Gazprom’s European gas supplies drop to decade low amid fractured unity over sanctions

Gazprom’s gas supplies have dwindled to 10-year lows on the continent, revealed European Commission President Ursula von der Leyen yesterday.

She explained that the Kremlin-backed gas giant has been delivering supplies to the European Union (EU) at the bare minimum levels required in its contracts.

Speaking at a security conference in Munich, she said: “What we’ve seen over the last six months is that Gazprom has delivered always at the lowest level.”

The Kremlin-backed gas giant has a ‘pay or deliver’ deal with the trading bloc, and has often chosen the payment option rather than delivering in recent months.

The European Commission President said: “So often they’ve chosen the payment instead of delivering gas, and the storage of Gazprom in our storage is at a 10-year low this year.”

This has resulted in supplies into Europe shortening amid rebounding post-lockdown demand, while wholesale costs have remained historically high.

Currently, the EU relies on Russia for around 40 per cent of its natural gas, but in its full-year results Gazprom seemingly failed to reach its output targets for Europe.

It also cut its export growth to less than five per cent over the last three months of 2021.

The International Energy Agency has previously accused Russia of deliberately throttling supplies to put pressure on Europe amid growing tensions between the West and the Kremlin over Ukraine.

Russian President Vladimir Putin has previously dismissed the accusations as ‘politically-motivated blather’.

The issue of shortening natural gas supplies has been compounded by nine consecutive weeks of eastwards flows on the key Yamal-Europe pipeline, according to data from Gascade.

The link between Poland and Germany has been flowing away from the continent since Christmas, and would normally responsible for supplying around 15 per cent of Europe’s gas from Russia.

Gazprom can book pipeline capacity at daily auctions, but so far has not ordered any transit capacity for February and March via the route.

It also did not book capacity for the second and third quarters of the year.

The EU has recently deepened its investigation into Gazprom’s European business amid the supply shortages.

Tensions over sanctions undermine Europe’s response

Russia is also pushing for the already-constructed £8.4bn Nord Stream 2 pipeline to be approved by EU and German regulators, with the trading bloc suspending its process while the German overseers are not expected to reach a verdict until this summer.

It has faced certification issues due to concerns over both governance and the EU’s environmental goals.

If green-lit, it would double Moscow’s exports to Germany and provide 55bn cubic metres of gas every year.

However, US President Joe Biden has warned the pipeline will not be approved if Russia invades Ukraine.

Despite reports from Russia that the country was withdrawing troops from Ukraine’s border, the West now estimates that nearly 200,000 Russian troops are amassed within close proximity of Ukraine.

On Friday, Biden said that he believed Vladimir Putin has made the decision to invade Ukraine “within days”.

Conflict in the region could put further pressure on Europe’s energy grid.

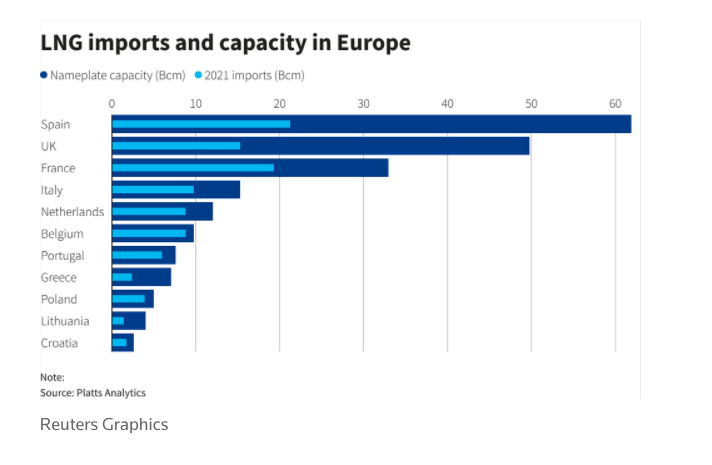

Due to shortages in natural gas supplies, Europe has sought to boost its energy reserves with continued arrivals of liquified natural gas (LNG), chiefly from the US – with terminals now brimming at close to full capacity.

While this has staved off immediate fears of blackouts, the process involved in turning LNG into usable gas or power for consumers is extensive and slow.

This means the continent will be racing to process supplies ahead of fresh arrivals from overseas if conflict emerges in Ukraine, and Russian natural gas supplies falter further.

Von der Leyen has suggested that Europe could now cope with a partial disruption to Russian gas supplies following the LNG top-ups, however investment bank Stifel and think tank Bruegel have both suggested the continent would only be able to manage a short-term supply shock.

Despite calls for a united stance against Russia from the White House and Downing Street, there appears to be a fracturing consensus on potential measures to impose on the Kremlin if it does invade Ukraine.

Italian Prime Minister Mario Draghi said on Friday that sanctions imposed on Russia by the EU should not include energy imports.

He said: “We are discussing sanctions with the EU and in the course of these discussions we have made our position known, that they should be concentrated on narrow sectors without including energy.”

Putin has also recently extended an olive branch to Italy, and asked to meet Draghi to discuss a deal between the two countries on boosting gas supplies.

Meanwhile, Germany fears Russia could retaliate against western sanctions in the event of war with Ukraine by cutting off gas supplies.

The country’s finance minister warned such measures could cripple its domestic economy.

Christian Lindner told the Financial Times that Russia had always been a reliable supplier of natural gas to Germany, even at the height of the cold war.

However, that could change if Russia invaded Ukraine and the west punished Moscow with a hard-hitting package.

“If you look at the cold war, whatever happened between Nato and the Warsaw Pact, there was never a situation where political tensions harmed co-operation in the energy sector,” Lindner said.

“Things might be different now.”