Giving the dream

Fund manager Nicola Horlick wants to do her bit for society, she tells Timothy Barber

Nicola Horlick has never been known for mincing her words. When asked about the turmoil currently engulfing Western economies, the chief executive of Bramdean Asset Management is characteristically forthright. “This all feels like the last days of the Roman Empire, what’s going on in America and over here,” she laments. “Greed has taken over and there’s no rationality any more in people’s decision making, it’s just all about instant gratification, and no one’s really thinking straight.”

On the face of it, this might sound a little bit rich for someone whose spectacular success has been forged at the heart of the free market machine, and whose current investment fund is largely involved in the less-than touchy-feely areas of hedge funds and private equity.

Compulsions

But Horlick, 47, has a more authoritative perspective than many when considering both the mounting problems of the financial markets and the compulsions and recklessness that have, in part at least, fed them.

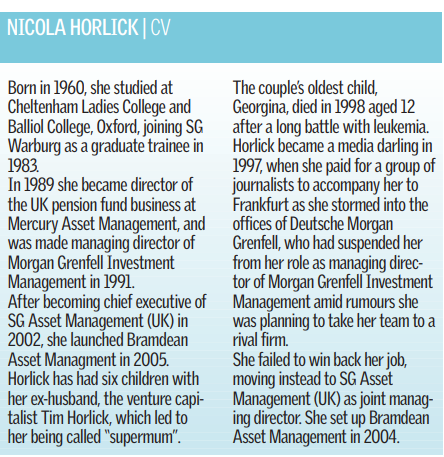

Now chief executive of Bramdean, a boutique investor in the alternatives marketplace, the former boss of SG Asset Management (UK) and Morgan Grenfell Investment Management – who first leaped into the headlines in 1997 after taking a cohort of journalists to the latter’s Frankfurt head offices to demand her job back after owners Deutsche Bank suspended her – has spent two decades at the top of the financial services industry. She states that the key part of her job is being able to “take a long term view about where the world is going to go.”

It is on a personal level, however, that Horlick can speak out about a lack of responsibility among the beneficiaries of the financial markets’ boom years. As well as being both a highly influential fund manager and a reluctant icon for successful working mothers – Horlick has maintained her career while raising six children, something which has led her to be dubbed “supermum” – she is one of the business world’s more prominent philanthropists.

Charitable gift

As recently reported in CityA.M., Horlick’s latest act has been a charitable gift with a difference. Rather than a lump sum, she has donated a share in the equity of Bramdean itself to Great Ormond Street Hospital, along with three other recipients. Ten per cent of her holding in Bramdean – amounting to roughly four per cent of the company – is to be split equally between the leading children’s hospital, Oxford University’s Balliol College (her alma mater), and the London private schools where her children are being educated, St Paul’s Girls and St Paul’s Boys.

Horlick reckons that this style of equity gift is not only mutually beneficial from a tax perspective, but that linking her charitable activity with the performance of Bramdean, gives her extra motivation to bring about positive results.

Raising Money

“I’ve centred it all around health, education and my children, and these are obviously things I care about and that I’m happy to raise money for,” she explains. “But I wanted to align my interests with theirs so that if I work harder and do well and make the business worth more, then it benefits them as well.”

She adds: “It’s a bit different to me just going round and asking all my friends yet again for yet more money – they actually get rather sick of you after a while!”

Horlick is making the gift as a way of marking the tenth anniversary of the death from leukaemia of her eldest daughter Georgina, who succumbed in 1998, aged 12, after a battle that had lasted most of her life. Great Ormond Street cared for Georgina throughout her illness, and since then Horlick’s charitable activities are reckoned to have raised in excess of £2 million to help treat child cancer sufferers at the hospital.

