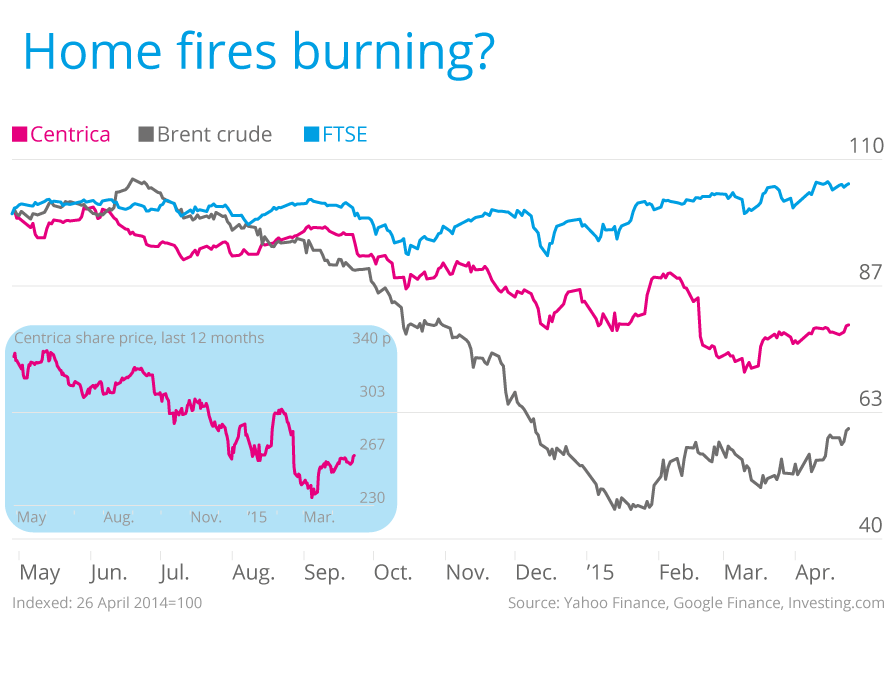

Centrica expects choppy waters ahead as low oil and gas prices continue to weigh on peformance

Centrica said this morning that the continued weight of low commodity prices meant it was unable to revise up the gloomy forecast it gave investors in February.

The company's preliminary results, released on 19 February, revealed a full-year net loss of £1bn and left dividends slashed by 30 per cent. Also in that statement, the group, which owns British Gas, said it expected capital expenditure to drop to £800m this year and £650m in 2016 – around 40 per cent of 2014 levels.

Today's statement had little in the way of good news:

Overall, the group continues to trade in line with the guidance provided at the time of its 2014 Preliminary Results in February, with improved year-on-year profitability downstream expected to be more than offset by the impact of lower commodity prices on the upstream business.

Centrica did, however, say that chilly weather in the UK and the US had led to higher-than-expected consumption by British Gas and Direct Energy customers.

It added that, in the year to date, it had implemented plans to improve its position. It "progressed capital expenditure and cost reduction programmes… against a continued low commodity price backdrop", strengthened its balance sheet by issuing £1bn in securities and sold Lincs wind farm debt. It has also undertaken a group-wide strategic review.