De Beers boosts sales but stays cautious

The world’s top diamond producer De Beers posted a 10 per cent rise in gem sales to $3.3bn (£1.7bn) on strong demand and price rises – but warned a slowdown of sales in America may hit revenues in the second half of the year.

De Beers boosted rough-diamond prices by about 8 per cent in the first six months. Buoyant growth in China, India, Russia and the Middle East helped balance slowing sales in the US retail jewellery market, which accounts for half of all revenues worldwide.

Managing director Gareth Penny said that while demand for high-end diamonds is “very, very strong”, sales of smaller lower-quality gems in the American market is likely to be “pretty flat” in the second half of the year.

Penny added: “Clearly in the current economic climate that surrounds all of us, it would be imprudent not to be cautious about the second half of 2008.”

He said: “In aggregate, we would expect the second half of the year as a whole in our business to reflect positively against 2007. Our first-half sales are up this year 10 per cent, hopefully they’ll reflect that for the year as a whole.”

De Beers said its contribution to the underlying earnings of mining group Anglo American, which holds a 45 per cent stake in the diamond producer, was $166m, up from $156m for the same period last year. De Beers first-half net earnings fell 10 per cent to $316m, mainly due to a $92m tax bill, which was a two-thirds increase on the year before.

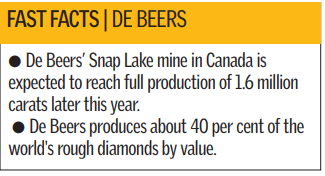

Penny repeated that full-year production would be flat at around last year’s level of 51 million carats. De Beers has mines in Canada and well as South Africa.