World Cup fever is setting in, but investors are getting out of Brazil. Here’s why

With just over a week until things kick off in Brazil, the host country is no longer a favourite.

While still firmly favoured by bookies, Brazil is looking less attractive investors, according to research firm Markit.

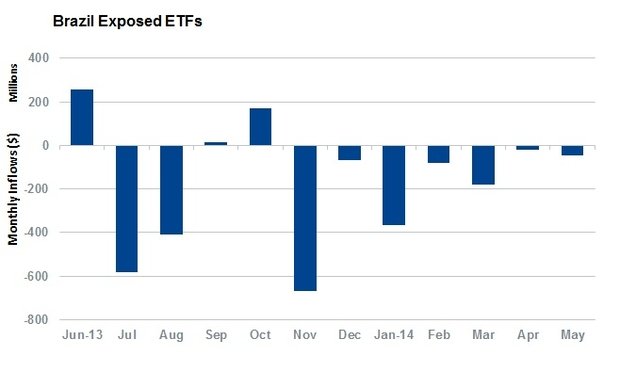

They say that investors have withdrawn from Brazil exposed funds for nine of the last 12 months, with one US listed ETF seeing almost $305m withdrawn.

Expectations of World Cup victory are not feeding through into investor appetite. Markit say that the pessimism reflects the country's heavy dependence on volatile commodities, including slumping iron ore.

"The 11 Brazilian basic materials firms in the Markit Research Signal Emerging Latin America universe have seen the worst analyst revisions in the last three months out of any of their country peers," says the firm.

That's set to slow economic growth in South America's largest economy. Current assets under management in Brazil exposed ETFs is now just above $10bn, having fallen by over $400m since the start of the year.

"This fall in AUM in the 46 Brazil exposed ETFs marks the lowest aggregate AUM figure since the start of 2008 when the total number of funds tracking the country was a third of the current offering," says Markit.

(Source: Markit)