Advertising watchdog bans Klarna Instagram ads

The advertising watchdog has banned several Klarna shopping adverts that appeared on Instagram and encouraged consumers to use Klarna to shop and ‘boost their mood’.

The Advertising Standards Agency (ASA) has banned Klarna’s Instagram campaign from appearing again, and warned the influencers involved to not “irresponsibly” encourage the use of Klarna’s deferred payment service.

The Swedish fintech firm is the highest-valued private fintech in Europe after a September funding round valued the group at $11bn (£8.54bn).

It has 9 million users in the US, and has more than 1.2 million active monthly users worldwide.

The banned adverts appeared on Instagram in April and May 2020. Klarna worked with four Instagram influencers, who each posted a picture of themselves, three of which were pictured with beauty products that could be bought through Klarna.

The campaign encouraged consumers to shop with Klarna to “boost their mood” during the Covid-19 lockdown.

The ASA received a complaint from Walthamstow MP Stella Creasy, who suggested the adverts were irresponsible.

The ASA upheld the complaint and said that in the context of the challenging circumstances caused by the lockdown at the time, including impacts on people’s financial and mental health, the ads irresponsibly encouraged the use of credit to improve people’s mood.

The ASA said the ads encouraged consumers to “splurge” on relatively expensive items, which were likely to go beyond the usual spending habits of many.

Klarna told the ASA it did not believe the adverts were irresponsible, and that the key theme was to take care of one’s self during the Covid-19 lockdown period.

Klarna said the ads were intended to highlight that self-care, skincare routines and pampering could be beneficial for improving mental health and staying entertained during the lockdown period, and any references to lifting one’s mood were in reference to using a beauty product or self-care – not using Klarna boost their mood.

In a statement Klarna said it was “disappointed” in the decision, and had removed the associated posts.

“During 2020, the single largest marketing investment we made was in KlarnaSense, a campaign to address impulse shopping. In that context, we thought long and hard about the text of the posts which were subsequently investigated by the ASA,” said Klarna.

“It was a genuine attempt to recognise the mood of many of our consumers at the start of the first lockdown. We recognise that, whilst we had the best of intentions, we missed the mark with the four posts the ASA has looked into.”

Klarna said it was setting up an thought leadership council consisting of media owners, consumers, a wellness charity partner and influencers, with the intention of providing better guidance for all brands in this space, and engage with the ASA.

More regulation needed

Klarna has faced criticism for encouraging frivolous and unnecessary spending, which could land people in debt.

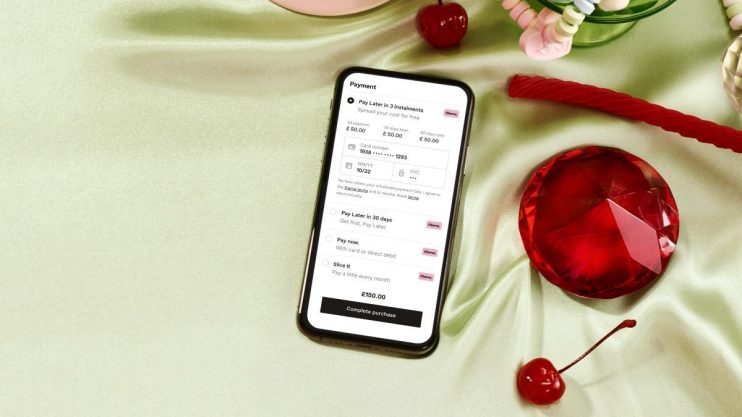

Klarna allows online shoppers to postpone paying for products or to pay in instalments, providing them with an interest-free loan. For shouldering this risk, Klarna charges retailers every time it is used.

Richard Lane, director of external affairs at debt charity StepChange, said deferred payment services could be harmful to consumers.

“Buy-now, pay-later services are increasingly being marketed as a source of convenience for consumers, but it’s important that consumers recognise that the main benefit to retailers of offering these services is to sell more goods.

“The convenience may be real, but so is the financial commitment. Advertising around these services needs to adhere to the same standards as other commercial borrowing, and clear guidance needs to be given to the providers of these services to ensure any marketing is done in a responsible way.”

He continued: “As we recently told the FCA’s Woolard Review, we do think buy-now, pay-later services can create a risk of harm to consumers, so we believe there’s a strong case for the need to look at greater regulation of these kinds of services.”