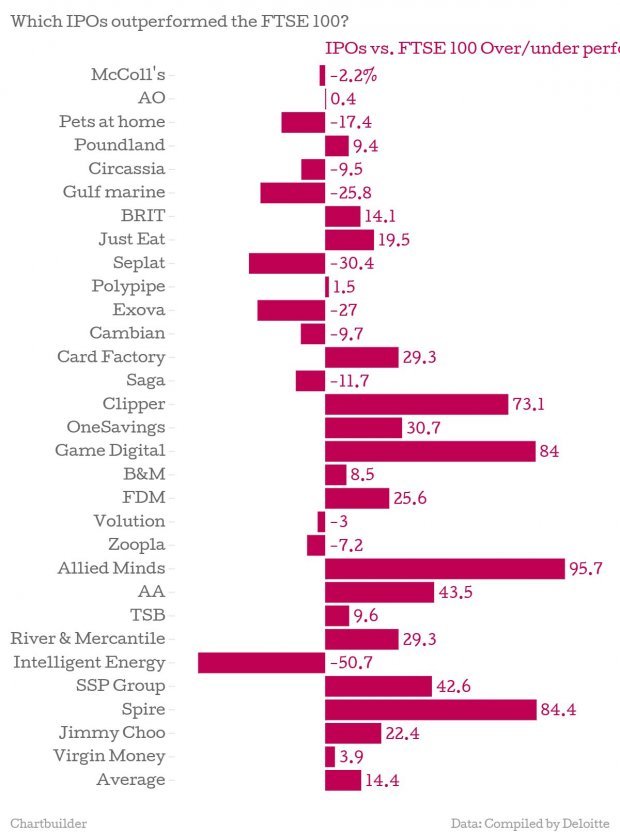

Here’s why investors should’ve bet on stock market floats last year: IPOs beat the FTSE 100 in 2014

Plucky investors looking to make a quick buck should've stomached the risk and brought companies that floated last year, as their shares outperformed the FTSE 100.

New research by accounting firm Deloitte shows that the 30 IPOs which completed in 2014 generated an average return of 12.4 per cent, outperforming the FTSE 100 by 14.4 percent over the year.

"IPOs in 2014 have performed better than many would have expected," said John Hammond, head of equity capital markets at Deloitte.

"An investment of £1,000 in each of the 30 IPOs would have been worth £33,715 at the year end, whereas a £1000 investment in the FTSE at each IPO date would have fallen to £29,388," he said.

What's more, 22 of the companies which floated were backed by private equity firms, together generating an average return of 14.6 per cent.

This was actually a better performance than those not backed by private equity, which had returns averaging 6.4 per cent.

"It is particularly notable that private equity backed IPOs have performed well, illustrating how IPOs can offer a 'win-win' result for both exiting and new investors," said Chris Nicholls, head of IPO and equity advisory at Deloitte.

Throughout the first half of 2014 companies clamoured to take advantage of London's booming IPO market with Pets at Home, Just East, AO World and Poundland all garnering significant attention.

But towards the end of the year a number of companies unexpectedly cancelled plans to float amid volatile stock markets and concerns regarding waning investor appetites.

This year's IPO market looks like it'll maintain momentum – bar a few hiccups from the general election in May, a potential interest rate rise (although this is looking increasingly unlikely) and an ailing eurozone.

"We expect investors to continue to view quality IPO stories favourably but see market volatility as the key concern that could impact the number of IPOs that get away," said Nicholls.