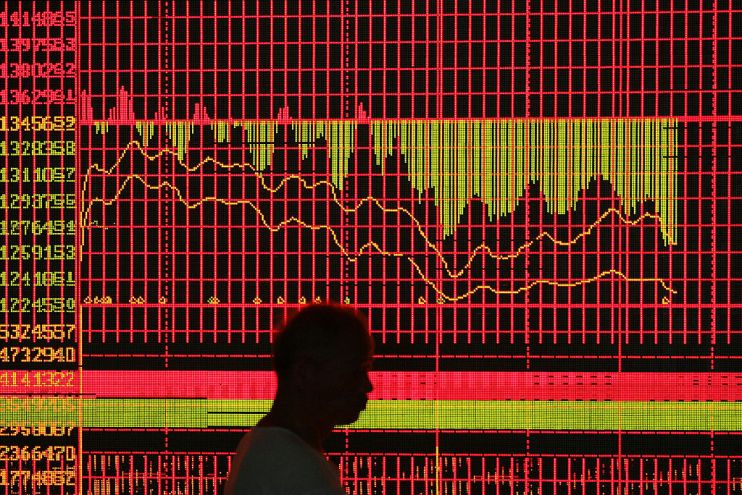

Investing in distressed assets is only getting more complex, so is it worth the trouble?

Recent geopolitical instability has added even more complexity to the world of distressed asset investment, writes Simon James

In the investment world, the field of distressed assets is a highly specialised area that has grown increasingly complex due to the unpredictable nature of geopolitics. This sector, traditionally focused on acquiring undervalued and failing assets, goes beyond just identifying potential value. Investors must tackle a range of legal, reputational and operational challenges, now further complicated by the shifting landscape of international politics.

Distressed assets, typically linked with failing companies nearing bankruptcy or mired in legal troubles, can attract investors based on their apparent low valuation. Yet, revitalising these assets is a complex and costly venture. Recent geopolitical instability since the Russian invasion of Ukraine has introduced additional challenges. Such global events disrupt supply chains, change trade dynamics and alter the cost of financing debt, potentially derailing even the most well-planned strategies for asset recovery. The energy sector is a prime example, where European companies bear the brunt of their governments’ drive to end reliance on cheap energy from Russia, whilst benefiting from an apparent softening in the stance and timetables of home governments to meet climate targets.

Adding to these complexities, recent data from Allianz Research’s “Business Insolvencies: No rest for the leveraged – 2023-2024 outlook” report illustrates a rising tide in insolvency indices into 2024, particularly in regions like Central and Eastern Europe. This trend not only underscores the growth potential within distressed assets but also accentuates the inherent risks. The increased frequency of insolvencies serves as a stark reminder that the terrain of distressed investing is fraught with both opportunities for substantial returns and the peril of significant losses, necessitating a balance of strategic acumen and caution for those operating in this space.

In this highly specialised and challenging world, the distressed asset landscape is primarily dominated by larger institutional organisations like Aurelius Capital or Elliott Associates, as well as highly specialised boutique outfits such as SARN. SARN, in particular, specialises in distressed assets within heavily regulated sectors, focusing on revitalising fundamentally sound but undervalued companies burdened by legal and regulatory issues. Unlike typical investors, SARN does not involve itself in the daily operations of these companies.

During a recent conversation with Armen Agas, deputy to the chairman of SARN, he emphasised the unique challenges faced by distressed companies, stating, “Most of these companies lack the necessary policy, regulatory and other expertise to navigate these distress situations. Often, they are unsure about whom to hire or the guidance required to resolve these issues. They may not even be able to pinpoint the exact problem. Their role is to fill this gap. We bring the expertise they lack, having honed their skills in product development and service excellence but not in managing these types of challenges.”

However, the complexities of distressed asset investing extend beyond the initial acquisition and revitalisation efforts. Valuation disputes can unexpectedly surface years later, casting a shadow over past transactions. As Justin Burchett, managing director at Stout, cautioned during a Financier Worldwide panel discussion on the impact of the Covid-19 crisis on the valuation of distressed assets, “These disputes tend to arise years after the litigated transaction and serve as a warning that transactions and value determination made in the heat of the crisis are subject to ex-post scrutiny by litigious parties with the benefit of hindsight.”

While acknowledging the potential for disputes, Armen Agas highlighted the firm’s remarkable track record, stating, “litigation is almost inevitable in the distress business because there is an underlying dispute to the distress. However, we were founded in 2012 and since then we have processed many deals. We have litigated with just two counterparties, that’s a good track record.”

Litigation isn’t the only threat; operating in Eastern Europe raises a whole new plethora of risks. Companies, much like politicians, can find themselves ensnared in a web of disinformation campaigns orchestrated by Russian agents. This phenomenon becomes particularly pronounced when companies invest in projects aimed at decoupling from Russia. According to Armen Agas, “Geopolitical decoupling is one of our preferred niches. However, as we sever legacy ties between businesses and Russia, replacing them with American practices, we often become targets of disinformation attacks orchestrated by Russian propaganda outlets. These attacks frequently involve the recycling of falsehoods originally published in Russian propaganda platforms such as Parlamentni Listy.”

The evolving dynamics of distressed asset investing have intensified the barriers to entry. Merging traditional financial analysis and asset restructuring with international politics and associated risks, this field differs significantly from mainstream investment. Distressed asset investors must skilfully navigate a complex landscape, making critical decisions about assets in precarious positions and assessing their potential for value restoration through comprehensive operational and financial restructuring.

This specialised role demands a deep understanding of restructuring principles, risk management, credit structures and bankruptcy laws, coupled with a sharp sense for operational value creation. Time-sensitive decisions elevate the due diligence process, necessitating a broad skill set that surpasses traditional investment roles. This industry shift has created a unique domain for those adept in navigating the myriad challenges and risks of distressed asset investing.

Engaging with this intricate blend of finance, politics and business, distressed asset investing offers a rare opportunity to influence global economic trends and social change. It’s a demanding yet potentially rewarding field where strategic foresight and deep expertise are essential for success.