Jupiter orbits record high on funds growth

STRONG flows of cash into fixed-income products helped fund manager Jupiter Asset Management hit a record asset high in June, the FTSE 250-listed group said yesterday.

Funds under management, a measure of how much cash it invests on behalf of customers, rose 4.4 per cent to a record high of £33.1bn for six months ending June.

About £1.3bn was handed to Jupiter by new and existing customers during the period.

Chief executive Maarten Slendebroek told City A.M.: “The implementation of our growth strategy went really well in the first half of the year.

“The £1.3bn came mainly from international clients and went into fixed income products, which carry a lower sticker price.”

Revenues rose six per cent to £148.5m, but management fee margins were lower due to the strong flows into fixed income products, which earn the company less money than other types of funds.

Margins fell from 92 percentage points to 87 percentage points.

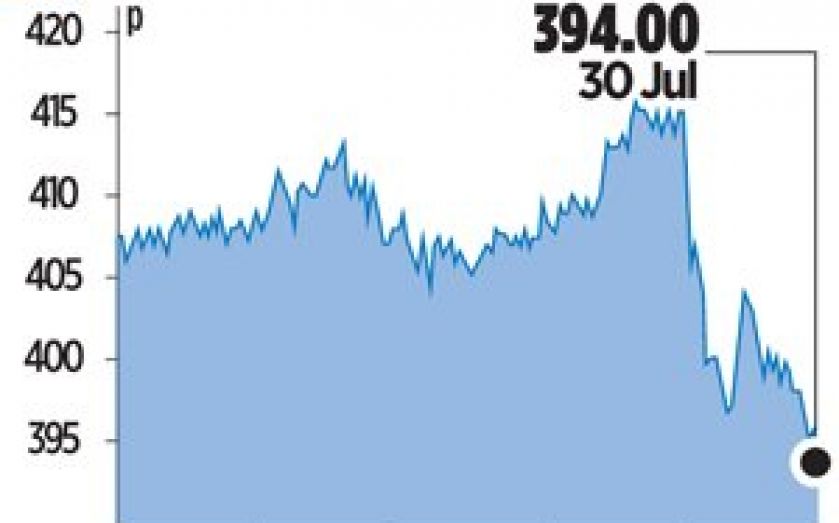

The company also revealed one anonymous customer was set to pull a slug of cash from the business at some point this year, sparking fear in investors and sending shares down four per cent.

The company also reiterated its plans to start paying a special dividend, on top of its usual interim payout.