HSBC warns against EU bonus cap as shares fall on disappointing profits

HSBC has reported pre-tax profits of $14.071bn (£9.2bn) for the first six months of the year, up ten per cent from the same period in 2012, but falling short of analysts' expectations of a 15 per cent increase. Earnings per share rose by a fifth to 54 cents. Shares fell nearly four per cent on the news, making HSBC the biggest faller on the FTSE (results).

HSBC's growth was driven largely as expected by a fall in operating costs as the bank sold off or closed another 11 businesses in the period, bringing the total to 54. Underlying costs were down eight per cent, mainly due to the large provisions for fines and penalties in the first half of 2012, and from lower restructuring costs. Since embarking on its cost cutting drive two and a half years' ago, HSBC has cut 46,000 jobs and has plans to cut employee numbers by a further 9,000 to 19,000 by 2016.

However, revenue fell by a larger-than-expected seven per cent to $34.4 billion (analysts had expected a six per cent fall). The bank put this down to low growth in Western economies, and a slowdown in growth in China and Asia.

HSBC said there was a good balance between businesses, with the largest (global banking and markets) representing just over 40 per cent of pre-tax profits. All regions were profitable in this period. Chairman Douglas Flint said the bank continues to believe strongly in the benefits of scale and a diversified universal banking model.

Commenting, group chief executive Stuart Gulliver said:

Despite slower growth in the short term, the long-term economic trends remain intact. The global economy will continue to rebalance towards the faster-growing markets and trade and capital flows will continue to expand.

With growth subdued in western economies in particular, Gulliver said any tapering off of monetary stimuli would need to be approached with caution. He also urged a review of the use of "bail-ins" to rescue troubled banks within the eurozone, a move he says has industry backing in principle, but could nonetheless have unforeseen consequences.

He also sees the pace of growth in mainland China slowing – but this isn't necessarily a bad thing.

In mainland China, the new emphasis on the quality rather than the quantity of growth is shifting the policy balance away from stimulus and towards reform. We believe this is likely to limit the pace of China’s growth to 7.4% for 2013 and 2014, which is already being reflected in more modest growth figures in other markets, particularly in Asia.

However, we believe that China’s reform agenda, which covers financial, fiscal, deregulation and urbanisation reforms, will provide the basis for more sustainable growth in the medium to long term.

The bank head added that the EU bonus cap could have a "highly damaging impact" on HSBC's competitive position in many of its key markets – including those outside Europe.

The Board is committed to protecting the competitive position of these operations, which are critical to the continued success of your Group. We will therefore be consulting on how best to achieve this aim while seeking to preserve the essence of the remuneration framework supported by shareholders two years ago.

Speaking later in Hong Kong, Flint said one of the options being considered was a potential pay rise for staff, although it was unlikely HSBC would want to move its headquarters out of the UK.

In the first half of 2013, HSBC set aside $9.496bn for its 259,397 employees, meaning the average employee was paid $36,608 (£23,944). While this was down 8.8 per cent from the $40,161 average paid out in the same period the year before, it was only half a percentage point lower than the six months to December ($36,786), suggesting pay cuts could be slowing.

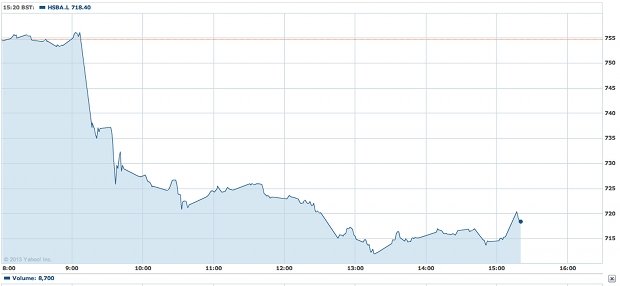

HSBC shares are down around over four per cent at around 720p. But Shailesh Raikundlia, banking analyst at Espirito Santo, says HSBC's dividend yield is still expected to be the highest among its peers and holds the "buy" rating on its stock.

The bank said in May it hoped to pay 40 to 60 per cent of its profits in dividends. The bank announced today a second interim dividend of ten cents per ordinary share, taking total dividends declared in the first half of the year to 20 cents per ordinary share – up two cents from the year before.

Raikundlia added that dividend yields are forecast to be six and seven per cent in 2014 and 2015 respectively, taking into account share buybacks to make up for the dilutive effect of its scrip dividend (whereby new shares are created and given to shareholders usually instead of a payout from next year).

Jonathan Jackson, head of equities at Killik & Co. agrees, holding the "buy" recommendation.

HSBC has the best yield of the UK banks, on a prospective 4.7 per cent. While these results have disappointed the market, we continue to like the long-term investment case for HSBC. It is one of the few truly global banks, both for corporate and individual customers. It is well placed to benefit from continued globalisation and the shift of economic power to Asia, with a strong position in Greater China as the leading Hong Kong bank. Within developed markets, it has restructured the US business to remove high-risk consumer lending, whilst in Europe it has a very strong UK business. It has a strong funding position, with excess cheap deposits, and is well capitalised, with no issues expected in meeting Basel 3 requirements.

From a technical standpoint, Accendo Markets's head of research Mike van Dulken says it's disappointing share prices failed for the second time at the 760p to 770p level to reach September/October 2008 highs of 800p. If support doesn't emerge around 700p, he says, "it's back to 650p – a historical trendline from the high of Nov 2006 which was resistance until January 2013 before reverting to support in April".

Source: Yahoo

Earlier today, the bank said it would be closing the bank accounts of dozens of foreign missions in London, affecting more than 40 embassies, consulates and high commissions. The bank said it had a "significantly diminished appetite for the embassy business".

Without a valid UK bank account, it is difficult for embassies to pay accomodiation costs and expenses for ambassadors. However, embassies are considered by some to be more at risk of money laundering activities for their political exposure, and HSBC is still being rocked by a money laundering scandal that landed it with a record £1.2bn fine last year over allegations it had been handling the assets of Iranian, Libyan and Mexian drug cartels.