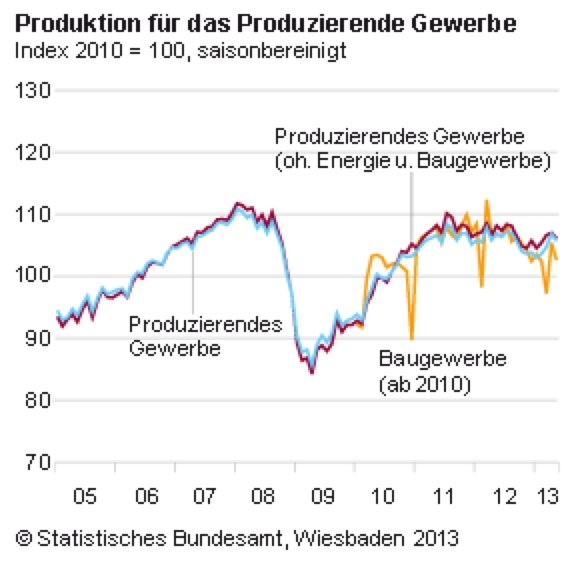

German industrial production easily beats expectations reaching 14-month high

German industrial production figures smashed expectations in June, rising by half a percentage point year-on-year and 2.4 per cent from the month before.

This follows a 1.0 per cent fall in annual data and an upwardly revised 0.8 per cent monthly figure. Analysts had expected a decline of 0.4 per cent and an increase of 0.3 per cent respectively.

Source: Statistisches Bundesamt Deutschland

The results should ease concerns of the impact of the eurozone debt crisis on its biggest economy, with the monthly figure at a 14 month high, driven by a 1.6 per cent jump in construction and a 2.2 per cent boost in industry. Capital goods production also increased significantly by 4.1 per cent while consumer goods production rose 1.1 per cent.

The euro fell 0.09 per cent against the dollar to $1.3293.

Ben May, European economist at Capital Economics, said the data points to a healthy GDP growth for the second quarter of the year and generates hope that this can be sustained – if accompanied by a recovery in the rest of the eurozone.

Accordingly, it appears that the industrial sector increased GDP by 0.7% in Q2, after the sector made no contribution in Q1 when the economy expanded by 0.2%. In the near-term, the industrial sector could pick up further. Not only did industrial orders rise sharply in June, the surveys of business sentiment and activity have continued to improve. Indeed, at face value, the PMI points to a pick-up in the annual production growth to almost 5%.

Nonetheless, we doubt that the current pace of expansion can be sustained for too long without the rest of the euro-zone staging a solid recovery, which still appears a hope too far. Accordingly, while Germany looks set to remain the euro-zone’s star performer, the consensus forecast for a solid 1.6% rise in GDP next year is too optimistic.

Christian Schulz, senior economist at Berenberg Bank, adds that market participants and policymakers should not get carries away.

The jump in output boosts hopes that German GDP expanded strongly in Q2, although some other data, especially retail sales and trade, suggested some caution. The last time industrial output expanded at such a rate was in late 2010 and early 2011, with the overall economy growing at about 1% per quarter. That would be more than the 0.8% qoq we are currently forecasting for Q2.

The latest expansion is not due to the catch-up effect after the long and harsh winter anymore, which had boosted output in April. Stabilisation in the Eurozone and healthy import growth in the US and other developed export markets are keeping Germany’s export locomotive on its rails, despite the wobbles in China. And domestic demand has also been robust, although firms’ investment probably remained lacklustre in Q2 according to the orders data. Growth may recede a little over the coming quarters, but Germany is firmly back to expansion territory, thanks largely to the ECB’s intervention to end the financial tensions last summer.

Source: Capital Economics