Is Musk’s SpaceX IPO date written in the stars?

SpaceX may be aiming for the stars in more ways than one as Elon Musk has floated the idea of timing the rocket maker’s IPO to coincide with a rare planetary alignment, as well as his own birthday.

The tentative window is mid-June, when Jupiter and Venus will appear unusually close together in the night sky, a so-called conjunction that occurs only every few years.

A few days later, Mercury is also expected to line up diagonally with the pair.

The celestial timing, in the eyes of the superstitious billionaire, has appealed as an “auspicious” moment for what would be the largest IPO in history, according to the FT.

SpaceX is understood to be exploring a float that could raise as much as $50bn at a valuation of around $1.5tn, eclipsing the $29bn raised by Saudi Aramco in 2019

All figures remain preliminary and subject to market conditions.

The date would also land close to Musk’s birthday on June 28, a detail that has not gone unnoticed by bankers and investors, given his long-running fondness for bizarre symbolic timing.

Musk’s symbolism

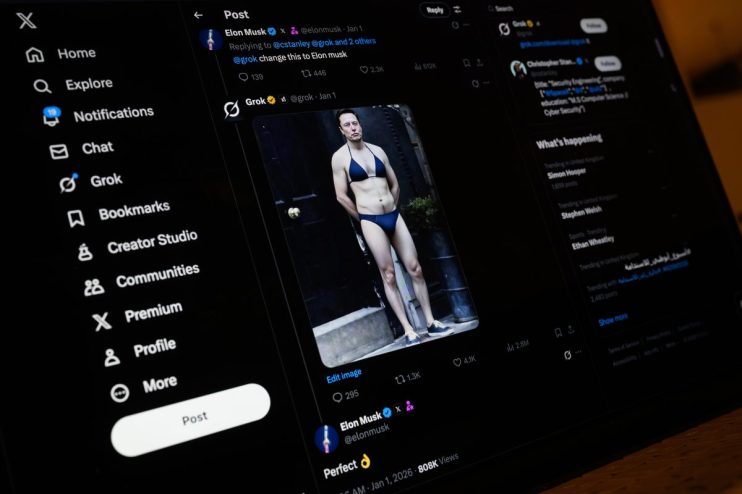

Musk has form when it comes to mixing symbolism and high-stakes corporate decisions.

In 2018, he famously tweeted about taking Tesla private at $420 a share, a move that later drew scrutiny from US regulators and cost him dearly. The 420 reference was taken as a nod to Musk’s occasional penchant for smoking cannabis, given the slang term’s popularity among users.

More recently, he has joked about buying Ryanair following a public spat over Starlink, even suggesting he would replace chief executive Michael O’Leary with someone named Ryan.

This latest flourish, however, seems to come with far higher stakes.

Any SpaceX listing would still need to clear regulatory hurdles, including filing a prospectus with the US Securities and Exchange Commission and embarking on a global investor roadshow.

Concerns are also swirling about whether a June timetable leaves enough room to execute a deal of that scale.

The timing is also complicated by volatile markets, with investor sentiment being buffeted by renewed trade tensions, geopolitical uncertainty and unpredictable shifts in US monetary policy.

Behind the scenes, SpaceX chief financial officer Bret Johnsen has been sounding out existing investors since December on appetite for a public listing, with some discussions previously pointing to a mid-2026 timeframe rather than this summer.

SpaceX is pouring capital into its Starship rocket programme, expanding its Starlink satellite network and exploring ambitious plans to deploy data centres in orbit infrastructure.

Musk believes this is critical to competing in AI against rivals such as Anthropic and OpenAI, hence the race to an IPO.

For long-standing backers, including several UK investment trusts that hold stakes in SpaceX, an IPO would finally provide clarity on valuation after years of private funding rounds and opaque price discovery.

Investors will be eagerly waiting to see see whether the markets, or indeed planets, align in Musk’s favour.