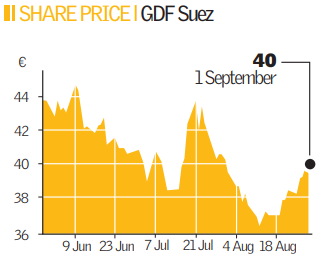

Bumper profits at GDF-Suez

The newly-formed French energy giant GDF Suez yesterday heralded the start of a “beautiful industrial adventure”, announcing that net profit had soared by 14 per cent.

Rising energy demand and rocketing oil prices helped the powerhouse report bumper first-half profits of €3.4bn (£2.76bn), after it was created following the merger of France’s state owned Gaz de France with Franco-Belgian electricity firm Suez in July.

The company also said that core earnings were up 20 per cent to €8.1bn on sales of €43.1bn in the results, which were calculated on a pro forma basis by working as if the two companies had in fact merged in January.

Chairman and chief executive Gerard Mestrallet said the group’s first set of numbers marked “the beginning of a very beautiful industrial adventure” and that the firm was on track to achieve ebitda growth of more than 10 per cent.

Europe’s fifth-largest electricity producer and its biggest purchaser of gas also said it would pay an interim dividend of €0.80 to shareholders on 27 November and announced a €1bn share buyback program. Gaz de France and Suez first revealed plans to merge in February 2006, but regulatory setbacks hampered progress.