How the Fed data leak illustrates the problem of central bank power

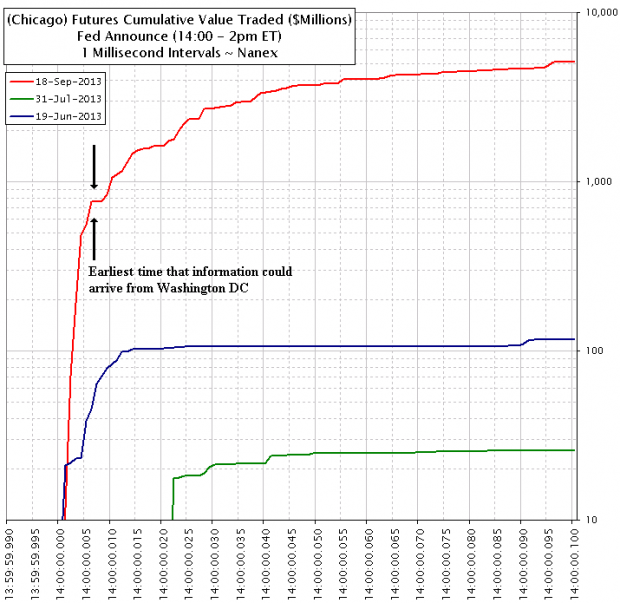

One chart has the US' Federal Reserve worried that it has a secrecy problem. Research from Nanex shows that trades were made on data at exactly the same time in both Chicago and New York at the time of the Fed's "no taper" decision last Wednesday.

That should be impossible, even with the latest technology data should take five to seven miliseconds to travel between the two locations. Nanex says there are two ways that could happen – a timed release by a news organisation(s) at both locations, or a leak to a Wall Street firm.

(Nanex)

Both are bad news for the Fed. Journalists with access to information before that 2pm release are held in a lock up room and aren't supposed to be able to transmit any of that information outside.

This is a testament to just how important the decisions the Fed central bankers make. Their discretion based systems are hugely market moving – so much so that it appears that someone may have been willing to break confidentiality rules despite the threat of harsh penalties. In a world where central bankers are king, their declarations are hugely important.

That's not to say that leaks aren't relevant when it comes to private data releases – they are. But such powerful government commands are incredibly influential, and with higher stakes, the incentives to cheat increase. A rules based monetary system would be more predictable, and the returns from cheating aren't going to be of the same magnitude – because investors will have a better idea of what's coming.

Rules based systems and the greater degree of certainty they offer aren't just good news for Wall Street, but for main street too. Businesses can be positive that central bankers aren't going to change policy on a whim, and can be more confident when planning for the future.