Could decarbonisation be the mega-trend of the next decade?

US equities have led global stock markets higher over the past decade. In the last ten years, US equities have returned a stellar 292%, compared to just 73% for global equities (as measured by the MSCI USA Index and MSCI AC World ex US Index respectively, in US dollar terms, as at 31 August 2020).

But the past isn’t always a good guide to the future. As climate change moves up the political and social agenda, decarbonisation could be the mega-trend of the next decade. And we think many of the companies best placed for the transition to a low carbon future are listed outside the US.

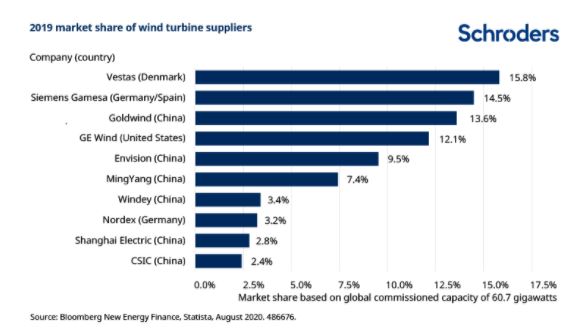

Which companies dominate the wind and solar market?

The US has a number of companies who are the dominant players in their field. But this isn’t always the case if we look at renewable energy.

Take the wind energy industry, which is dominated globally by a handful of companies. Only one of the major manufacturers – GE – is a US firm. The biggest global operators are Denmark’s Vestas Wind and the German-Spanish group Siemens Gamesa. Chinese firms tend to have a strong focus on their domestic market.

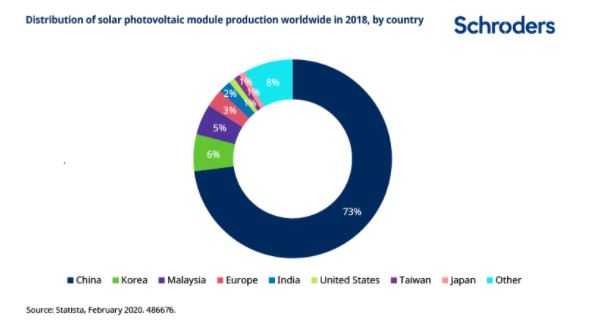

Meanwhile, the solar industry is heavily dominated by Chinese firms. China leads the way in the production of polysilicon, as well as in solar cell manufacturing capacity. This is a fairly commoditised industry, with limited scope for generating above-average profit margins. Nonetheless, if there is a boom in solar then it is these Chinese firms who will benefit. First Solar, a US company, is one of the only notable non-Chinese firms in the industry.

Which companies dominate the electric vehicle market?

When it comes to pure electric vehicles, US-listed Tesla is the brand name everyone knows. It currently leads the way in terms of sales of battery electric vehicles (BEVs), as opposed to hybrids.

But that dominance may not last much longer. Germany’s Volkswagen has high ambitions for BEV production, and is poised to overtake Tesla by 2025 when it is targeting 1.4 million BEV sales. The Renault/Nissan/Mitsubishi alliance – producers of the Leaf – and China’s Geely are also poised to catch Tesla by 2025 (source: CNN Business 2019.)

From a decarbonisation point of view, the important part of a battery electric vehicle is the battery. Here again, non-US firms are the market leaders. The battery supply chain is dominated by Asian companies such as South Korea’s LG Chem and Samsung SDI, Japan’s Panasonic, and CATL in China.

US and European car firms may try to source more batteries locally as they ramp up production of BEVs, but for now the technical know-how resides with these Asian companies.

It is also the case that the main buyers of electric vehicles currently are Chinese and European consumers. This faster market adoption will bring economies of scale, development of technical knowhow, and faster growth in related services businesses to support the EV industry.

Three more stories from Schroders you might like:

– How working flexibly can give investors an edge

– Why digital infrastructure could emerge stronger from Covid-19

– Seven reasons behind the resilience of “green” investments in the pandemic

Is hydrogen the way forward?

Much of the conversation around decarbonisation focuses on the use of electricity from renewable sources. However, hydrogen could be an alternative energy source for industries that are hard to decarbonise using electricity.

Hydrogen can be produced from fossil fuels with the emissions from the process captured via carbon capture and storage (CCS) technologies. It can also be produced via renewable power, and over the coming five to ten years this renewable (emission free) derived hydrogen is likely to become cheaper than fossil fuel hydrogen.

The advantage of hydrogen is that it does not emit carbon dioxide when burned in an engine. Converting hydrogen into electricity can also take place via a hydrogen fuel cell, which consumes hydrogen and oxygen. When a fuel cell is continuously supplied with hydrogen and oxygen, the fuel cell can generate electricity with water as the only by-product.

Hydrogen can also be used to store surplus power produced via renewable sources. This power can then be used at a time when wind and solar are not producing electricity, smoothing out the peaks and troughs of renewables production.

Currently the cost of producing hydrogen is elevated and this has weighed on demand. However, the sharp reduction in the cost of other green energy sources in recent years indicates that hydrogen will follow the same path.

Japan and Europe are currently the leaders in developing hydrogen power. Japan adopted its “Basic Hydrogen Strategy” back in 2017 with the aim of reducing hydrogen costs to the same level as conventional energy sources, thereby ensuring energy security and reducing emissions.

