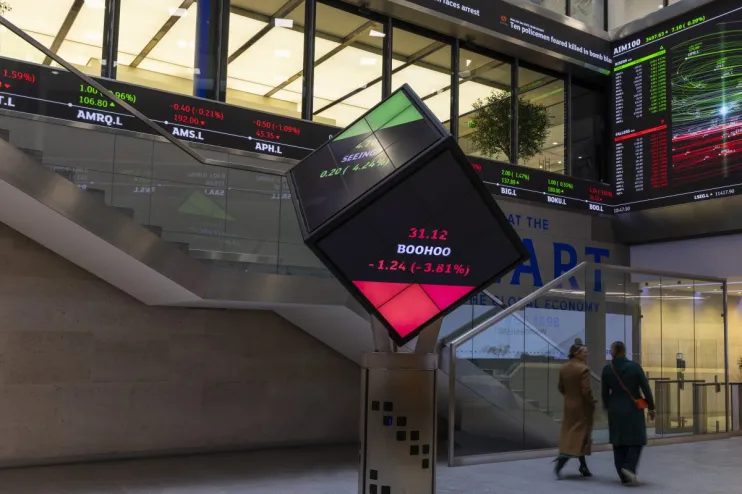

ESG-backed firms ‘fell twice as much’ as FTSE 100 in 2024

UK firms that gained approval from an Environmental, Social, and Governance (ESG) ratings provider fell by twice as much as the FTSE 100 in 2024, researchers have said in a report spelling out the costs and problems companies face in complying with sustainability targets.

Analysts at the right-leaning think tank Policy Exchange said firms incurred unnecessary costs for managing ESG rankings amid a period of low growth across the UK economy.

Researchers said that 29 UK-backed companies included in S&P Global’s Sustainability Yearbook 2023 ago fell by twice as much as the FTSE 100 in the same financial year.

The Policy Exchange report also said that similar findings could be found on a longer trend in a difference in performances across the MSCI World ESG Leaders Index and MSCI World Index between 2009 and 2024.

It also argued that the costs of ESG – estimated at around £3m a year for a FTSE company by one executive – had pushed some firms away from the stock market and into private equity.

By contrast, researchers said the global size of ESG data providers had quadrupled to £1.5bn, adding that some providers excluded companies which manufacture weapons, thereby damaging the UK’s ability to support the likes of Ukraine.

The findings provided a response to widespread suggestions that ESG could boost returns for companies.

For example, an EY article in 2021 by a climate change and sustainability executive said: “Investors increasingly believe companies that perform well on ESG are less risky, better positioned for the long term and better prepared for uncertainty.”

The report comes as the Tories pledge to overhaul ESG reporting requirements if they return to government, with shadow business secretary Andrew Griffith calling the rules “ridiculous.”

ESG costs in the thousands

Ross Clark, who authored the report, also said smaller businesses had been disproportionately affected.

Clark said some ESG ratings schemes did not clarify how much they charged for companies to list in their indices, though said B Lab, one provider, could charge up to £30,000.

His report also cited one fund manager who said a mid-sized company was paying £1m for ESG data.

Clark wrote: “There is a fundamental weakness with ESG: it conflates things like a business donating to, sponsoring and getting involved in good causes – all good for society but which do not really impact on a company’s economic fortunes, beyond a bit of positive PR – with matters which really could destabilise a company, such as poor governance.

“It fixates on risks from climate change, while distracting from the more straightforward issues why companies get into trouble – such as having a poor business model, or some small weakness which leads to a disaster.”

Equality and human rights commissioner Baroness Cash said in a foreword that the paper unveiled a “reluctance by business leaders to speak openly about their concerns”.

“As a country we need to answer urgent questions: why is economic growth stagnant, why do we struggle with productivity, what factors are driving our economic strategy.

“As part of that an honest conversation about the role ESG has played, the shortfalls of it and what changes are needed is vital.”