Bwin.party share price rises as GVC joins with poker giant Amaya for new bid

The battle for online gambling firm Bwin.party accelerated yesterday, with a new entrant to the bidding war.

GVC said that instead of pushing for a reverse takeover alone, it was combining its hand with Canadian online poker giant Amaya for a takeover bid worth around €1.5bn (£1bn).

A source close to the matter told City A.M. that the combined offer would involve a new company, which will be created for the purposes of the deal with GVC shares and Amaya cash. If the bid is successful, this new vehicle would purchase Bwin.

After a likely two-year turnaround and restructuring project, to be led by GVC management, the new company would sell off Bwin’s assets.

Given the two firms involved, the source said, it is likely that GVC would purchase the sportsbook, while Amaya would buy the online poker business. Alternatively, the new-look company could be spun off and sold into the wider marketplace.

The aim of the deal is to reinstate some value into Bwin, then bring in money for shareholders.

It is a similar move to GVC’s bid for Sportingbet, made with William Hill.

888 Group also formally announced its intention to bid in a statement yesterday. Bwin management will have to decide which bid to recommend for approval by shareholders.

The statement from 888 said: “The Board believes that there is significant industrial logic in a combination of 888 and bwin.party, benefiting both companies and all shareholders and, accordingly, has submitted a proposal regarding the acquisition of the entire issued and to be issued share capital of bwin.party for consideration comprising cash and 888 shares.”

Peel Hunt analyst Nick Batram wrote in a note: “A marriage between 888 and bwin.party makes sense on many levels. Most obviously, Bwin.party would deliver a proprietary and sizeable sportsbook, something 888 does not have. The deal would also dilute 888’s exposure to poker (21 per cent vs 13 per cent at Bwin.party).”

Canaccord yesterday upgraded its rating for Bwin from “Hold” to “Buy”, as the buyers began lining up, and said that 888 were “in the driving seat” to win the battle for Bwin.

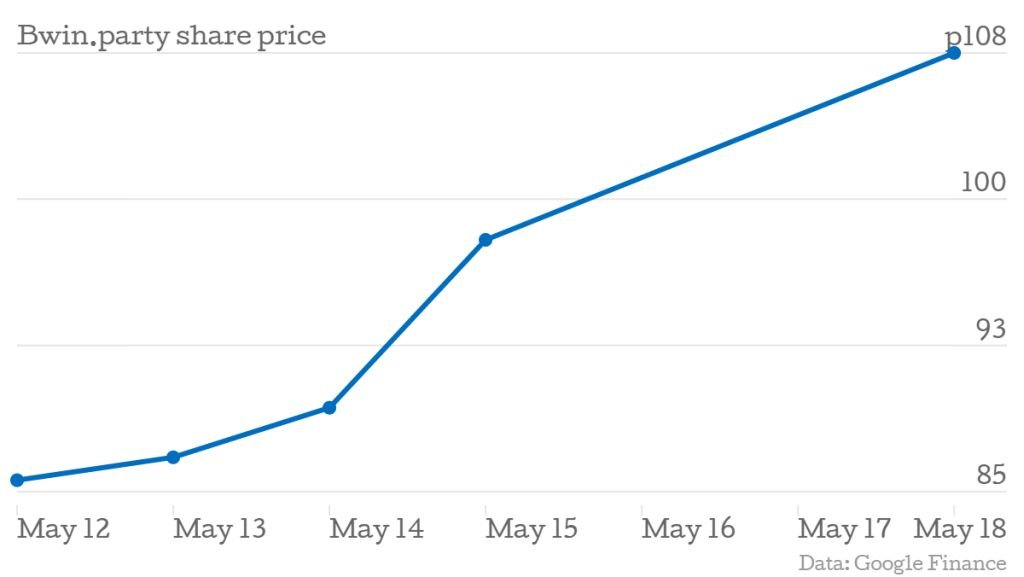

Shares in Bwin ended yesterday up 8.6 per cent at 108p, while 888 closed down 1.62 per cent and GVC closed up 0.65 per cent.

BEHIND THE DEAL

INVESTEC | GARRY LEVIN

1 Scottish corporate finance star Levin trained as a solicitor and is a veteran of almost 20 years in dealmaking.

2 Levin is one of the most prominent ex-Evolution bankers at Investec following the merger between the two groups. He has also worked at Altium Securities and KBC Peel Hunt.

3 His recent deals include the flotation of Bonmarche, which raised £40m, and the £300m IPO of IT services business FDM. Levin also worked on taking Lonrho private.

Also advising…

Investec is joint financial adviser, sponsor and broker to 888, and the firm’s Duncan Williamson is working alongside Levin on the bid. John Orem and Derek Herbert from Stifel are also advising.