EU deepens investigation into Gazprom’s European business amid supply concerns

European Union (EU) antitrust regulators will knuckle down and boost information gathering on Gazprom’s European business, amid the continent’s escalating supply crisis and growing fears of a Russian invasion of Ukraine.

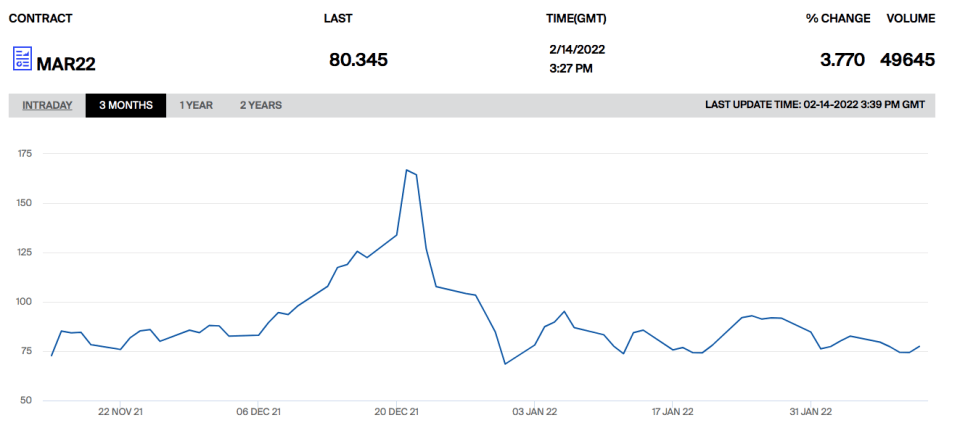

According to Reuters, the group will renew its efforts to determine why Gazprom’s supplies into the continent remain tight, with the company reportedly missing its export targets to Europe and Turkey in its full-year results.

Last month the EU’s antitrust chief Margrethe Vestager revealed that she was investigating companies including Gazprom.

A source told the news service that the EU Commission has yet to make a final decision on the next stage of the investigation.

However, a fact-finding exercise could help it build a case against the Russian energy titan.

The investigation follows accusations from the International Energy Agency (IEA) the Kremlin-backed gas giant was withholding extra production, which could be released to lower soaring prices and help mitigate the current crisis.

Last month, IEA head Fatih Birol said Russia was throttling supplies of natural gas to Europe, amid a standoff between Moscow and the West over Ukraine.

Gazprom has denied the allegations and consistently stated it is supplying gas above contracts when it sees requests.

However, the Yamal-Europe pipeline has been operating with eastward flows since December 21 away from Germany, while the Kremlin-backed gas giant reportedly has no further export deals planned with Europe this month.

Ron Smith, senior oil and gas analyst and executive director at BCS Global Markets told City A.M. he was sceptical of Europe’s complaints.

He said: “Note that no European company has yet accused Gazprom of failing to meet its contractual obligations. As long as that remains the case, the European Commission really doesn’t have a leg to stand on in its complaints.”

Commenting on supply shortages into Europe, he explained: “Gazprom’s exports to Europe in January fell sharply not because it was maliciously withholding supply, but because the pricing formula on many of its European contracts put it well out-of-the-money versus spot prices. We can infer that Gazprom was ready to fulfil its contractual obligations, but there was no demand for the gas at the prices stipulated in many of the contracts.”

The Nord Stream 2 pipeline also still awaits approval from European regulators, despite its construction being completed last year.

The £8.4bn project, which provides gas via the Baltic Sea over a 759-mile route, would double exports from Moscow to Germany – offering 55bn cubic metres of gas per year.

EU scrambles for supplies as fears of Russian invasion escalate

US President Joe Biden has warned the pipeline will be rejected by his Western partners if Russia instigates conflict with Ukraine.

However, as Europe relies on Russia for around 40 per cent of its natural gas, such escalation would potentially come with heavy consequences.

As fears Russia could invade Ukraine have escalated in recent days, there are growing concerns sanctions and disruptions amid conflict could result in further supply shortages.

The US has been helping Europe negotiate LNG contracts with Middle East partners and has boosted the continents reserves with its own stocks.

Japan has also offered to boost the continent’s LNG supplies.

However, it is questionable how much external boosts will help Europe manage any crisis, with Bruegel estimating that non-Russian sources could only temporarily sustain Europe’s consumption needs.

Speaking to City A.M. about rising gas prices and Europe’s position, Craig Erlam, senior analyst at OANDA said: “The tightness of the market leaves Europe very vulnerable to an invasion as they have promised severe sanctions in the event that happens, which would almost certainly lead to retaliation. That may not come from oil and gas immediately, but it will be on the table as so risk premiums will reflect that.”

Meanwhile, BP is sticking with its Russian oil and gas business, which has so far been unaffected by tensions between Russia and the West.

At a conference in Cairo, chief executive Bernard Looney said:”Quite frankly, there is no impact on our ongoing operations in Russia and we are sticking to the business.”

BP is the largest foreign investor in Russia with a 19.75 per cent stake in the country’s national oil company Rosneft.

It also holds stake in several other oil and gas projects in the country.

He added that BP will comply with any western sanctions on Moscow.