Forecasting the US election: should investors prepare for a new president?

Our analysis shows that the US presidential race may be closer than it first appears, but investors should at least be questioning what a Biden win will mean for markets and policy.

When it comes to forecasting the US election, on the face of it both macro modelling and polls point to a comfortable win for Joe Biden.

However, when you adjust the polls to account for the lessons learned from 2016’s failures, it shows that the presidential race could be closer than first anticipated.

The first approach: macro modelling

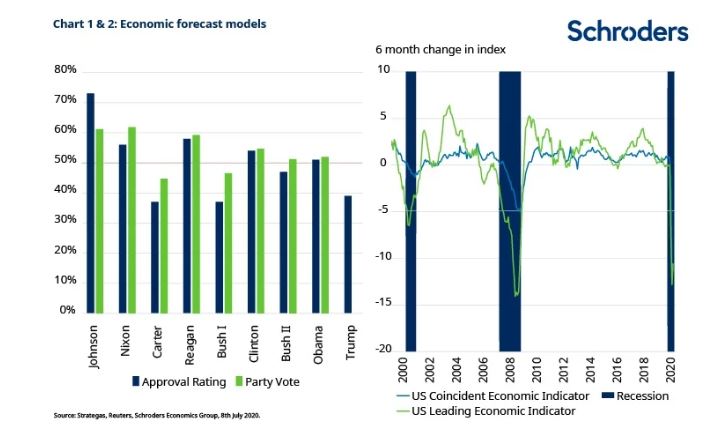

The economic modelling approach is based on the idea that the election is a referendum on how well the incumbent president has handled economic and non-economic issues. This uses historical relationships to forecast the popular vote using an economic variable and a popularity variable as inputs. We use two models that did particularly well forecasting the 2016 vote[1].

With Trump’s approval rating at a dismal 38% – according to Gallup – and the US economy in recession (chart 1 & 2), it is no surprise that poor inputs lead to a poor output. These models point to Trump winning only 43% of the popular vote.

But in 2016, Trump won the electoral college vote but lost the popular vote. Could these models be tripped up again? Yes, but it’s unlikely; in theory, a president can win the electoral college with only 23% of the popular vote. But in reality the lowest popular vote that has won the electoral vote was 47.8% all the way back in 1888.

Even so, Trump’s win in 2016 shows the importance of understanding the electoral college voting system, which leads us nicely to our second approach.

Discover more:

- Learn: Why digital infrastructure could emerge stronger from Covid-19

- Read: Investors crave knowledge – but where do they find it?

- Watch: Is Big Tech under threat?

The second approach: polling

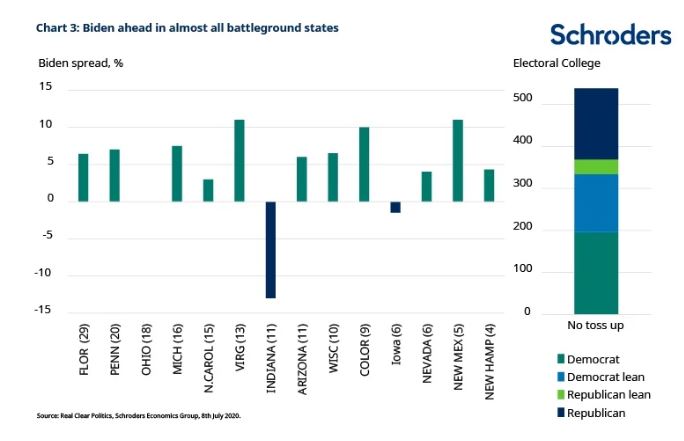

This widely used approach aggregates polls to forecast the outcome. We use the data from poll aggregator Real Clear Politics and focus on the “battleground” states.

We assume all other states will vote in-line with how they voted (consistently) in the last four elections. This assumption does not come without risk – for example, we consider Texas as a Republican state, but it is currently one of the most highly contested states in the polls.