Our Data Insights Unit used its expertise in managing alternative data sets to analyse which companies are registering the most patents related to hydrogen production. They found that the top three were all Japanese firms: Toshiba, Honda and Asahi Kasei.

In addition, European companies such as Siemens, Thyssen, NEL, and ITM are all at the forefront of the development of hydrogen electrolysis equipment. The EU’s new investment programme to build out a hydrogen infrastructure is likely to give these companies a major head-start over foreign competition in this early stage of the industry development.

A hydrogen strategy forms part of the European Union’s recently-announced Green Deal. The strategy set out an ambition for one million tonnes of renewable hydrogen to be produced by 2024, rising to ten million tonnes by 2030.

Is there political will for decarbonisation?

Europe has often been on the front foot when it comes to recognising the climate challenge on the political agenda. Asian countries are fast catching up in this regard though too.

The same urgency to tackle climate change and switch to renewable power sources has so far been lacking in the US. This could partially account for why US corporates are currently relative laggards in the decarbonisation journey.

There have been some ambitious recent decarbonisation policies and ambitions from the likes of Microsoft and Amazon. But in general European companies are much more focused on decarbonising their own operations and supply chains, with more ambitious long term goals aligned to the Paris Agreement goal of limiting temperature increases to 2 degrees, and intermediate milestones along the way to track them against.

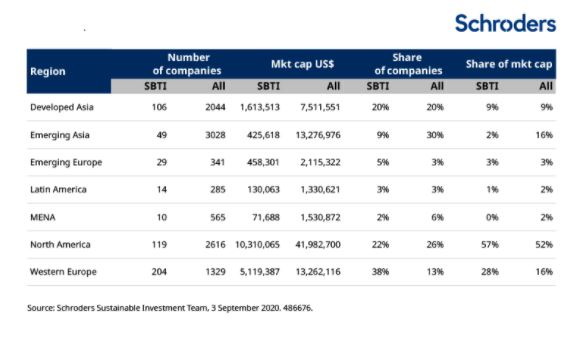

The table below demonstrates this. Our Sustainable Investment Team analysed over 10,000 global companies for their commitment to science based target initiatives (SBTIs) on climate change. SBTI essentially means having a strategy committing the company to greenhouse gas (GHG) reduction targets consistent with the pace recommended by climate scientists to limit the worst impacts of climate change.

The regional differences are striking. Despite accounting for only 13% of listed companies analysed, Western European companies account for 38% of the total number with science based targets. North American companies only make up 22% of this group, despite being 26% of the listed universe.

There is also a higher proportion of listed companies in Developed Asia, Latin America, and Emerging Europe committed to science based climate targets than there is in North America.

It is clear that European companies are much further down the path of optimising their operations for a rapid transition to a low carbon economy, something that will help them competitively as carbon emissions become a more significant liability in future.

As we go into a phase where carbon taxes and carbon prices rise are likely to rise globally to address climate change, this head-start in reducing their own emissions will become a more valuable competitive and cost advantage.

The US stock market dominance of the past decade has largely been thanks to the strong performance of a handful of major stocks in a few key sectors. The FAANGs (Facebook, Amazon, Apple, Netflix, Google) have led the way.

These fantastic companies will likely continue to be leaders in their fields. However, with momentum growing around the need for a low carbon future, we think stock market investors should pay heed to the leadership role that non-US companies are taking in decarbonisation.

Any references to stocks/companies are for illustrative purposes only and not a recommendation to buy and/or sell. Reliance should not be placed on any views or information in the material when taking individual investment and/or strategic decisions. If you are unsure as to the suitability of any investment speak to a independent financial advisor

The value of investments and the income from them may go down as well as up and investors may not get back the amounts originally invested.

Important Information: This communication is marketing material. The views and opinions contained herein are those of the author(s) on this page, and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds. This material is intended to be for information purposes only and is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. It is not intended to provide and should not be relied on for accounting, legal or tax advice, or investment recommendations. Reliance should not be placed on the views and information in this document when taking individual investment and/or strategic decisions. Past performance is not a reliable indicator of future results. The value of an investment can go down as well as up and is not guaranteed. All investments involve risks including the risk of possible loss of principal. Information herein is believed to be reliable but Schroders does not warrant its completeness or accuracy. Some information quoted was obtained from external sources we consider to be reliable. No responsibility can be accepted for errors of fact obtained from third parties, and this data may change with market conditions. This does not exclude any duty or liability that Schroders has to its customers under any regulatory system. Regions/ sectors shown for illustrative purposes only and should not be viewed as a recommendation to buy/sell. The opinions in this material include some forecasted views. We believe we are basing our expectations and beliefs on reasonable assumptions within the bounds of what we currently know. However, there is no guarantee than any forecasts or opinions will be realised. These views and opinions may change. To the extent that you are in North America, this content is issued by Schroder Investment Management North America Inc., an indirect wholly owned subsidiary of Schroders plc and SEC registered adviser providing asset management products and services to clients in the US and Canada. For all other users, this content is issued by Schroder Investment Management Limited, 1 London Wall Place, London EC2Y 5AU. Registered No. 1893220 England. Authorised and regulated by the Financial Conduct Authority.