FTSE 100 trounces US and Europe since start of interest rate hikes

The FTSE 100 has emerged as the West’s best-performing major stock index in the era of higher interest rates following a massive rally that has narrowed the blue-chip’s discount to its international peers.

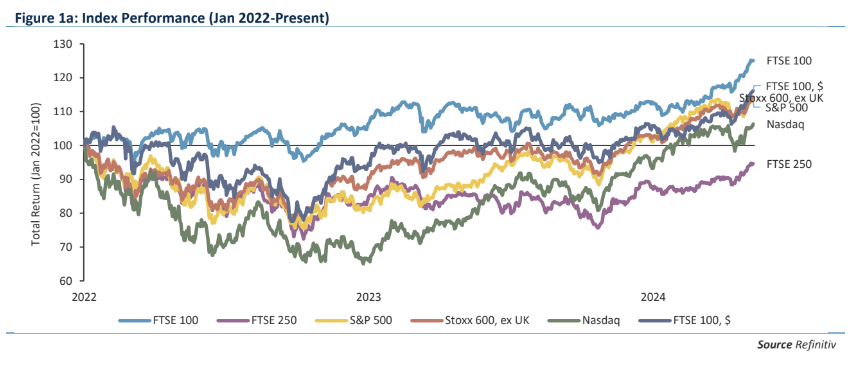

London’s premier index has produced a total return of 14.2 per cent since the end of 2021, when central banks across the world began to hike interest rates in an effort to tame runaway inflation.

Despite a challenging 2023, the FTSE 100 has taken off since last month and gained 9.4 per cent year-to-date on a total return basis on the back of an improving outlook for the domestic economy and optimism over near-term interest rate cuts.

The rally has seen the index set 12 all-time highs over the last month – a figure previously unheard of in the FTSE’s 40-year history.

Other global stock indexes are also rallying, with the US Federal Reserve and European Central Bank now expected to lower borrowing costs in the next few months as inflation falls to target.

But London remains on top. New York’s S&P 500 and tech-heavy Nasdaq 100 have rallied 11.4 per cent and 14.1 per cent respectively since the end of 2021.

Simon French, head of research at brokerage Panmure Gordon, pointed out in a note that the FTSE 100’s total returns during the period also beat both of these heavyweight indexes in dollar terms.

Meanwhile, Europe’s Stoxx 600 benchmark, excluding the UK is up 4.9 per cent since the rate hiking cycle began. With the UK included, this figure comes in at 7.8 per cent.

French said on Thursday that the FTSE 100’s recent gains had helped to narrow the discount of UK public companies to their international peers from 19 per cent in the final quarter of last year to 17 per cent now.

Analysts have blamed this remaining gulf for a wave of takeover deals sweeping through the UK’s public markets in recent months, many of which have originated from bigger US rivals pouncing on lower valuations.

“This UK discount – that has become self-reinforcing through falls in liquidity and relative performance – can unwind quickly given the procyclical nature of asset class performance but it will need UK policymakers to back up warm words with concrete actions,” French added.

“We remain adamant that the opportunity is real, broad-based across all sectors, amplified at the mid and small cap level – and recent public-to-private transactions have illustrated all these points. The opportunity for investors continues to hide in plain sight.”