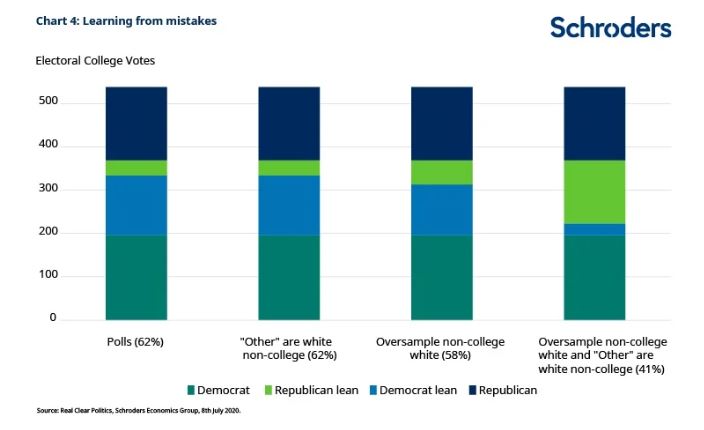

Polls show Biden ahead in almost all battleground states (chart 3), with Ohio, Indiana and Iowa being the exceptions. When we collate the implied electoral college votes, in the form of leaning states, this suggests that Biden would win 62% of the vote. If we were to allow for more uncertainty, by including “toss up” states (with a spread below 5), polls point to Biden winning 57% of the vote. All in all, still a fairly comfortable Biden majority.

But polls got it wrong in 2016

Investors will not forget that the polls got it wrong in 2016. In particular, state polls underestimated support for Trump in the Upper Midwest including key swing states like Pennsylvania, Michigan and Wisconsin. In hindsight, pollsters have put this down to three reasons:

- The “shy Trump Vote”; those who supported Trump for president but did not admit this to pollsters

- Those who made a last minute decision, choosing to vote for Trump extremely close to the election

- Oversampling college-educated voters as they were more likely to answer the surveys

Despite an election post-mortem, it is unclear whether pollsters have significantly changed their approach. Some university pollsters who had not done so before, are now weighting their results by education. But some pollsters are not.

Pollsters point out that last minute voting decisions is not a polling problem and is not something that can be “fixed”, but only watched to gauge the level of uncertainty. Finally, the “shy Trump vote” does not reflect a weakness in the polling itself.

We think the “shy Trump vote” will be a less of a factor this time around given Trump has a track record serving one term as President, giving people more confidence to be open in their support. We can make adjustments to the polls for the other two factors.

To capture the last minute decision-makers, we assume that anyone who does not pick a candidate in the polls has Republican voting preferences – specifically of white non-college voters. Though this lowers the Biden spread amongst battleground states, it is not enough to flip any states to Trump, leaving Biden with 62% of the vote.

To counter oversampling problem, we oversample white non-college educated workers to counteract this. This flips North Carolina and Nevada, but still points to Biden getting 58% of the vote.

When doing both adjustments, this flips many more states and points to a Trump victory, leaving Biden with only 41% of the vote. So, assuming the pollsters have made no changes since 2016, the election is likely closer than what the headline polls suggest. But still, fairly aggressive assumptions are needed to point to a Trump win.

Stepping back, our work shows that investors should prepare for a Biden win, or at the very least, question what a Biden win means for policy and markets.

[1] We use Lewis Beck & Tien (2016) & Erikson and Wlezien (2016).

Important Information: This communication is marketing material. The views and opinions contained herein are those of the author(s) on this page, and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds. This material is intended to be for information purposes only and is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. It is not intended to provide and should not be relied on for accounting, legal or tax advice, or investment recommendations. Reliance should not be placed on the views and information in this document when taking individual investment and/or strategic decisions. Past performance is not a reliable indicator of future results. The value of an investment can go down as well as up and is not guaranteed. All investments involve risks including the risk of possible loss of principal. Information herein is believed to be reliable but Schroders does not warrant its completeness or accuracy. Some information quoted was obtained from external sources we consider to be reliable. No responsibility can be accepted for errors of fact obtained from third parties, and this data may change with market conditions. This does not exclude any duty or liability that Schroders has to its customers under any regulatory system. Regions/ sectors shown for illustrative purposes only and should not be viewed as a recommendation to buy/sell. The opinions in this material include some forecasted views. We believe we are basing our expectations and beliefs on reasonable assumptions within the bounds of what we currently know. However, there is no guarantee than any forecasts or opinions will be realised. These views and opinions may change. To the extent that you are in North America, this content is issued by Schroder Investment Management North America Inc., an indirect wholly owned subsidiary of Schroders plc and SEC registered adviser providing asset management products and services to clients in the US and Canada. For all other users, this content is issued by Schroder Investment Management Limited, 1 London Wall Place, London EC2Y 5AU. Registered No. 1893220 England. Authorised and regulated by the Financial Conduct Authority.