Corbin & King ‘under siege’ from investor Minor International

The founder of the restaurant chain behind the Wolseley has reassured customers the business is in “rude financial health” after it was plunged into administration this week.

Administrators from FRP were appointed for Corbin & King earlier this week, although the chain’s restaurants have continued to trade.

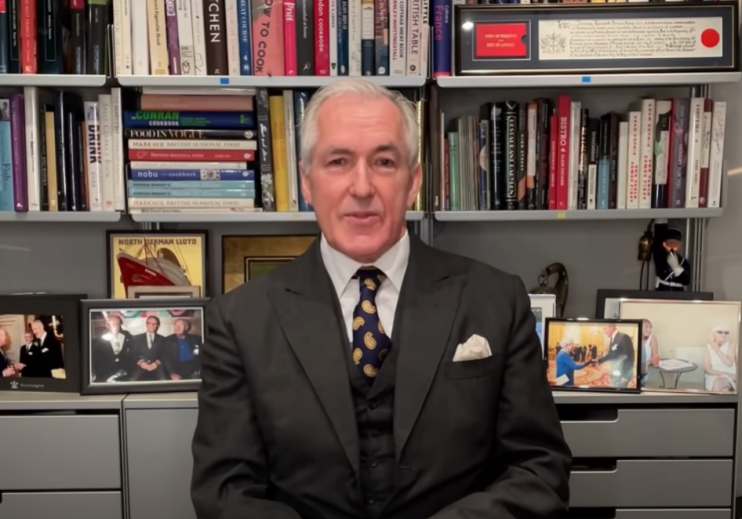

Founder Jeremy King has now hit back once more at claims from the group’s largest shareholder, Thai hospitality firm Minor International, and said his business was “under siege” from the investor.

Minor International, which has a 74 per cent stake in Corbin & King, had said the company was not solvent and had failed its financial obligations.

In a YouTube message posted on Thursday, King told customers they had nothing to be concerned about and it was “very much, business as usual.”

The administration had been a “technical one” engineered by Minor in an “attempt to seize control of the company,” King said.

There was a “fundamental difference of opinion” on how restaurants should be run between the chain and its shareholder. “I will never change my principles to the detriment of those essential elements for a successful restaurant,” King said.

Corbin & King had only failed to meet obligations in respect of a loan from Minor, he said.

The shareholder said it provided the restaurant group with £38m in loans and loan guarantees since May 2020.

“That was part of a transaction that saw Minor buy into the company. They said then that they would be refinancing it,” King said.

The restauranter also hit back at the investor’s claims that the group suffered from “major liquidity constraints” during the pandemic.

“We didn’t, we got through it, without any support other than the government furlough scheme,” he added.

King also spoke of Minor’s comments that the chain had declined a cash injection. “They don’t mention the conditions attached to the small amount they proposed were in the best interests only of themselves,” he said.

Rude financial health

“I can assure you all that the restaurants are fully solvent, trading well and all our staff and suppliers are secure and fully paid,” King said. He said the company in administration was the holding company and there were more than a dozen other companies “which actually run the restaurants.”

King said he planned to bring the holding company back out of administration and “pay back all the monies so we can get back to what we do best.”

“We are as busier and profitable as ever,” he added. “Despite all the difficulties over the last two years, we are in rude financial health.”

In a statement, Minor International said: “We will not get drawn into a war of words. There is an administration process to follow that we respect. Minor International remains committed to preserving and protecting the long-term future of the company’s iconic brands and employees.”

New-York based hedge fund Knighthead Capital Management reportedly approached the restaurant group’s administrators with a £38m offer earlier this week, Sky news reported.

Corbin & King confirmed to reporters that bosses had been in discussions with the investor for months over a cash injection.

Speaking to the Guardian newspaper, Dillip Rajakarier, the group chief executive of Minor International, said administration had been the only choice for Corbin & King.

Rajakarier said: “Contrary to the picture that Mr King is trying to paint, the business is insolvent and is in strong need of further financial support. Minor is prepared to offer this support to secure the long-term future of Corbin & King’s employees and restaurants.”