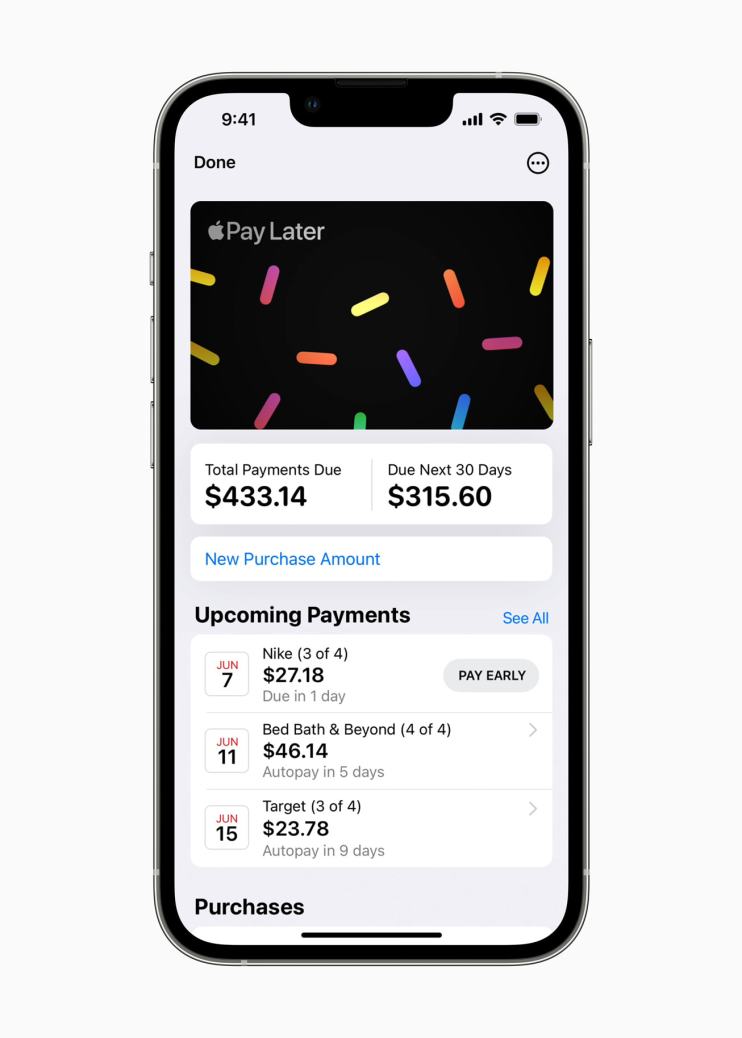

[Re: Apple launches buy-now-pay later offering, yesterday]

The fact that Apple has officially entered the buy-now pay-later space brings an appetite for ecommerce to the forefront. From a surge in online shopping to an increase in edtech, owing to physical restrictions, the pandemic has accelerated the already burgeoning space of e-commerce. As a result, the payments space has rapidly evolved to reach into emerging markets where technologies that target fraud and checkout abandonment are key to companies determined to expand their global footprint.

Apple’s new feature not only marks the tech giant’s entrance into the highly competitive payments space but is part of a wider push from companies looking to expand their infrastructure, technology and services. Given the competitiveness of the space, emerging markets are now a natural place for businesses to look for growth and retain profitability. We’re already seeing reports of Big Tech betting large on India, one country now in the midst of a large digital boom.

In fact, PwC’s report on emerging markets states that the payments business in these markets will continue to grow between now and 2030. Undoubtedly, the competitiveness and growth of the payments industry, coupled with an increased appetite among brands to tap into these relatively untouched territories with a growing number of consumers, means emerging markets will only gain more momentum. Businesses that don’t get on board face getting left behind in the dust.

Manpreet Haer