Economic gloom finally sweeps through UK jobs market

UK job growth has slimmed for the first time since the 2021 Covid-19 winter lockdown, driven by employers bracing for the longest recession on record, a new survey out today unveils.

For the first time since February 2021, when the country was in the late stages of the third and longest pandemic lockdown, businesses trimmed hiring, according to the Recruitment and Employment Confederation (REC) and consultancy KPMG.

The pair’s employment index dropped to 45 last month, down sharply from September, meaning there are fewer vacancies.

Any reading below 50 indicates most employers recorded a hiring reversal.

London led the overall survey lower, with the capital posting the weakest reading at 41.5. Demand for part-time staff also fell steeply, down to 50.1.

Firms are reining in expansion plans over fears they could collapse during what is forecast by the Bank of England to be the longest recession on record at eight consecutive quarters.

Inflation, running at a 40-year high of 10.1 per cent, and the Bank’s campaign to stem it by raising interest rates eight times in a row to three per cent has sent a chill through the economy.

Up until now, the UK jobs market has held up astonishingly well despite the slowdown. Unemployment is at its lowest level since the 1970s, and the ratio of vacancies to jobless people is near a record high. These numbers have been partly driven by a large chunk of people dropping out of the jobs market.

However, KPMG and REC’s survey indicate higher borrowing costs and prices are now kneecapping the jobs market.

Analysts said the financial market upheaval sparked by former prime minister Liz Truss’s mini-budget on 23 September had soured employers’ hiring intentions.

Neil Carberry, chief executive of the REC, said: “The economic and political uncertainty of September and October has caused employers to become more cautious in their approach to hiring than during the frenzy of earlier in the year.”

The survey showed starting pay salaries fell to their lowest level in a year and a half, suggesting the Bank’s crusade against inflation is taking effect. The Bank thinks unemployment will nearly double by the end of 2025.

Central bankers raise interest rates to prevent higher prices in the near term forcing workers to demand higher pay and businesses to lift prices sharply to protect margins. This scenario can result in elevated inflation becoming a long-term fixture in an economy.

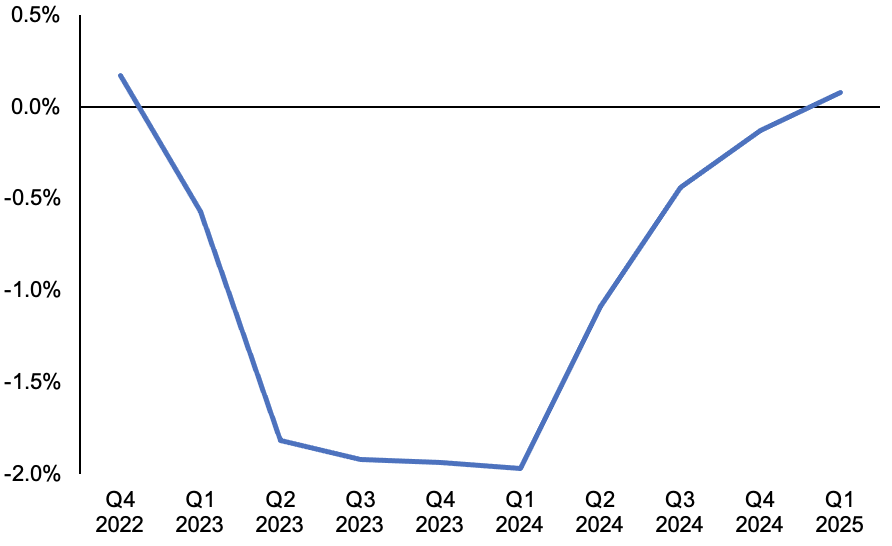

Bank of England’s bleak GDP forecasts

Tighter financial conditions are intended to stop employers from raising wages rapidly to attract and retain talent by making it costlier for them to borrow. Consumers are also incentivised to save instead of spend.

Taken together, this is supposed to bring inflation back down.