Inflation picks up to surprise four per cent on higher tobacco prices

Inflation picked up in December due to rising duties on alcohol and tobacco, surprising economists who had expected a slight fall, new figures show.

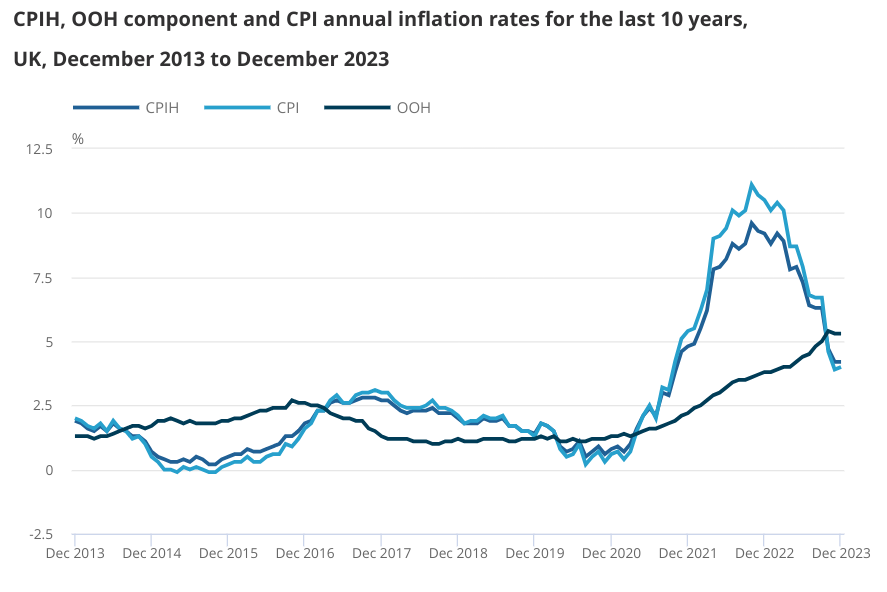

According to figures from the Office for National Statistics (ONS), the consumer price index (CPI) came in at four per cent in the final month of the year, up from 3.9 per cent the month before.

This was the first time since February 2023 that the annual rate of inflation had increased. Economists had expected inflation would fall slightly to 3.8 per cent in December.

“The rate of inflation ticked up a little in December, with rises in tobacco prices due to recently introduced duty increases,” Grant Fitzner, chief economist at the ONS said.

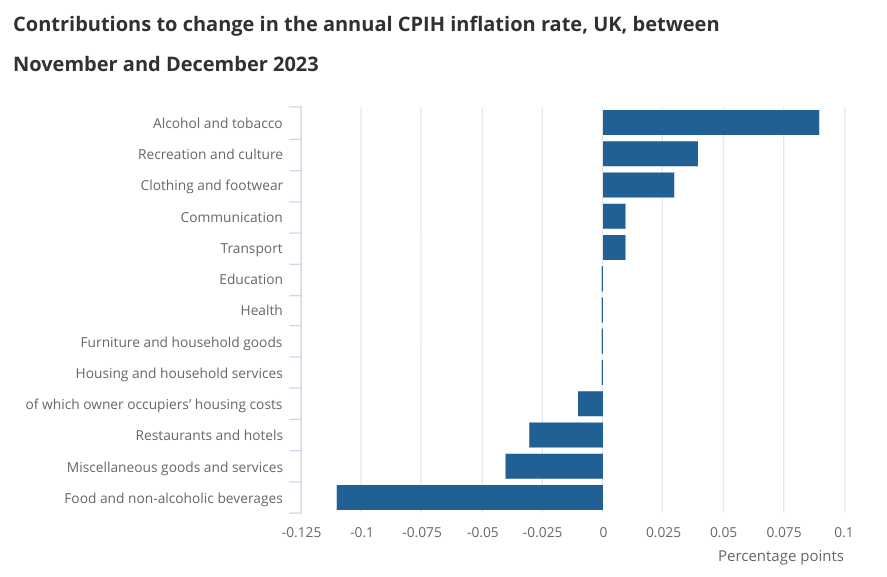

Alcohol and tobacco prices rose 1.2 per cent in December after the government announced higher taxes on both products in the Autumn Statement.

“These were partially offset by falling food inflation, where prices still rose but at a much lower rate than this time last year,” Fitzner added. Energy prices continued falling fast too.

Core inflation – which strips out volatile components and is seen as a more accurate gauge of inflationary pressures – remained stuck at 5.1 per cent. Economists had expected it to fall to 4.9 per cent.

Services inflation, which policymakers at the Bank have identified as a key measure of domestic inflationary pressures, picked up to 6.4 per cent from 6.3 per cent the month before. Ruth Gregory, deputy UK economist at Capital Economics, said this was “a little concerning,” although she noted it was comfortably below the Bank’s own predictions from November.

Chancellor Jeremy Hunt commented: “As we have seen in the US, France and Germany, inflation does not fall in a straight line, but our plan is working and we should stick to it”.

The slight uptick in December is likely to dampen bets that the Bank of England is on the cusp of unwinding its historic bout of monetary tightening.

Inflation fell sharply in October and November last year, bringing the headline rate down from 6.7 per cent to 3.9 per cent.

A large part of the decrease was due to base effects, but the speed of disinflation has surprised both markets and the Bank of England. When it made its latest round of economic forecasts, the Bank only expected inflation to have hit 4.6 per cent by the end of the year.

Entering 2024, markets thought that the Bank would start lowering interest rates in May with a further four base rate cuts pencilled in for the year. Bank officials, however, have stressed that it is still “too early” to discuss cutting rates, warning domestic inflationary pressures are not yet contained.

“The rise in inflation today suggests that the market has got ahead of itself in expecting early rate reductions,” Ed Monk, associate director at Fidelity International commented. “Predictions of a Spring cut look optimistic this morning,” he added.

Investors will have to wait until 1 February to know how the Bank will respond. While rate-setters will almost certainly leave rates on hold, their forward guidance will be closely scrutinised for signs of a pivot.