Irish borrowing costs tumble on strong demand

THE IRISH government successfully raised €3.75bn (£3.1bn) in long term debt yesterday in its first return to the markets since exiting its bailout programme last year.

The troubled economy’s relatively healthy revival has been met with strong demand from investors – the 10 year bond was more than three times oversubscribed.

Investors placed bids for around €14bn in the auction.

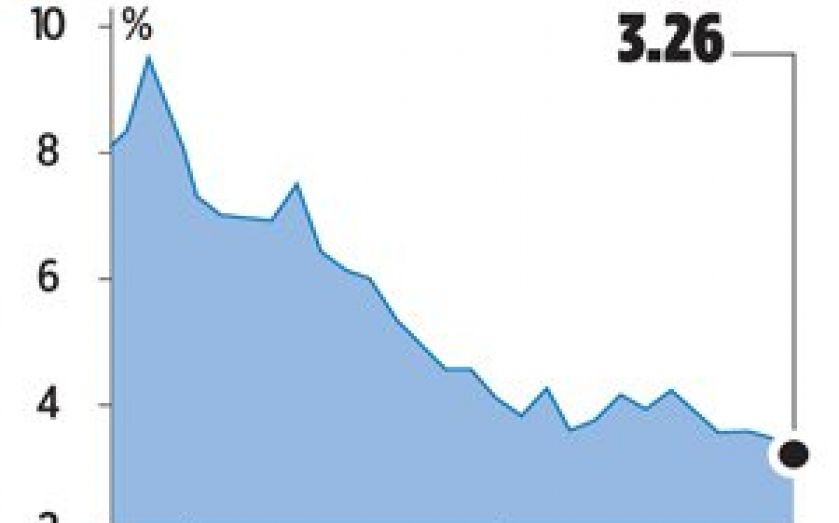

Such strong demand helped push down the government’s borrowing costs to their lowest level in eight years.

Ten-year bonds were trading last night at a yield of just 3.28 per cent, down 0.12 per cent on the day.

That is down from almost 12 per cent in mid-2011 and 7.26 per cent two years ago.

The strong demand and relatively low borrowing costs will be a boost to the government which aims to raise up to €10bn in the markets this year.

Other governments in the centre of the Eurozone sovereign debt crisis have also seen their bond market positions improve.

Spain, which saw borrowing costs peak at above seven per cent in the middle of 2012 can now raise 10-year funds at 3.8 per cent.

Italian bond yields have fallen from similar highs to 3.87 per cent.

And Greece’s have plunged from 36 per cent, when investors were suffering haircuts, to 7.84 per cent.