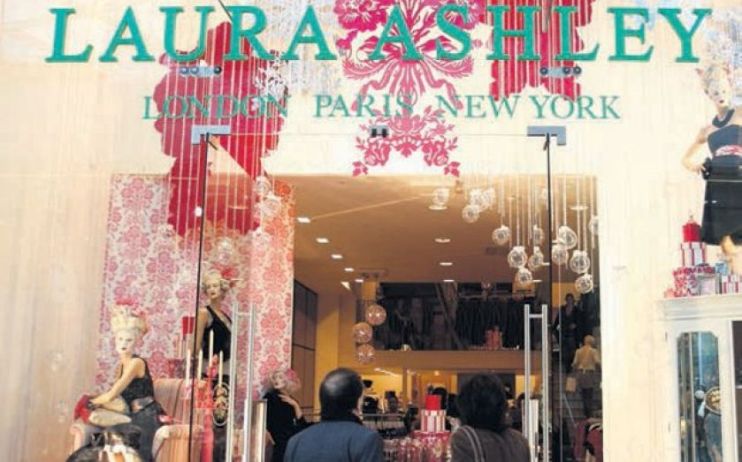

Laura Ashley owners battle with lenders in race to save high street chain

The owner of high street chain Laura Ashley is in talks to secure a fresh draw down from one of its lenders to keep the struggling brand trading.

A dispute between Laura Ashley and lender Wells Fargo over the retailer’s access to a £20m funding line has pushed the fashion firm’s Malaysian owner MUI Group into discussions about making new arrangements on the loan.

Laura Ashley confirmed late last night that talks were ongoing about adjusting the rules in order for the retailer to “meet the group’s immediate funding requirements, and to draw down additional amounts to meet ongoing working capital needs”.

Laura Ashley agreed a loan with Wells Fargo in October, however the loan is asset backed, meaning the retailer must put up assets as security in order to draw down the cash. The amount of the Wells Fargo loan the retailer can access dropped in line with its stock and customer deposit levels, the Sunday Times first reported.

It added that should those talks fail, Laura Ashley will be considering “all appropriate options”. It denied reports that MUI was planning an immediate cash injection into the group.

The retailer, which is known for its floral print homeware and clothing, said last month that chief executive Kwan Cheong Ng would step down after eight years in the role. Chief operating officer Katharine Poulter will take over the job in May.

In last night’s statement, Laura Ashley said trading during the current financial year had “continued to be challenging”.

It reported initial figures which showed sales of £109.6m for the last six months of 2019, down 10.8 per cent from the same period in 2018 at £122.9m. Laura Ashley said this was the result of “market headwinds” and weakened consumer spending, which knocked sales of big-ticket items.

The company plans to announce interim results for the six months ending 31 December 2019 on Thursday.

Chairman Andrew Khoo said: “We acknowledge that recent trading conditions, in line with the overall UK retail market, have indeed been challenging. There is however a robust plan in place to turn the business around and the board of directors is confident and optimistic that the recent appointment of Katharine Poulter will enable the business to execute this broad based strategy.

“The major shareholders have indicated their continued confidence in the business and are fully supportive of the management team and execution of the transformation plan.”