Boom time for LSE after equity raising doubles

THE LONDON Stock Exchange, the 300 year old trading venue, yesterday said new cash raised on the equity market almost doubled last year to £28bn.

The group, which in a strange quirk is listed on its own exchange, said 162 new issues in the 11 months between April 2013 and February 2014 raised £28.3bn – 91 per cent higher than the £14.8bn raised last year.

The group added there was “continuing good signs of issuance activity in the period ahead”.

London’s initial offerings markets burst back into life last year, with large flotations like the £3.3bn float of Royal Mail. The FTSE 100 also rose 14 per cent in 2013.

The increase in activity this past January and February has also helped deliver higher secondary market values. The average daily UK equity value traded rose eight per cent for the 11 months; stripping out the figures for January and February it rose only three per cent. The group operates several trading and clearing venues, including Borsa Italiana, fixed income trading market MTS as well as data and news services like the Regulatory News Service (RNS).

It took a 60 per cent stake in clearing house LCH.Clearnet in 2012 and yesterday said derivatives clearing volumes there rose 17 per cent year on year.

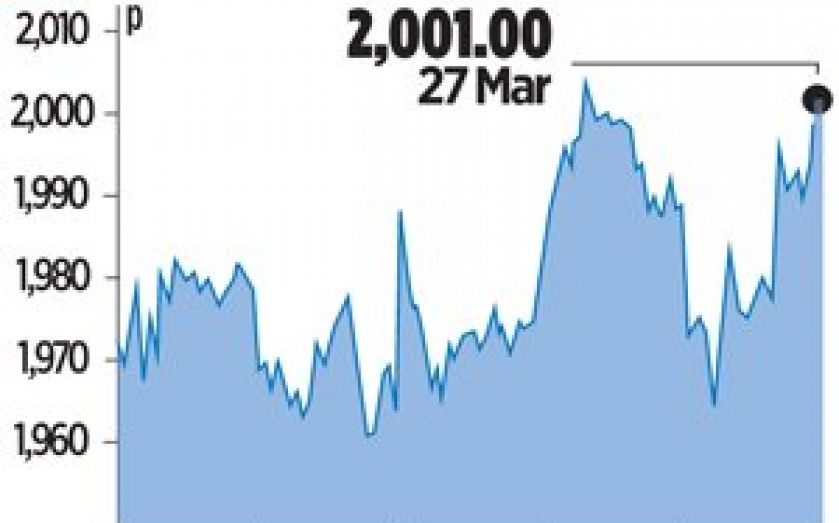

Shares in the group nudged up only slightly, given nine months of the data had already been disclosed in previous updates to the market.