Stubborn services prices to raise concerns as inflation remains at two per cent

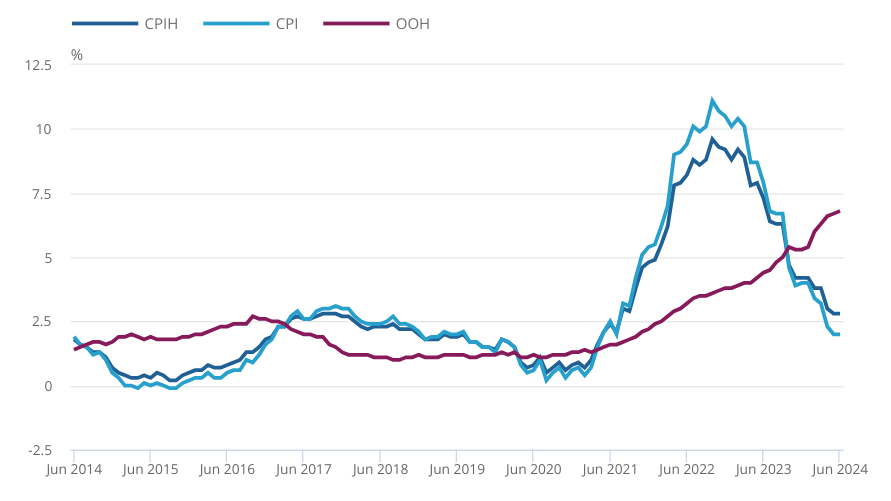

Inflation remained at the Bank of England’s two per cent target for the second month in a row but services inflation was unchanged, complicating the path to an August interest rate cut.

Figures released this morning by the Office for National Statistics (ONS) showed that prices rose 2.0 per cent in the year to June, unchanged on last month and slightly higher than the 1.9 per cent expected by economists.

Services inflation, meanwhile, remained stuck at 5.7 per cent when it was expected to fall to 5.6 per cent. Prices in the services sector are seen as a particularly good gauge of domestic inflationary pressures and are closely scrutinised by policymakers at the Bank of England.

Core inflation, which strips out volatile components such as food and energy, stayed at 3.5 per cent in June, which was in line with City estimates.

The largest upward contribution to inflation came from hotel prices, which rose 8.8 per cent in June compared to 1.7 per cent last year. Part of this may be due to increased spending around Taylor Swift’s Eras tour, which was cited by many economists before the figures were released.

More positively, food and drink prices rose at the lowest annual rate since October 2021, easing for the 15th consecutive month to 1.5 per cent. The products making the largest downward contribution were packs of cakes and crumpets.

“While these figures provide further reassurance that the UK’s inflation crisis is in the rear-view mirror, uncomfortably high services inflation suggests that its damaging after-effects are still being felt,” Suren Thiru, economics director at ICAEW, said.

June’s batch of inflation figures are the last before the Bank of England will announce its latest decision on interest rates in a couple of weeks time.

Before the figures were released, traders put the chance of a rate cut in August at a little less than half but that fell to just a quarter following the release. Paul Dales, chief UK economist at Capital Economics said “the chances of an interest rate cut in August have diminished a bit more”.

Bank officials are concerned by signs that domestic inflationary pressures are not yet fully under control, with wage growth in particular a concern for policymakers.

Annual wage growth is currently running around six per cent, around twice the level consistent with inflation remaining at two per cent sustainably.

Strong wage growth could keep cost pressures elevated in the labour intensive services sector. New wage figures will come out tomorrow.

Speaking last week, Huw Pill, the Bank’s chief economist, said persistence in wage growth and services inflation points to “uncomfortable strength in those underlying inflation dynamics”.

Yael Selfin, chief economist at KPMG UK, said some of the stickiness in services prices was likely to prove “fleeting”, but argued the Bank is “likely to pay more attention to elevated pay growth”.

The Bank left rates on hold at its last meeting in June, but minutes from the meeting showed that the decision was “finely balanced” suggesting many rate-setters are actively considering voting for a cut next time around.

Darren Jones, chief secretary to the Treasury, said: “It is welcome that inflation is at target, but we know that for families across Britain prices remain high.”