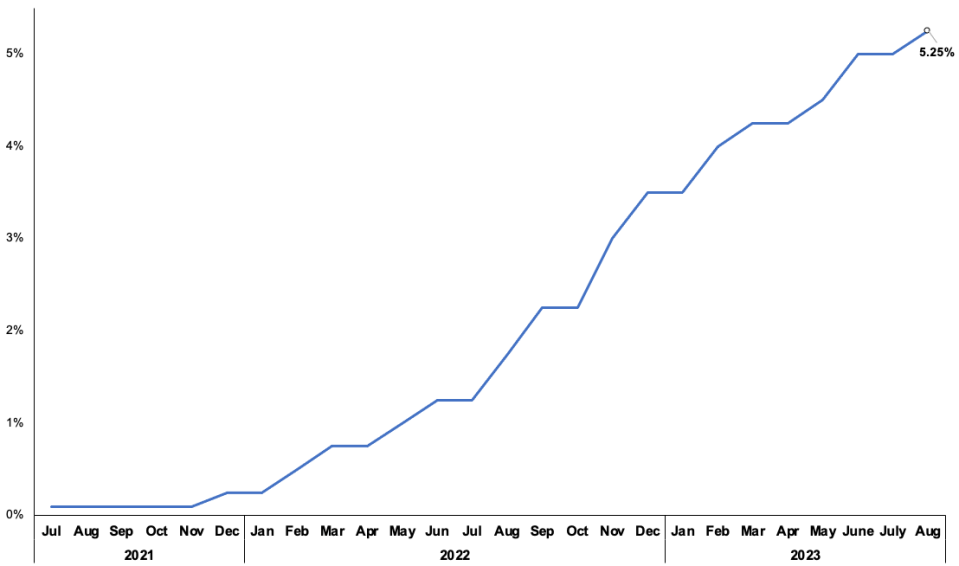

Bank of England lifts interest rates to fresh 15 year high in smaller than feared 14th straight hike

The Bank of England today hiked the UK’s official interest rate for the 14th time in a row but by a lower degree than some had feared.

Members of the nine-strong monetary policy committee (MPC) voted 6-3 in favour of a 25 basis point rise, smaller than the 50 basis point lift some in the City had expected headed into the meeting.

The move was in line with the consensus forecast.

London’s FTSE 100 fell 0.61 per cent, while pound sterling whipsawed against the US dollar after the announcement. It was down 0.28 per cent against the greenback in afternoon trading.

It means UK borrowing costs now stand at 5.25 per cent, their highest since March 2008, extending the Bank’s toughest tightening cycle since the 1980s.

The Bank, in new, more forceful language, signalled it is anxious about high wage demands in response to rising prices embedding elevated inflation into the UK economy over the long term.

“Some key indicators, notably wage growth, suggest that some of the risks from more persistent inflationary pressures may have begun to crystallise,” the MPC said in its policy statement.

Wages are rising at their joint fastest pace on record across the UK economy at 7.3 per cent and are up 7.7 per cent in the private sector alone.

Inflation over the next three years is poised to be more persistent than the MPC expected in May and won’t hit the two per cent target until the beginning of 2025. The last time the Bank reached its target was July 2021.

However, the Bank said the rate of price growth is on track to drop to seven per cent in July and five per cent in October due to lower energy price cap taking effect. Chancellor Jeremy Hunt and Prime Minister Rishi Sunak are set to meet their target of halving inflation by the end of the year.

In sharper wording from its previous meeting in June, the monetary authority said it will “ensure that Bank Rate is sufficiently restrictive for sufficiently long to return inflation to the two per cent target,” indicating borrowing costs will stay higher for longer.

“We need to make absolutely sure that [inflation] falls all the way back to the two per cent target,” Governor Andrew Bailey said today.

Markets don’t expect rate cuts to come until the middle of next year at the earliest.

UK interest rates have risen 14 times in a row

The economy is set to stagnate until 2026 and get very close to tipping into recession at the end of next year, the Bank said.

The fresh rate rise will intensify the cost of living crunch that has gripped families across the UK for two years and piles yet more misery on to homeowners. Before today’s decision, markets expected two more rate rises were in the pipeline and that they would peak at 5.75 per cent.

“Another hike in September seems likely, but by November we think the news on services inflation and wage growth should be looking a little better,” James Smith, developed markets economist at ING, said.

“The hawkish tone means there is a risk that rates rise further, perhaps to 5.75 per cent or six per cent,” Paul Dales, chief UK economist at Capital Economics, said.

The Bank lifted rates again to curb inflation. Tighter credit conditions reins in demand by making it more expensive to borrow and more attractive to save which, in theory, cools price growth.

Official data leading up to the August MPC meeting indicated that soaring living costs could finally be in the early stages of sustained slowdown.

The headline rate of inflation in the UK fell quicker than expected in June to 7.9 per cent after being stuck at 8.7 per cent for two months in a row.

However, core inflation – which removes volatile food and energy price movements – remains very high at around seven per cent.

MPC officials’ preferred measure of price pressures, services inflation, is also elevated at over seven per cent. The Bank today in notched up forecasts said services inflation will barely fall throughout the rest of this year.

Britain has the highest headline inflation rate in the G7. America’s rate is three per cent and the eurozone’s is 5.3 per cent.

There are concerns the Bank has already heaped enough pain onto the economy to get the cost of living lower.

The effects of the central bank’s prior rate rises have yet to fully pass through the UK, mainly due to more and more Brits taking out fixed rate mortgages since the 2008 financial crisis.

UK economic growth is already very weak, with GDP flatlining in the three months to May. Timelier business surveys have indicated activity is sagging.

It is not just the Bank that is downbeat on the economy’s prospect. Last month, the International Monetary Fund predicted the UK would notch the second worst growth in the G7 this year at 0.4 per cent.

An upsurge in mortgage rates over the last couple months has reignited recession fears, although lenders in the past couple weeks have been loosening credit conditions.

June’s quicker than tipped inflation drop pushed market peak rate expectations down from 6.5 per cent, compelling mortgage providers to steadily lower rates on their products.

Six members, including Governor Andrew Bailey, backed the 25 basis point increase today. Two, Catherine Mann and Jonathan Haskel, wanted a larger 50 basis point jump, while Swati Dhingra favoured leaving rates unchanged, a position she has held for several meetings.