Here’s how you might benefit from Tory tax cuts

Well, it's the morning after the night before and policy wonks and media hacks are digesting David Cameron's pledge for a host of tax cuts if the Tories win next year's general election.

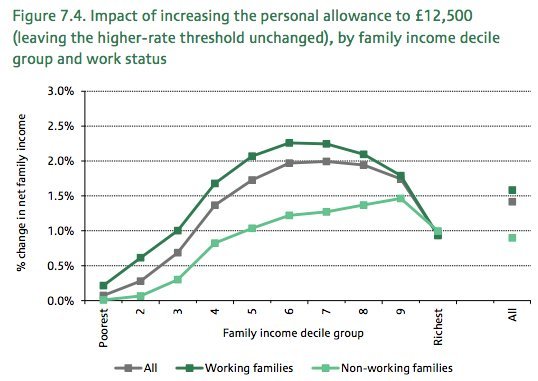

In a widely praised conference speech, the Prime Minister told his party they would fight the next election on a platform of raising the personal allowance to £12,500 and lift the 40p income tax band to £50,000.

The tax cuts, which will cost around £7bn, were greeted with cheers in the conference hall and will benefit around 30m people.

So would you benefit from Tory tax cuts?

- A basic rate taxpayer will benefit to the tune of £500, according to the Treasury.

- The Institute for Fiscal Studies says a higher rate taxpayer would save around £430 and 800,000 people would be taken out of the higher rate band altogether.

- Those earning £46,000 would see their income tax cut by 17 per cent if both the personal allowance and the raising of the higher rate threshold are taken into account.

- If you have an annual salary of £50,000, you will pay £2,127 less in income tax, according to partner at chartered accountants Blick Rothenberg, Nimesh Shah.

- The Treasury estimates someone earning between £50,000 and £100,000 a year will pay £1,313 less.

(Source: IFS)

The raising of the personal allowance was welcomed by the research director of the Adam Smith Institute:

Taking minimum wage workers out of tax is a way of giving workers a ‘Living Wage’ without risking jobs. The difference between the Living Wage and the minimum wage is entirely tax – if we stopped taxing minimum wage workers, they would earn the equivalent to a post-tax Living Wage.

The lifting of the 40p threshold was given a cautious nod from the director general of the Institute of Economic Affairs Mark Littlewood:

Finally the Prime Minister has shown intent to ease the burden on UK taxpayers. However, it’s important to remember that in real terms the changes to the 40p rate will not be as momentous in four years’ time when taking inflation into account.