Bank of England imposes limits on high loan-to-income mortgages

The Bank of England has introduced new mortgage controls, in an attempt to contain possible risks to the UK's financial system.

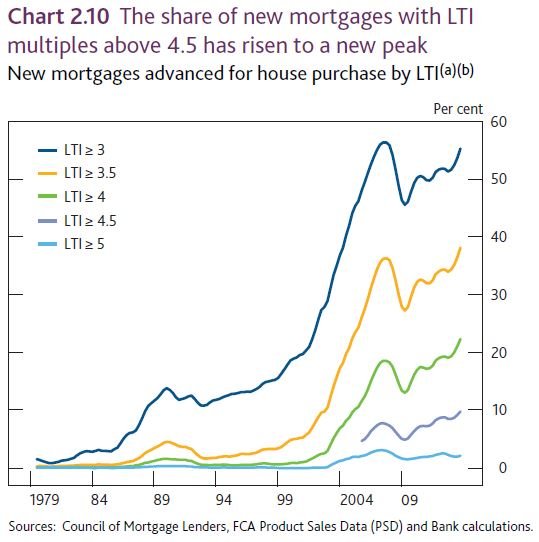

New limits will apply from 1 October, and will see that no more than 15 per cent of mortgages issued should exceed a loan-to-income ratio of 4.5.

Currently only 11 per cent of UK bank lending exceeds that ratio, so that cap is unlikely to bite. The current average ratio on new mortgages stands at 3.4.

The Bank has itself called the expected effect "minimal". In a press conference, Bank governor Mark Carney said that the central bank was taking "action today, to avoid risks tomorrow", saying that because it's acting earlier, drastic measures won't be necessary later on.

The announcement is technically a recommendation by the Financial Policy Committee (FPC) to the Prudential Regulation Authority (PRA) and the Financial Conduct Authority (FCA). They've both welcomed the recommendation.

That recommendation applies for all lenders which extend residential mortgage lending in excess of £100m per year. The Treasury has also adjusted the Help to Buy scheme in line with these proposals, so no Help to Buy loans with a loan-to-income ratio exceeding 4.5 can be issued. Buy-to-let and remortgaging loans are excluded from the limit.

An announcement on some kind of action was widely expected today. The Bank has been under pressure to act for a while now, and analysts were expecting to see decisions today motivated more by risk management than a desire to cool borrowing. Despite these changes, the Bank's central prediction is that house prices will rise by 20 per cent in the next three years.

Jeremy Cook, chief economist at World First, says that the announcement hasn't stopped the climb of the pound, as the market deems the Bank's measures "as unlikely to curtail near-term frothiness in housing".