Gun makers targeted by short sellers

It's been nearly two years since 20 children and six adults were killed during a shooting at the Sandy Hook Elementary school in Connecticut, which prompted the US to once again debate its gun control laws.

President Barack Obama declared he would make gun control a central issue in his second term, signing a series of executive orders to tighten rules around the ownership of weapons – but most of the subsequent legislation has been defeated in the senate since.

In the past year, Americans have stocked up on firearms just in case new restrictions are brought in. This market saturation, combined with Obama's failure to tackle the subject, has seen a change in fortunes for gun-makers, leading short sellers to once revive their interest in the sector.

A note published by Markit analyst Simon Colvin this morning said short interest in Sturm Ruger had increased by a quarter since issuing disappointing second quarter results, while Smith & Wesson's falling share price has also attracted interest.

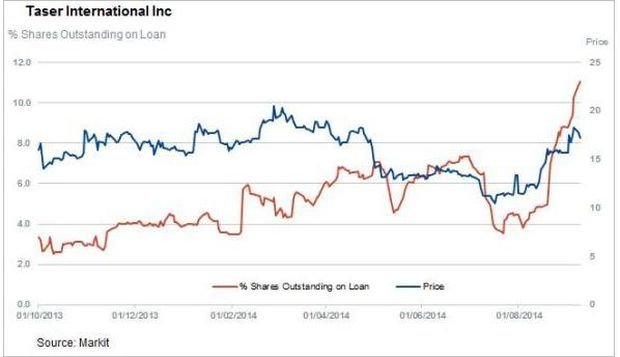

Taser International, the company that produces the eponymous electroshock devices, has also seen shorts pile in after a rally in shares following the weeks of ongoing unrest in Ferguson, Missouri.

Sturm has received the most interest, with short sellers borrowing just over a quarter of the company’s shares – a new six month high, despite shares falling by a third year to date, Colvin notes.

Analysts are not expecting for the firm to post an increase in year on year sales until the second quarter of next year, at which point sales will have fallen by 15% from 2013’s bumper year.

Smith & Wesson has also seen a surge in shorting activity after missing its revenue forecast two weeks ago.