GDF Suez joins search for shale gas in Britain

GDF SUEZ has bought into the prospect of fracking in Britain, spending $39m (£24m) on exploring Dart Energy’s licences in the Bowland Basin.

The French firm is taking a 25 per cent stake in Dart’s 13 licences, as well as putting money towards drilling costs as the companies look for commercially viable deposits of natural gas in shale formations.

“We are very confident about the potential of shale gas in the UK, and its anticipated contributions to UK energy security,” said Jean-Marie Dauger, executive vice-president, GDF Suez in a statement yesterday.

The transaction is due to complete by the end of the year.

The British Geological Survey estimated this summer that some 40 trillion cubic metres (1,300 trillion cubic feet) of shale gas are trapped underground in the Bowland Shale area, which stretches from Blackpool on the west coast to Scarborough on the east coast of Yorkshire.

The Dart licences that have attracted GDF Suez’s investment are clustered around Chester, York and south of Doncaster, and cover around 530 square miles.

Centrica is also looking for gas in the area, having bought a stake in Cuadrilla’s licences in Lancashire for up to £100m in June.

The Cuadrilla venture pulled out of one of its sites in the area earlier this month, having been blamed for small earthquakes in Blackpool in 2011 as well as wildlife disturbances. It has suspended drilling in the region until next year.

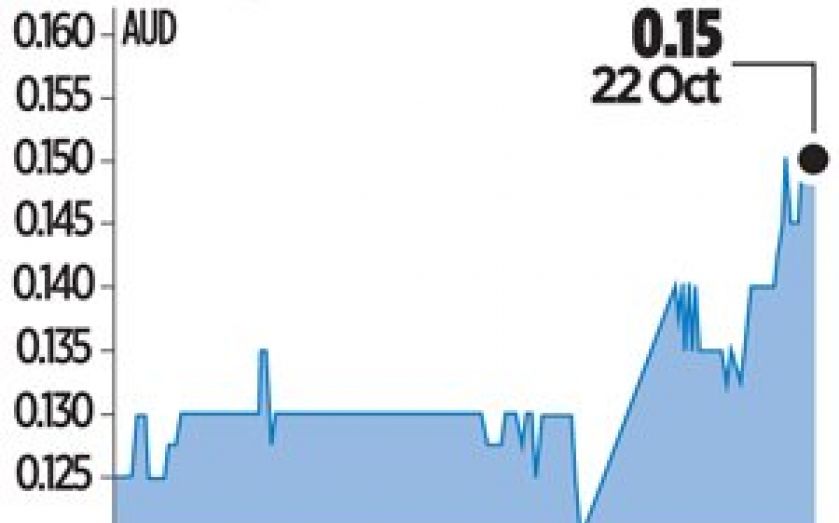

Australia-listed Dart Energy bought into the British shale business in 2011 by snapping up Composite Energy, which was backed by RBS and BG Group.

It also holds exploration licences in eastern Scotland and in Wales.

“The level of interest in UK unconventional gas is growing almost daily,” said chief executive John McGoldrick in a statement yesterday.

“Dart holds one of the UK’s largest unconventional acreage positions, and today’s agreement represents a significant development for Dart.”