As we’re pushed towards supply chains of isolation, we must protect openness

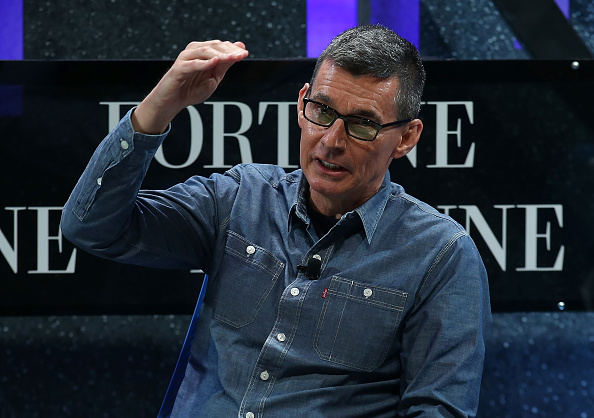

Globalisation is dead. So declared Chip Bergh, the chief executive officer of Levi’s, the maker of the iconic 501 jeans, at this year’s World Retail Congress. That doesn’t mean globalisation is going away; but it will need to take a very different form from the one we once knew.

The principle of comparative advantage is the economic foundation behind globalisation – this is as strong as ever today. It is an acknowledgement that some countries are better equipped to produce certain goods and services; as economists put it, they can do it at a lower opportunity cost than others.

As each country focuses on production in specific sectors where they hold a comparative advantage, international trade and global supply chains become necessary to meet domestic demand in all other sectors.

But, interestingly, the supply chains of many companies are becoming less global today than historically. Tritax’s 2021 survey of the European logistics real estate sector showed that shortening or “re-shoring” the supply chain is likely to be the most significant change for businesses, as they seek to mitigate risk. After decades of lengthening supply chains, the trend is being reversed – and rapidly. For many, this has sounded like a death knell for globalisation and a rallying cry for isolationism.

The pandemic exposed the vulnerabilities of long, thin, global supply chains. Companies from all sectors found that temporary trade restrictions and lockdowns disrupted the delivery of goods. Levi’s, like so many other global businesses, missed out on sales because goods were being held up at ports.

The response has been an acknowledgment of the urgent need to build more resilient supply chains. We can see this happening: occupier demand for UK logistics jumped by 30 per cent in the first quarter of 2022, compared to the same period in 2021. This includes a move away from “just in time” supply chains, where the very minimum of inventory was being held to reduce costs. In many cases, it also has meant bringing production closer to demand – whether that means bringing it back onshore, or at least moving it to a closer country.

The second factor is political. The increase in more protectionist governments around the world is filtering into the economic sphere. Think of former president Donald Trump’s very public chiding of chief execs who sought to shift US manufacturing overseas. Many of Trump’s protectionist tariffs and regulations have been extended under President Biden.

In the UK, many point to the effect of Brexit on trade. Last month, the Office for Budget Responsibility estimated that UK trade volumes were 15 per cent lower than they would have been had the UK remained in the EU. According to the Tritax survey, Brexit was among the most common challenges identified by the UK logistics sector, although it ranked far behind the supply of new buildings and access to labour.

The strategic importance of the origin of supply has also increased within an uncertain geopolitical context. The war in Ukraine has raised questions about the economic versus ethical rationale for distributing goods and services, with several well-known businesses ceasing or suspending operations in Russia. They have had to look at new long-term solutions to ensure they can continue to distribute to their customers, whilst remaining accountable for good practice.

The rate of change in supply chains – and the underlying factors driving those changes – have thrust them into the public consciousness like never before. Many of these changes are still emerging but are becoming increasingly urgent as companies realise their existing infrastructure is not suitable for long-term behavioural shifts.

And there are further major transformations on the horizon with ESG policies driving the need for a more efficient, productive – and local – supply chain. The need to deliver sustainable, modern warehouses will require a real step change in terms of ESG initiatives. The growing strategic importance of power should not be underestimated as, going forward, the resilience of power supply within real estate will need to be a major consideration for companies seeking to be at the cutting edge of the sustainable supply chain.

Globalisation is a complicated beast, fraught with challenges. But it will also consistently deliver higher standards of living around the world. It is a value in the modern financial system we must safeguard, even as we are pushed inwards. International trade drives economic growth and understanding across cultures. To keep reaping the benefits of comparative advantage, we need to look ahead and future-proof our supply chains to create a more resilient and sustainable version of globalisation.