Fruits of success

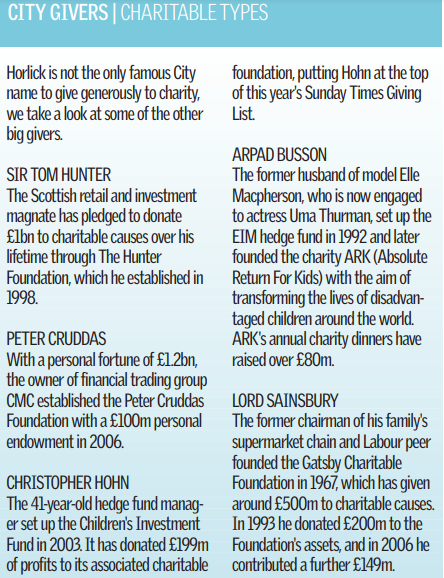

Horlick may have particularly strong personal reasons for involving herself in philanthropic projects, but she is adamant that people enjoying the fruits of success and wealth should be following her example.

“As far as I’m concerned it’s important for anyone who’s been successful to give something back,” she says, emphasizing that as the credit crunch eats into the ability of the charitable sector to raise funds, it’s even more important for the wealthy and influential to be prepared to step up their efforts.

“It is cyclical, so it’s much harder to raise money at times like this. It’s all about sentiment, and if people feel insecure about their investments or their jobs, they’re less inclined to give money away.

“It can be a struggle to persuade people to contribute, but I think when they’ve given once they get into it a bit more – you need to get people into the habit of giving.”

She continues: “Around the City are some of the poorest areas in London, and that juxtaposition just makes you think. If you live in Tower Hamlets your life expectancy is seven years shorter than if you live in Richmond – it drives you to want to do something.”

These days Horlick herself isn’t based in the City at all, running Bramdean from plush offices on Park Lane. She set up the firm in 2005 after leaving Societe Generale’s fund management branch SG Asset Management (UK) at a time when the kind of aggressive equity investing in which she specialised was becoming less popular, particularly among pension funds affected by the bear market in 2002 and 2003.

She was all set to move with her family to Australia upon leaving Soc Gen, to work for the Sydney-based financial services company AMP. However her marriage broke down at the same time, and she decided instead to stay put and go it alone in founding a boutique firm with an absolute return strategy that would appeal to a more cautious pension fund client-base looking to preserve their capital, as well as high net worth individuals.

Horlick’s expectations for the current economic turbulence are far from positive, though she reckons the short-term threat of recession is nothing compared to the long-term prospect of Chinese dominance once the problems of the West’s obsession with borrow-and-spend economics come home to roost.

10,000 Geniuses

She sees the credit crunch as an inevitable side affect of such incautious attitudes, but even the current crisis has its plus side, particularly when it comes to separating the wheat from the chaff in the controversial hedge funds sector.

“There are 10,000 hedge funds in the world but there are not 10,000 geniuses, and not everyone can cope with this kind of turbulent environment,” she says. “The last twelve months have been some of the most difficult for any investor and a lot of hedge funders have never seen anything like this, so it’s a really good test of their skill.

“You can’t have everything going up forever, it is unhealthy and you get excesses that build up in the system that have to be driven out.”

Given the problems affecting mainstream investment areas, it’s a good time to be involved in alternatives, and Horlick is fiercely proud of what she is achieving at Bramdean – a distinctly entrepreneurial venture for someone used to working within large financial services institutions.

Stepping up

She is showing no signs of backing off from her personal initiatives, quite the opposite in fact. Horlick is stepping up her involvement with the NHS – of which she is a passionate supporter – with a place on the board of a Hampshire foundation hospital and chairmanship of the London Health Forum, a body encouraging partnerships between the state, voluntary and private sectors.

And Horlick, who has taken her children to Zambia to show them the reality of those living in dire poverty, is adamant that they will not grow up expecting to be able to live off the wealth she has accumulated.

“There is this question about whether children should inherit large amounts of money. I would expect that 10 per cent holding in Bramdean to be worth many millions of pounds ultimately, and if that’s the case I’d much rather it went to Great Ormond Street than my children, I don’t want to be ruining their lives. And I’ll probably be giving away more.”