Blackberry ripe for the picking as it considers sale

STRUGGLING smartphone maker BlackBerry yesterday opened the door to a multi billion dollar sale of the company as it unveiled a dealmaking committee tasked with reviving the group’s flagging fortunes.

The Canadian firm, famed for its email-friendly phones and formerly known as Research In Motion, said US M&A guru Tim Dattels would head an executive committee to explore strategic options for the firm.

These include joint ventures, strategic partnerships, or an outright sale of the company, it said in a statement.

BlackBerry’s biggest shareholder, Fairfax Financial, also said its chief executive Prem Watsa had resigned from the BlackBerry board to avoid conflicts of interest if a bid is made.

The move follows a lacklustre few years for the firm, which has seen market share grabbed by rivals such as Apple’s iPhone.

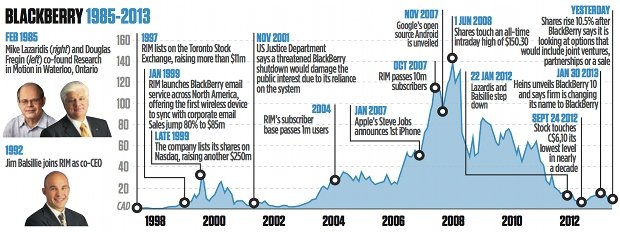

Its stock has fallen from a high of C$150 in 2008 to trade at just C$10 yesterday on the Toronto market.

“We believe that now is the right time to explore strategic alternatives,” Dattels, a senior partner at private equity firm TPG, said. Also sitting on the dealmaking panel is company chief executive Thorsten Heins and its chair Barbara Stymiest. Two telecom industry heavyweights, former Sony Ericsson chief executive Bert Nordberg and ex-Verizon vice president Richard Lynch, will join them.

The worsening of BlackBerry’s fortunes follows its stellar rise into the public consciousness more than a decade ago.

Its scrollable models became the phone of choice for politicians and financiers throughout the early 2000s, and the phone’s ubiquitous use led Webster’s dictionary to include the word “crackberry” in 2006 – acknowledging many executives’ addiction to the device.

But its star began to wane soon afterwards, as Apple’s then-chief executive Steve Jobs launched the first iPhone in 2007 and rival operating systems such as Android crashed the market.

The disastrous launch of BlackBerry’s first touchscreen model in late 2008 and a series of other badly received products led it to miss revenue targets in 2011.

Its co-founder Mike Lazaridis and long-standing chief executive Jim Balsillie quit the company last year.

The launch of a new model earlier this year has done nothing to reverse the slide. It had a 2.9 per cent share of the global smartphone market last quarter, down from its 2009 heyday when it laid claim to almost half of the market, figures from American research body IDC show.

A sale of BlackBerry, which is worth around $5bn but has $3bn in cash, would mirror moves by tech firm Dell, which is seeking a $25bn sale.

Baird analyst Will Power said: “A ‘go private’ deal could make sense, depending on the terms.”

Suitors could include the Canada Pension Plan. Its investment boss Mark Wiseman said on Friday he wanted to invest in the company if it went private.