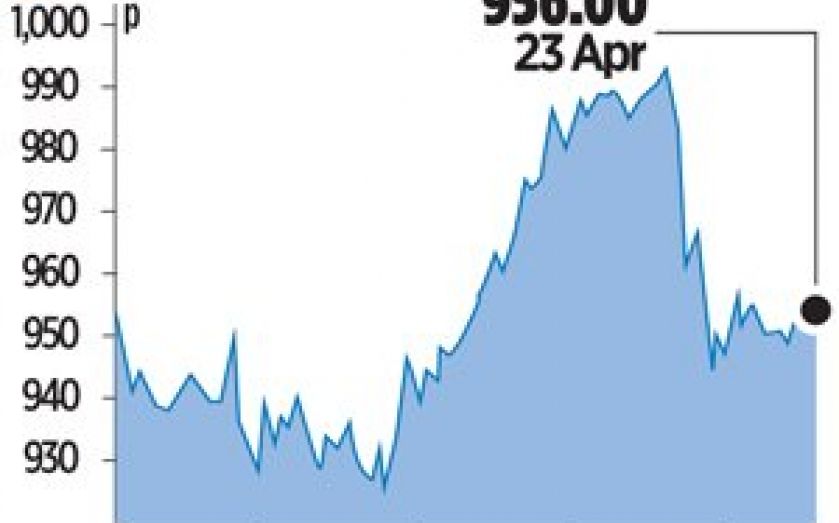

Arm shares hit as profit growth begins to slow

ARM Holdings, whose chip technology powers Apple’s iPhone, saw its shares slide yesterday after a disappointing end to 2013 resulted in first-quarter profit rising less than in previous years.

Sales of top-end smartphones, a market dominated by Apple and Samsung, were lower than predicted during the Christmas holiday season, leading to worries that the market was becoming saturated.

But Arm’s chief financial officer Tim Score said there were signs that demand was picking up for smartphones.

Cambridge-based Arm posted a nine per cent rise in pre-tax profit to £97.1m, broadly in line with market forecasts, on revenue collected in dollars of $305.2m, up 16 per cent. In comparison, a year ago adjusted pretax profit jumped 44 per cent.

Royalty payments, which Arm receives a quarter in arrears on every chip that contains its technology, rose by an underlying eight per cent year-on-year, about a quarter of the growth it was seeing at the same time last year.

The group said it expects revenue for 2014 to be in line with market expectations, but analysts at Liberum reiterated their ‘sell’ rating on Arm, and warned that slowing growth is down to disappointing sales of smart technology, a trend it expects to continue. Arm’s shares closed down 2.8 per cent.